Enlarge image

Print Save Reset

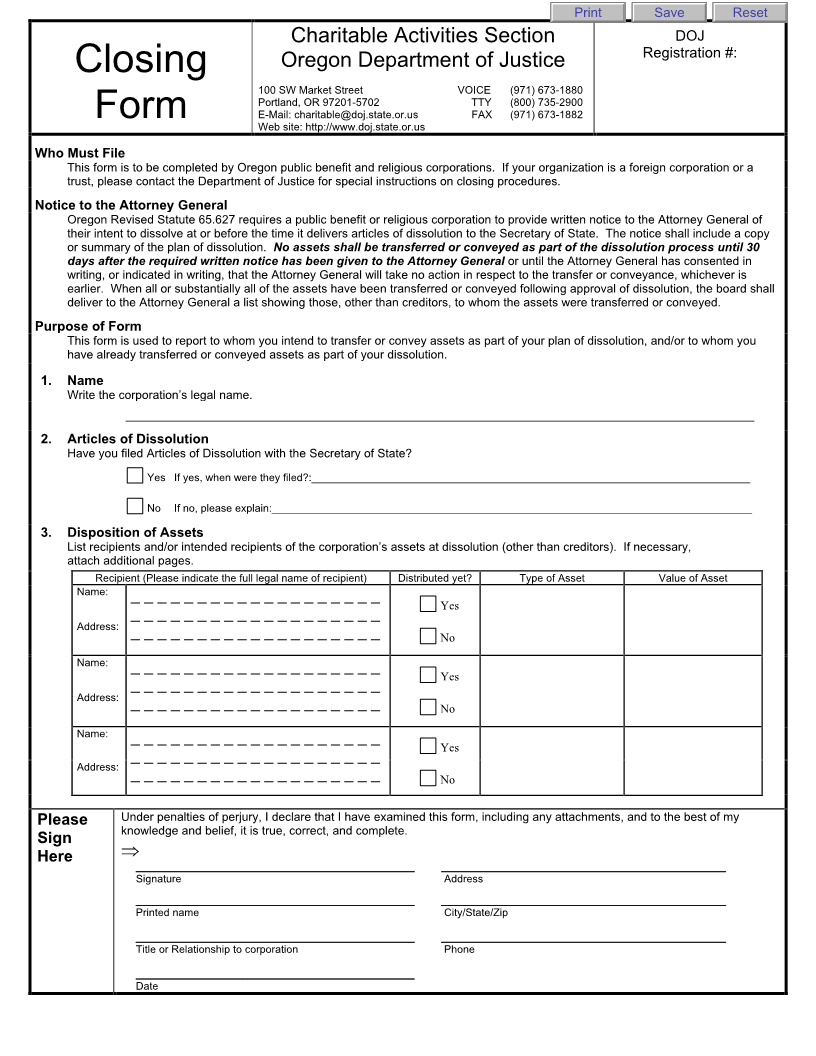

Charitable Activities Section DOJ

Registration #:

Oregon Department of Justice

Closing

100 SW Market Street VOICE (971) 673-1880

Portland, OR 97201-5702 TTY (800) 735-2900

E-Mail: charitable@doj.state.or.us FAX (971) 673-1882

Form Web site: http://www.doj.state.or.us

Who Must File

This form is to be completed by Oregon public benefit and religious corporations. If your organization is a foreign corporation or a

trust, please contact the Department of Justice for special instructions on closing procedures.

Notice to the Attorney General

Oregon Revised Statute 65.627 requires a public benefit or religious corporation to provide written notice to the Attorney General of

their intent to dissolve at or before the time it delivers articles of dissolution to the Secretary of State. The notice shall include a copy

or summary of the plan of dissolution. No assets shall be transferred or conveyed as part of the dissolution process until 30

days after the required written notice has been given to the Attorney General or until the Attorney General has consented in

writing, or indicated in writing, that the Attorney General will take no action in respect to the transfer or conveyance, whichever is

earlier. When all or substantially all of the assets have been transferred or conveyed following approval of dissolution, the board shall

deliver to the Attorney General a list showing those, other than creditors, to whom the assets were transferred or conveyed.

Purpose of Form

This form is used to report to whom you intend to transfer or convey assets as part of your plan of dissolution, and/or to whom you

have already transferred or conveyed assets as part of your dissolution.

1. Name

Write the corporation’s legal name.

__________________________________________________________________________________________________________

2. Articles of Dissolution

Have you filed Articles of Dissolution with the Secretary of State?

Yes If yes, when were they filed?:__________________________________________________________________________

No If no, please explain:_________________________________________________________________________________

3. Disposition of Assets

List recipients and/or intended recipients of the corporation’s assets at dissolution (other than creditors). If necessary,

attach additional pages.

Recipient (Please indicate the full legal name of recipient) Distributed yet? Type of Asset Value of Asset

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Yes

Address: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ No

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Yes

Address: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ No

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Yes

Address: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ No

Please Under penalties of perjury, I declare that I have examined this form, including any attachments, and to the best of my

knowledge and belief, it is true, correct, and complete.

Sign

Here ⇒

_______________________________________________ ________________________________________________

Signature Address

_______________________________________________ ________________________________________________

Printed name City/State/Zip

_______________________________________________ ________________________________________________

Title or Relationship to corporation Phone

_______________________________________________

Date