Enlarge image

MAKE CHECK

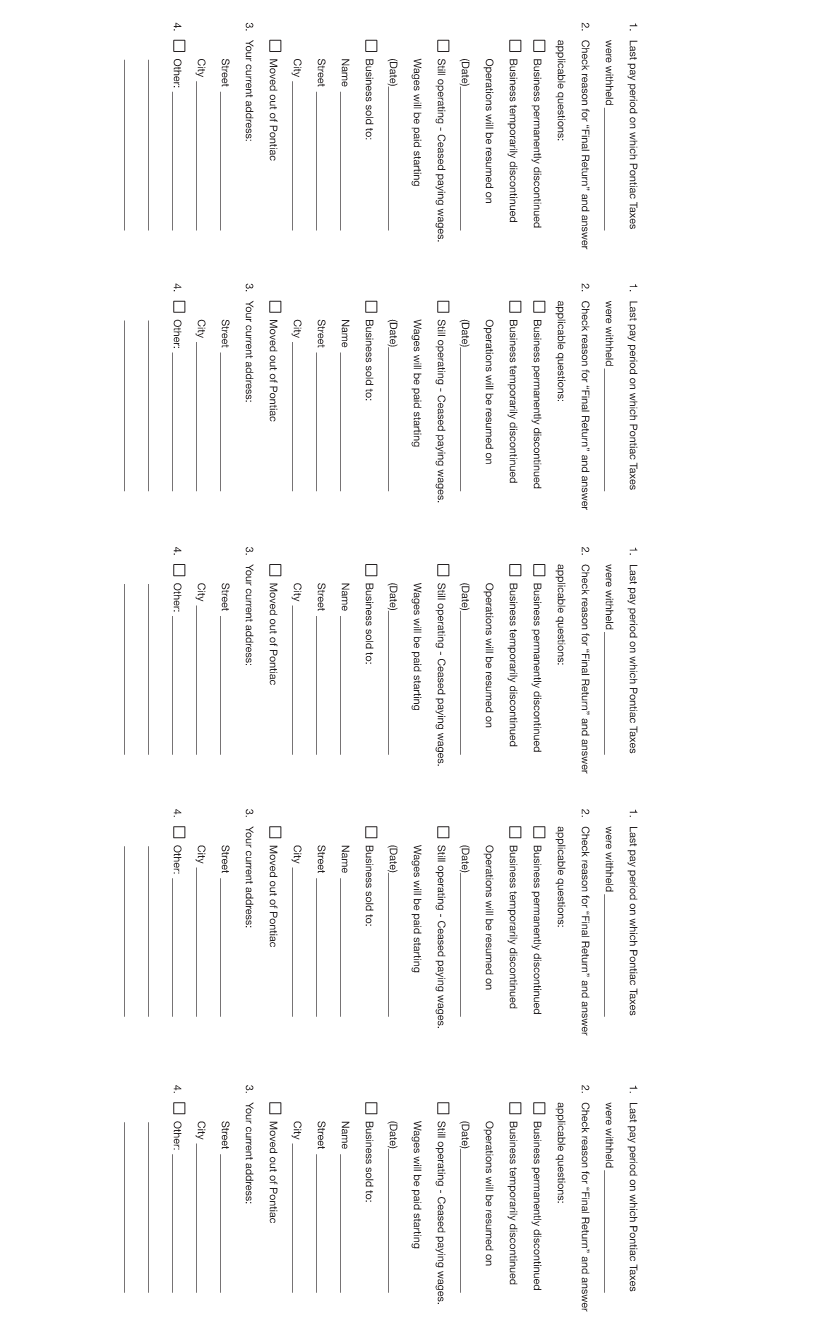

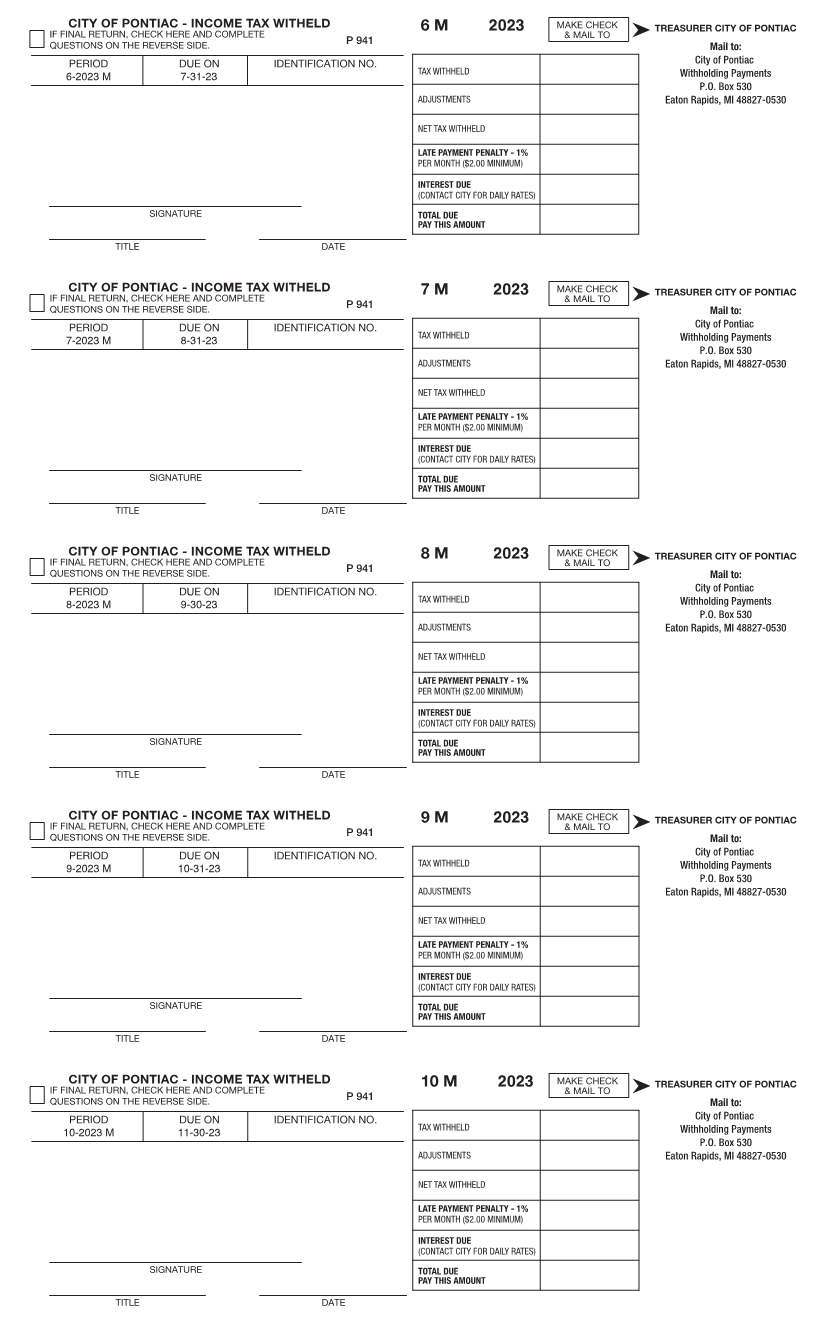

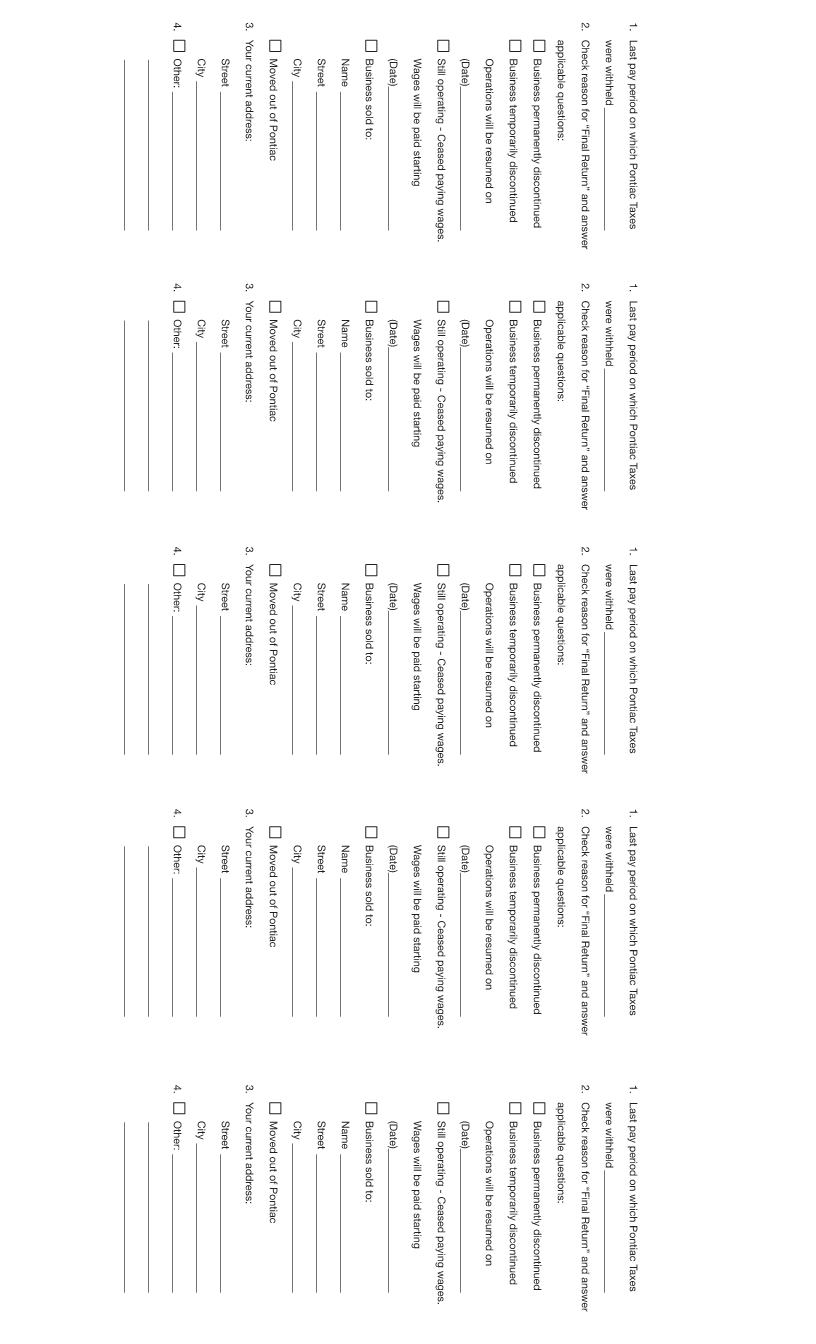

IF FINAL RETURN, CHECK HERE AND COMPLETECITY OF PONTIAC - INCOME TAX WITHELD 1 M 2023 & MAIL TO TREASURER CITY OF PONTIAC

QUESTIONS ON THE REVERSE SIDE. P 941 Mail to:

City of Pontiac

PERIOD DUE ON IDENTIFICATION NO. TAX WITHHELD

1-2023 M 2-28-23 Withholding Payments

P.O. Box 530

ADJUSTMENTS Eaton Rapids, MI 48827-0530

NET TAX WITHHELD

LATE PAYMENT PENALTY - 1%

PER MONTH ($2.00 MINIMUM)

INTEREST DUE

(CONTACT CITY FOR DAILY RATES)

SIGNATURE TOTAL DUE

PAY THIS AMOUNT

TITLE DATE

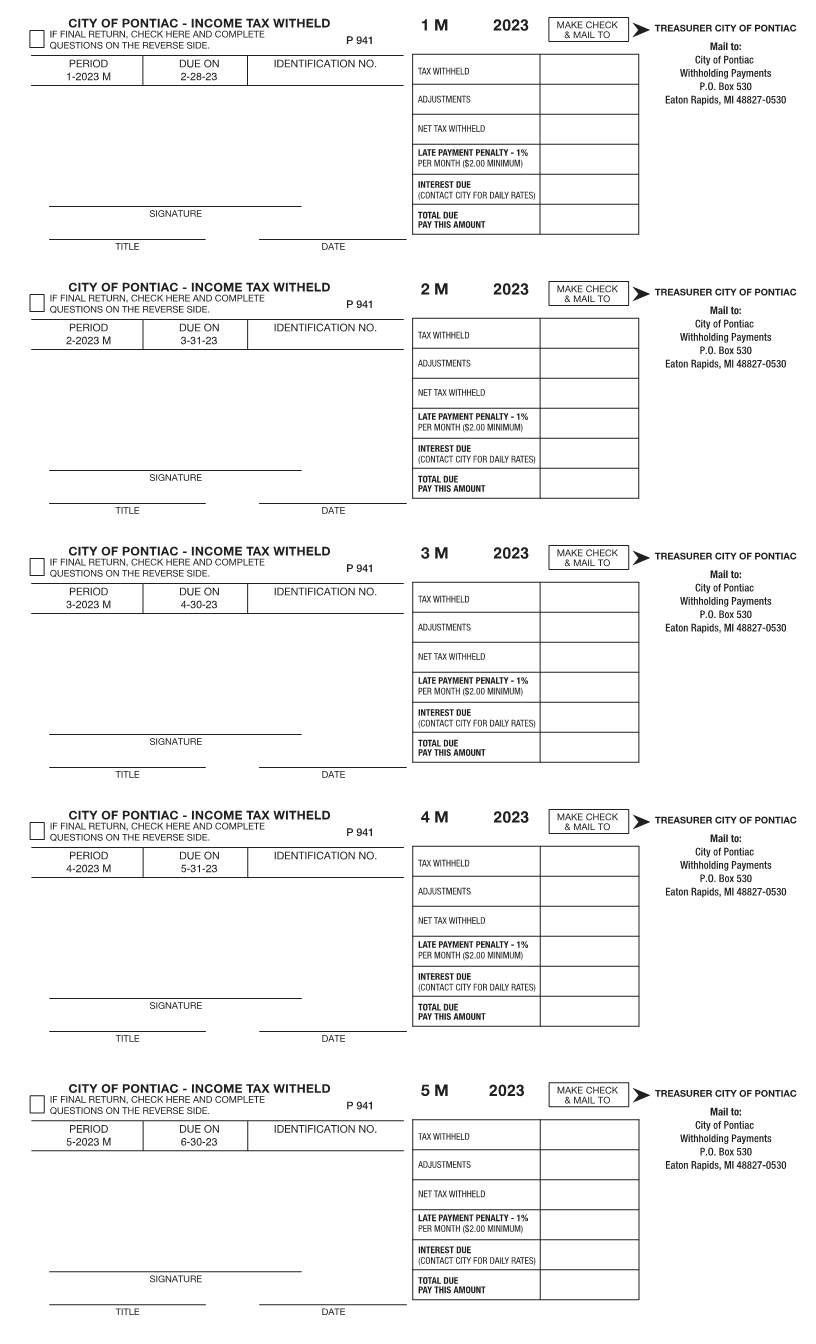

MAKE CHECK

IF FINAL RETURN, CHECK HERE AND COMPLETECITY OF PONTIAC - INCOME TAX WITHELD 2 M 2023 & MAIL TO TREASURER CITY OF PONTIAC

QUESTIONS ON THE REVERSE SIDE. P 941 Mail to:

City of Pontiac

PERIOD DUE ON IDENTIFICATION NO. TAX WITHHELD

2-2023 M 3-31-23 Withholding Payments

P.O. Box 530

ADJUSTMENTS Eaton Rapids, MI 48827-0530

NET TAX WITHHELD

LATE PAYMENT PENALTY - 1%

PER MONTH ($2.00 MINIMUM)

INTEREST DUE

(CONTACT CITY FOR DAILY RATES)

SIGNATURE TOTAL DUE

PAY THIS AMOUNT

TITLE DATE

MAKE CHECK

IF FINAL RETURN, CHECK HERE AND COMPLETECITY OF PONTIAC - INCOME TAX WITHELD 3 M 2023 & MAIL TO TREASURER CITY OF PONTIAC

QUESTIONS ON THE REVERSE SIDE. P 941 Mail to:

City of Pontiac

PERIOD DUE ON IDENTIFICATION NO. TAX WITHHELD

3-2023 M 4-30-23 Withholding Payments

P.O. Box 530

ADJUSTMENTS Eaton Rapids, MI 48827-0530

NET TAX WITHHELD

LATE PAYMENT PENALTY - 1%

PER MONTH ($2.00 MINIMUM)

INTEREST DUE

(CONTACT CITY FOR DAILY RATES)

SIGNATURE TOTAL DUE

PAY THIS AMOUNT

TITLE DATE

MAKE CHECK

IF FINAL RETURN, CHECK HERE AND COMPLETECITY OF PONTIAC - INCOME TAX WITHELD 4 M 2023 & MAIL TO TREASURER CITY OF PONTIAC

QUESTIONS ON THE REVERSE SIDE. P 941 Mail to:

City of Pontiac

PERIOD DUE ON IDENTIFICATION NO. TAX WITHHELD

4-2023 M 5-31-23 Withholding Payments

P.O. Box 530

ADJUSTMENTS Eaton Rapids, MI 48827-0530

NET TAX WITHHELD

LATE PAYMENT PENALTY - 1%

PER MONTH ($2.00 MINIMUM)

INTEREST DUE

(CONTACT CITY FOR DAILY RATES)

SIGNATURE TOTAL DUE

PAY THIS AMOUNT

TITLE DATE

MAKE CHECK

IF FINAL RETURN, CHECK HERE AND COMPLETECITY OF PONTIAC - INCOME TAX WITHELD 5 M 2023 & MAIL TO TREASURER CITY OF PONTIAC

QUESTIONS ON THE REVERSE SIDE. P 941 Mail to:

City of Pontiac

PERIOD DUE ON IDENTIFICATION NO. TAX WITHHELD

5-2023 M 6-30-23 Withholding Payments

P.O. Box 530

ADJUSTMENTS Eaton Rapids, MI 48827-0530

NET TAX WITHHELD

LATE PAYMENT PENALTY - 1%

PER MONTH ($2.00 MINIMUM)

INTEREST DUE

(CONTACT CITY FOR DAILY RATES)

SIGNATURE TOTAL DUE

PAY THIS AMOUNT

TITLE DATE