Enlarge image

CITY OF PONTIAC ESTIMATE INSTRUCTIONS

1. PURPOSE OF CITY OF PONTIAC ESTIMATED INCOME TAX VOUCHERS:

Payment vouchers are provided for paying currently any income tax due in excess of the tax withheld.

2. WHO MUST MAKE ESTIMATED TAX PAYMENTS:

A. Individuals and Unincorporated Businesses — Every resident and nonresident subject to the tax from whom the tax is not withheld must pay Estimated Income Tax. A payment

is not required from individuals and unincorporated businesses, if the estimated tax on line 6 is One Hundred ($100.00) or less. A husband and wife may make joint payments

unless they are legally separated or divorced, or have different taxable years.

B. Corporations — Every Corporation subject to the tax on all or part of its net profits must make payments of Estimated Income Tax. A payment is not required from corporations

if the estimated tax on line 6 is Two Hundred Fifty Dollars ($250.00) or less.

C. Partnerships — A partnership whose partners are subject to the tax on all or part of their distributive share of net profits may make payments of Estimated Income Tax. If the

partnership makes payments, the partners will not be required to make payments as individuals, unless they have other income on which the Pontiac income tax is expected

to exceed One Hundred ($100.00). The payments made by the partnership should be accompanied by a statement showing the names, addresses and social security numbers

of the partners on whose behalf the payments are being made.

3. WHEN AND WHERE TO PAY ESTIMATED TAX:

A. First Payment for Calendar Year — The First Payment for a calendar year must be filed on or before April 30th of that year. The estimated tax is payable in equal installments

on or before April 30th, June 30th, September 30th, and January 31st.

B. First Payment for Fiscal Year — The First Payment for a fiscal year, or period differing from the calendar year, must be filed within four (4) months after the beginning of each

fiscal year or period. For example, if your fiscal year begins on April 1st, your first will be due on August 1. Remaining installments will then be due on the last day of the 6th,

9th, and 13th months after the beginning of the fiscal year.

C. Filing and Payment — Mail and make checks payable to: City of Pontiac – Estimated Payment, P.O. Box 530, Eaton Rapids, MI 48827-0530. We do not send reminder

notices requesting estimated tax installment payments. Please send your payments with the attached vouchers when due. Put your social security number on your check.

4. INCOME SUBJECT TO TAX:

A. Resident — All salaries, wages, bonuses, commissions and other compensation, net profits from a business or profession, net rental income, capital gains less capital losses,

dividends, interest, income from estates and trusts and other income.

B. Nonresident — Salaries, wages, bonuses, commissions or other compensation for services rendered or work performed in Pontiac; net rental income from property in Pontiac,

net profit from a business, profession or other activity to the extent that it is from work done, services rendered or activity conducted in Pontiac; capital gains less capital losses

from the sale of real or tangible personal property located in Pontiac.

5. WITHHOLDING TAX CREDITS AND OTHER CREDITS;

A. Withholding Tax Credit — You may subtract from your estimate of Pontiac Income Tax the amount of Pontiac income tax expected to be withheld.

B. Income Tax Paid by Partnership — If you are a member of a partnership which elects to file a return and pay the tax on behalf of its partners, you may subtract from your estimate

of Pontiac Income Tax the amount of tax expected to be paid by the partnership for your distributive share of net profits.

C. Income Tax Paid to Another Municipality — If you are a resident of the City of Pontiac and pay income tax to another municipality, you may subtract from your

estimate of Pontiac Income Tax the amount of income tax expected to be paid to the other municipality. The credit may not exceed the tax that a non-resident of

Pontiac would have paid on the same income.

6. INTEREST AND PENALTIES:

If the total amount of tax withheld or paid is less than seventy percent (70%) of the tax shown on the taxpayer’s final return for the current or preceding taxable year, interest

and penalties will be charged.

7. ANNUAL RETURN REQUIRED:

The Payment of estimated tax does not excuse the taxpayer from filing an annual return.

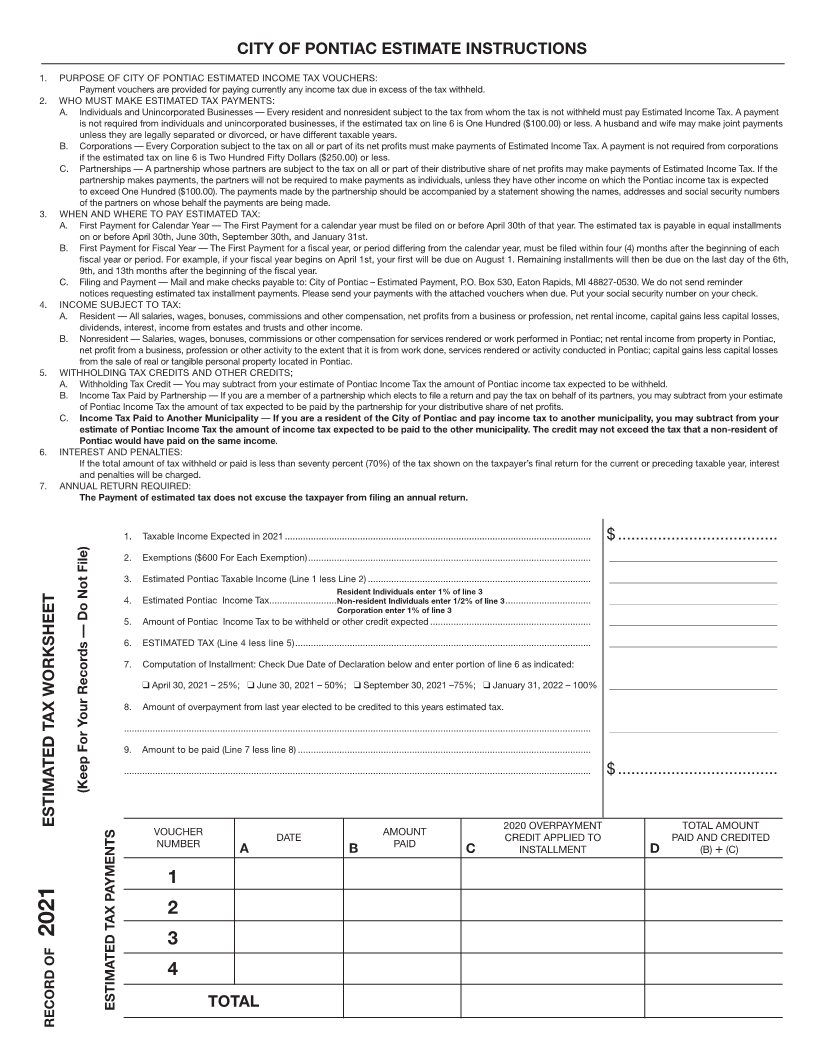

1. Taxable Income Expected in 2021 ...................................................................................................................... $ ....................................

2. Exemptions ($600 For Each Exemption) ............................................................................................................. ____________________________________

3. Estimated Pontiac Taxable Income (Line 1 less Line 2) ...................................................................................... ____________________________________

Resident Individuals enter 1% of line 3

4. Estimated Pontiac Income Tax ............................................................................................................................Non-resident Individuals enter 1/2% of line 3 ____________________________________

Corporation enter 1% of line 3

5. Amount of Pontiac Income Tax to be withheld or other credit expected .............................................................. ____________________________________

6. ESTIMATED TAX (Line 4 less line 5) .................................................................................................................. ____________________________________

7. Computation of Installment: Check Due Date of Declaration below and enter portion of line 6 as indicated:

❑ April 30, 2021 – 25%; ❑ June 30, 2021 – 50%; ❑ September 30, 2021 –75%; ❑ January 31, 2022 – 100% ____________________________________

8. Amount of overpayment from last year elected to be credited to this years estimated tax.

.................................................................................................................................................................................... ____________________________________

9. Amount to be paid (Line 7 less line 8) .................................................................................................................

.................................................................................................................................................................................... $ ....................................

(Keep For Your Records –– Do Not File)

ESTIMATED TAX WORKSHEET 2020 OVERPAYMENT TOTAL AMOUNT

VOUCHER DATE AMOUNT CREDIT APPLIED TO PAID AND CREDITED

NUMBER A B PAID C INSTALLMENT D (B) +(C)

1

2

2021

3

4

ESTIMATED TAX PAYMENTS TOTAL

RECORD OF