Enlarge image

Print Reset

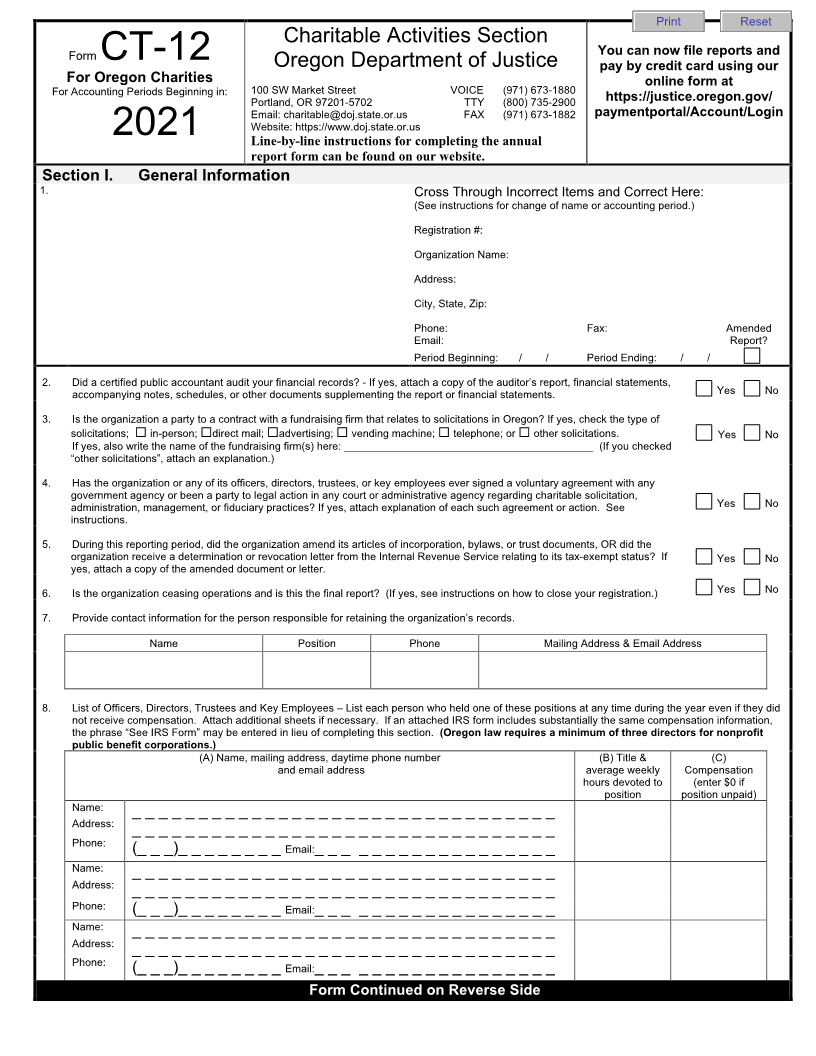

Charitable Activities Section

Form You can now file reports and

CT-12 Oregon Department of Justice pay by credit card using our

For Oregon Charities online form at

For Accounting Periods Beginning in: 100 SW Market Street VOICE (971) 673-1880

Portland, OR 97201-5702 TTY (800) 735-2900 https://justice.oregon.gov/

Email: charitable@doj.state.or.us FAX (971) 673-1882 paymentportal/Account/Login

Website: https://www.doj.state.or.us

2021 Line-by-line instructions for completing the annual

report form can be found on our website.

Section I. General Information

1. Cross Through Incorrect Items and Correct Here:

(See instructions for change of name or accounting period.)

Registration #:

Organization Name:

Address:

City, State, Zip:

Phone: Fax: Amended

Email: Report?

Period Beginning: / / Period Ending: / /

2. Did a certified public accountant audit your financial records? - If yes, attach a copy of the auditor’s report, financial statements,

accompanying notes, schedules, or other documents supplementing the report or financial statements. Yes No

3. Is the organization a party to a contract with a fundraising firm that relates to solicitations in Oregon? If yes, check the type of

solicitations; in-person; direct mail; advertising; vending machine; telephone; or other solicitations. Yes No

If yes, also write the name of the fundraising firm(s) here: __________________________________________ (If you checked

“other solicitations”, attach an explanation.)

4. Has the organization or any of its officers, directors, trustees, or key employees ever signed a voluntary agreement with any

government agency or been a party to legal action in any court or administrative agency regarding charitable solicitation,

administration, management, or fiduciary practices? If yes, attach explanation of each such agreement or action. See Yes No

instructions.

5. During this reporting period, did the organization amend its articles of incorporation, bylaws, or trust documents, OR did the

organization receive a determination or revocation letter from the Internal Revenue Service relating to its tax-exempt status? If Yes No

yes, attach a copy of the amended document or letter.

6. Is the organization ceasing operations and is this the final report? (If yes, see instructions on how to close your registration.) Yes No

7. Provide contact information for the person responsible for retaining the organization’s records.

Name Position Phone Mailing Address & Email Address

8. List of Officers, Directors, Trustees and Key Employees – List each person who held one of these positions at any time during the year even if they did

not receive compensation. Attach additional sheets if necessary. If an attached IRS form includes substantially the same compensation information,

the phrase “See IRS Form” may be entered in lieu of completing this section. (Oregon law requires a minimum of three directors for nonprofit

public benefit corporations.)

(A) Name, mailing address, daytime phone number (B) Title & (C)

and email address average weekly Compensation

hours devoted to (enter $0 if

position position unpaid)

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Address:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Phone:

(_ _ _)_ _ _ _ _ _ _ _ Email:_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Address:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Phone: (_ _ _)_ _ _ _ _ _ _ _ Email:_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Name:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Address:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Phone:

(_ _ _)_ _ _ _ _ _ _ _ Email:_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Form Continued on Reverse Side