Enlarge image

MAKE CHECK

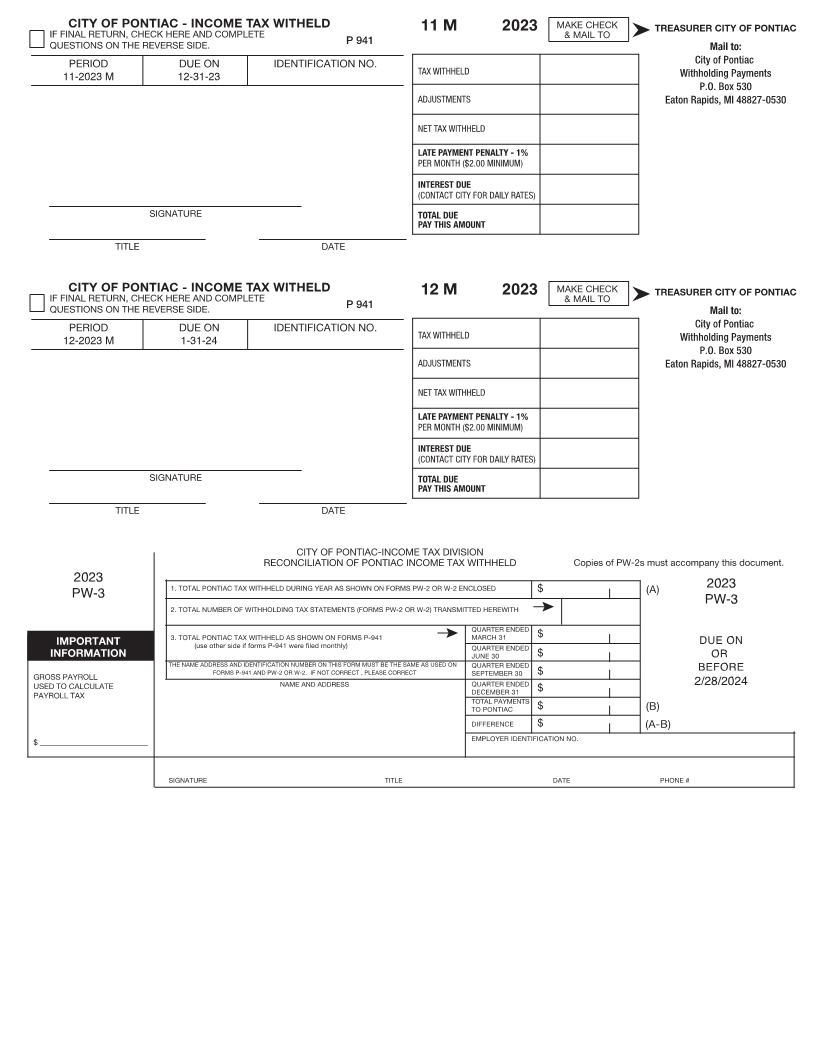

IF FINAL RETURN, CHECK HERE AND COMPLETECITY OF PONTIAC - INCOME TAX WITHELD 11 M 2023 & MAIL TO TREASURER CITY OF PONTIAC

QUESTIONS ON THE REVERSE SIDE. P 941 Mail to:

City of Pontiac

PERIOD DUE ON IDENTIFICATION NO. TAX WITHHELD

11-2023 M 12-31-23 Withholding Payments

P.O. Box 530

ADJUSTMENTS Eaton Rapids, MI 48827-0530

NET TAX WITHHELD

LATE PAYMENT PENALTY - 1%

PER MONTH ($2.00 MINIMUM)

INTEREST DUE

(CONTACT CITY FOR DAILY RATES)

SIGNATURE TOTAL DUE

PAY THIS AMOUNT

TITLE DATE

MAKE CHECK

IF FINAL RETURN, CHECK HERE AND COMPLETECITY OF PONTIAC - INCOME TAX WITHELD 12 M 2023 & MAIL TO TREASURER CITY OF PONTIAC

QUESTIONS ON THE REVERSE SIDE. P 941 Mail to:

City of Pontiac

PERIOD DUE ON IDENTIFICATION NO. TAX WITHHELD

12-2023 M 1-31-24 Withholding Payments

P.O. Box 530

ADJUSTMENTS Eaton Rapids, MI 48827-0530

NET TAX WITHHELD

LATE PAYMENT PENALTY - 1%

PER MONTH ($2.00 MINIMUM)

INTEREST DUE

(CONTACT CITY FOR DAILY RATES)

SIGNATURE TOTAL DUE

PAY THIS AMOUNT

TITLE DATE

CITY OF PONTIAC-INCOME TAX DIVISION

RECONCILIATION OF PONTIAC INCOME TAX WITHHELD Copies of PW-2s must accompany this document.

2023 1. TOTAL PONTIAC TAX WITHHELD DURING YEAR AS SHOWN ON FORMS PW-2 OR W-2 ENCLOSED 2023

PW-3 $ (A) PW-3

2. TOTAL NUMBER OF WITHHOLDING TAX STATEMENTS (FORMS PW-2 OR W-2) TRANSMITTED HEREWITH

QUARTER ENDED

IMPORTANT 3. TOTAL PONTIAC TAX WITHHELD AS SHOWN ON FORMS P-941 MARCH 31 $ DUE ON

(use other side if forms P-941 were filed monthly) QUARTER ENDED

INFORMATION JUNE 30 $ OR

THE NAME ADDRESS AND IDENTIFICATION NUMBER ON THIS FORM MUST BE THE SAME AS USED ON

FORMS P-941 AND PW-2 OR W-2. IF NOT CORRECT , PLEASE CORRECT QUARTER ENDED $ BEFORE

SEPTEMBER 30

GROSS PAYROLL NAME AND ADDRESS QUARTER ENDED $

USED TO CALCULATE DECEMBER 31 2/28/2024

PAYROLL TAX TOTAL PAYMENTS

TO PONTIAC $ (B)

DIFFERENCE $ (A-B)

$ ____________________________ EMPLOYER IDENTIFICATION NO.

SIGNATURE TITLE DATE PHONE #