Enlarge image

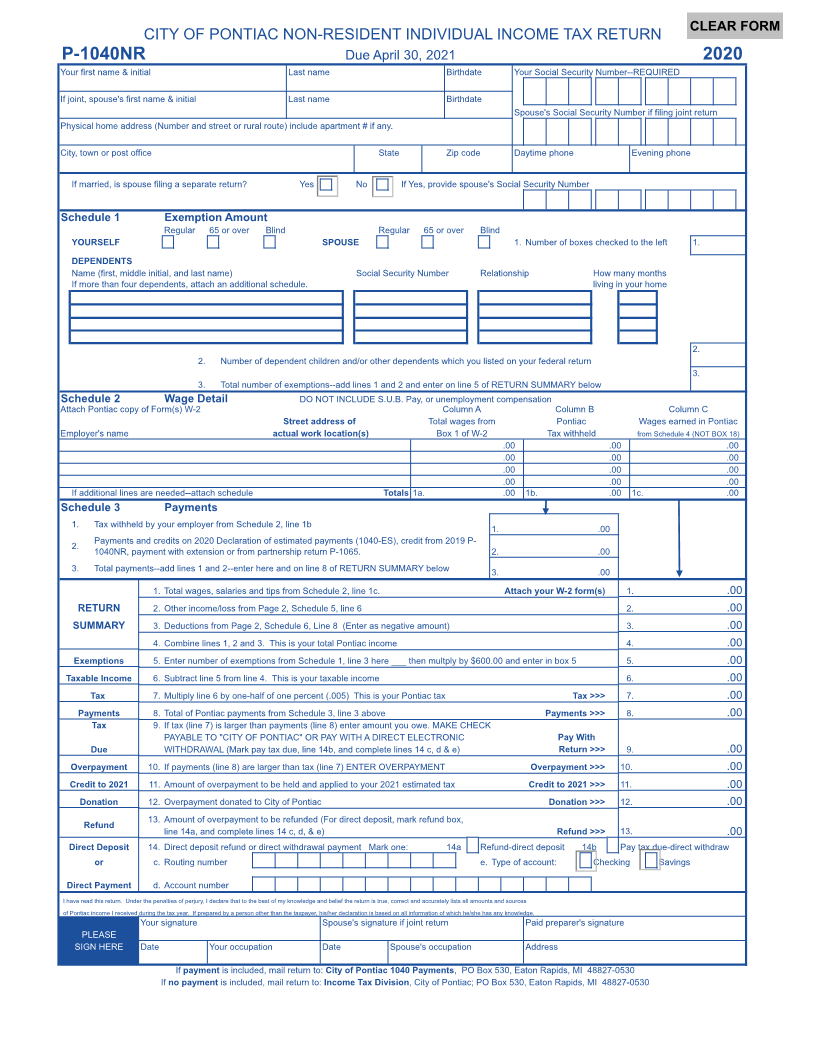

CLEAR FORM

CITY OF PONTIAC NON-RESIDENT INDIVIDUAL INCOME TAX RETURN

P-1040NR Due April 30, 2021 2020

Your first name & initial Last name Birthdate Your Social Security Number--REQUIRED

If joint, spouse's first name & initial Last name Birthdate

Spouse's Social Security Number if filing joint return

Physical home address (Number and street or rural route) include apartment # if any.

City, town or post office State Zip code Daytime phone Evening phone

If married, is spouse filing a separate return? Yes No If Yes, provide spouse's Social Security Number

Schedule 1 Exemption Amount

Regular 65 or over Blind Regular 65 or over Blind

YOURSELF SPOUSE 1. Number of boxes checked to the left 1.

DEPENDENTS

Name (first, middle initial, and last name) Social Security Number Relationship How many months

If more than four dependents, attach an additional schedule. living in your home

2.

2. Number of dependent children and/or other dependents which you listed on your federal return

3.

3. Total number of exemptions--add lines 1 and 2 and enter on line 5 of RETURN SUMMARY below

Schedule 2 Wage Detail DO NOT INCLUDE S.U.B. Pay, or unemployment compensation

Attach Pontiac copy of Form(s) W-2 Column A Column B Column C

Street address of Total wages from Pontiac Wages earned in Pontiac

Employer's name actual work location(s) Box 1 of W-2 Tax withheld from Schedule 4 (NOT BOX 18)

.00 .00 .00

.00 .00 .00

.00 .00 .00

.00 .00 .00

If additional lines are needed--attach schedule Totals 1a. .00 1b. .00 1c. .00

Schedule 3 Payments

1. Tax withheld by your employer from Schedule 2, line 1b 1. .00

Payments and credits on 2020 Declaration of estimated payments (1040-ES), credit from 2019 P-

2. 1040NR, payment with extension or from partnership return P-1065. 2. .00

3. Total payments--add lines 1 and 2--enter here and on line 8 of RETURN SUMMARY below 3. .00

1. Total wages, salaries and tips from Schedule 2, line 1c. Attach your W-2 form(s) 1. .00

RETURN 2. Other income/loss from Page 2, Schedule 5, line 6 2. .00

SUMMARY 3. Deductions from Page 2, Schedule 6, Line 8 (Enter as negative amount) 3. .00

4. Combine lines 1, 2 and 3. This is your total Pontiac income 4. .00

Exemptions 5. Enter number of exemptions from Schedule 1, line 3 here ___ then multply by $600.00 and enter in box 5 5. .00

Taxable Income 6. Subtract line 5 from line 4. This is your taxable income 6. .00

Tax 7. Multiply line 6 by one-half of one percent (.005) This is your Pontiac tax Tax >>> 7. .00

Payments 8. Total of Pontiac payments from Schedule 3, line 3 above Payments >>> 8. .00

Tax 9. If tax (line 7) is larger than payments (line 8) enter amount you owe. MAKE CHECK

PAYABLE TO "CITY OF PONTIAC" OR PAY WITH A DIRECT ELECTRONIC Pay With

Due WITHDRAWAL (Mark pay tax due, line 14b, and complete lines 14 c, d & e) Return >>> 9. .00

Overpayment 10. If payments (line 8) are larger than tax (line 7) ENTER OVERPAYMENT Overpayment >>> 10. .00

Credit to 2021 11. Amount of overpayment to be held and applied to your 2021 estimated tax Credit to 2021 >>> 11. .00

Donation 12. Overpayment donated to City of Pontiac Donation >>> 12. .00

Refund 13. Amount of overpayment to be refunded (For direct deposit, mark refund box,

line 14a, and complete lines 14 c, d, & e) Refund >>> 13. .00

Direct Deposit 14. Direct deposit refund or direct withdrawal payment Mark one: 14a Refund-direct deposit 14b Pay tax due-direct withdraw

or c. Routing number e. Type of account: Checking Savings

Direct Payment d. Account number

I have read this return. Under the penalties of perjury, I declare that to the best of my knowledge and belief the return is true, correct and accurately lists all amounts and sources

of Pontiac income I received during the tax year. If prepared by a person other than the taxpayer, his/her declaration is based on all information of which he/she has any knowledge.

Your signature Spouse's signature if joint return Paid preparer's signature

PLEASE

SIGN HERE Date Your occupation Date Spouse's occupation Address

If payment is included, mail return to: City of Pontiac 1040 Payments, PO Box 530, Eaton Rapids, MI 48827-0530

If no payment is included, mail return to: Income Tax Division, City of Pontiac; PO Box 530, Eaton Rapids, MI 48827-0530