Enlarge image

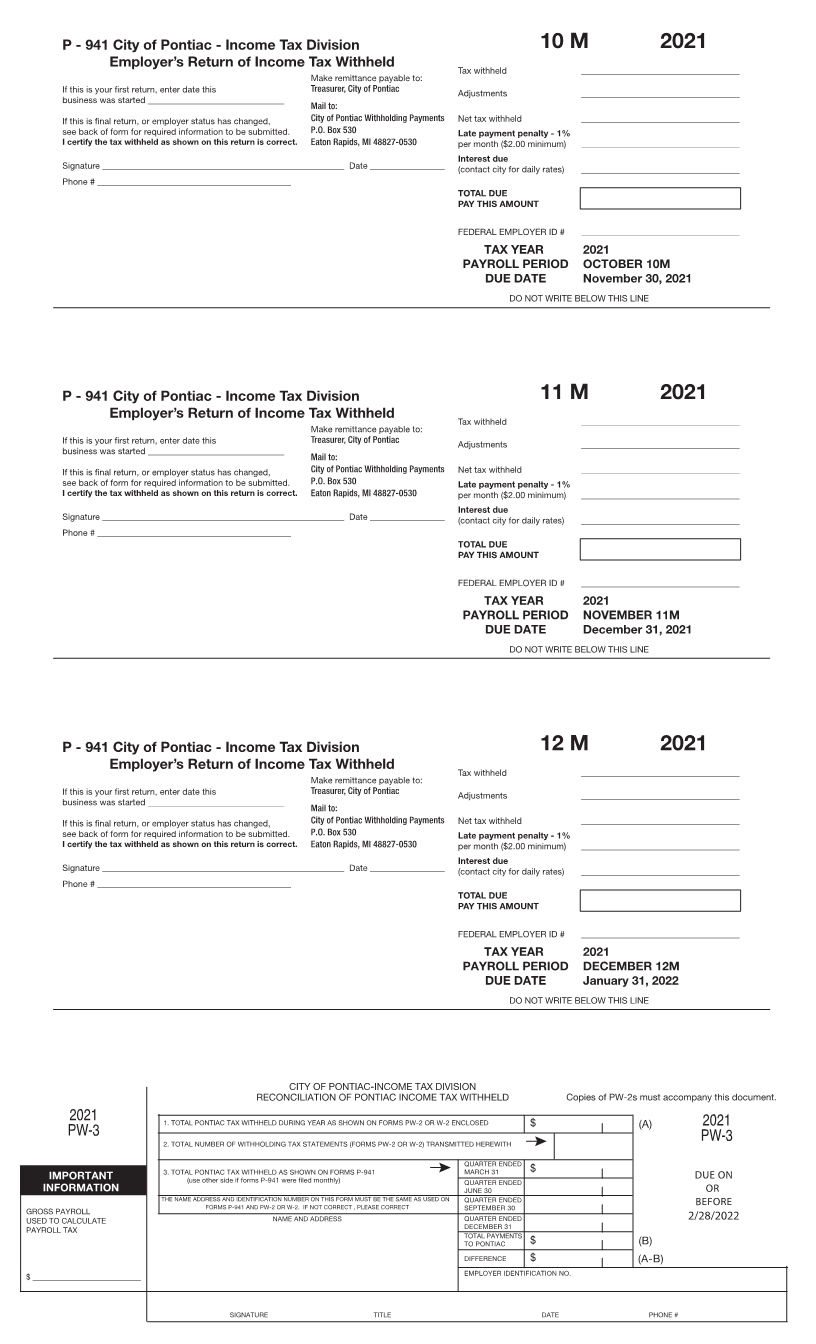

P - 941 City of Pontiac - Income Tax Division 10 M 2021

Employer’s Return of Income Tax Withheld Tax withheld ____________________________________

Make remittance payable to:

If this is your first return, enter date this Treasurer, City of Pontiac Adjustments ____________________________________

business was started _______________________________ Mail to:

If this is final return, or employer status has changed, City of Pontiac Withholding Payments Net tax withheld ____________________________________

see back of form for required information to be submitted. P.O. Box 530 Late payment penalty - 1%

I certify the tax withheld as shown on this return is correct. Eaton Rapids, MI 48827-0530 per month ($2.00 minimum) ____________________________________

Interest due

Signature _______________________________________________________ Date _________________ (contact city for daily rates) ____________________________________

Phone # ____________________________________________

TOTAL DUE

PAY THIS AMOUNT

FEDERAL EMPLOYER ID # ____________________________________

TAX YEAR 2021

PAYROLL PERIOD OCTOBER 10M

DUE DATE November 30, 2021

DO NOT WRITE BELOW THIS LINE

P - 941 City of Pontiac - Income Tax Division 11 M 2021

Employer’s Return of Income Tax Withheld Tax withheld ____________________________________

Make remittance payable to:

If this is your first return, enter date this Treasurer, City of Pontiac Adjustments ____________________________________

business was started _______________________________ Mail to:

If this is final return, or employer status has changed, City of Pontiac Withholding Payments Net tax withheld ____________________________________

see back of form for required information to be submitted. P.O. Box 530 Late payment penalty - 1%

I certify the tax withheld as shown on this return is correct. Eaton Rapids, MI 48827-0530 per month ($2.00 minimum) ____________________________________

Interest due

Signature _______________________________________________________ Date _________________ (contact city for daily rates) ____________________________________

Phone # ____________________________________________

TOTAL DUE

PAY THIS AMOUNT

FEDERAL EMPLOYER ID # ____________________________________

TAX YEAR 2021

PAYROLL PERIOD NOVEMBER 11M

DUE DATE December 31, 2021

DO NOT WRITE BELOW THIS LINE

P - 941 City of Pontiac - Income Tax Division 12 M 2021

Employer’s Return of Income Tax Withheld Tax withheld ____________________________________

Make remittance payable to:

If this is your first return, enter date this Treasurer, City of Pontiac Adjustments ____________________________________

business was started _______________________________ Mail to:

If this is final return, or employer status has changed, City of Pontiac Withholding Payments Net tax withheld ____________________________________

see back of form for required information to be submitted. P.O. Box 530 Late payment penalty - 1%

I certify the tax withheld as shown on this return is correct. Eaton Rapids, MI 48827-0530 per month ($2.00 minimum) ____________________________________

Interest due

Signature _______________________________________________________ Date _________________ (contact city for daily rates) ____________________________________

Phone # ____________________________________________

TOTAL DUE

PAY THIS AMOUNT

FEDERAL EMPLOYER ID # ____________________________________

TAX YEAR 2021

PAYROLL PERIOD DECEMBER 12M

DUE DATE January 31, 2022

DO NOT WRITE BELOW THIS LINE

CITY OF PONTIAC-INCOME TAX DIVISION

RECONCILIATION OF PONTIAC INCOME TAX WITHHELD Copies of PW-2s must accompany this document.

2021 1. TOTAL PONTIAC TAX WITHHELD DURING YEAR AS SHOWN ON FORMS PW-2 OR W-2 ENCLOSED $ (A) 2021

PW-3 2. TOTAL NUMBER OF WITHHOLDING TAX STATEMENTS (FORMS PW-2 OR W-2) TRANSMITTED HEREWITH PW-3

QUARTER ENDED

IMPORTANT 3. TOTAL PONTIAC TAX WITHHELD AS SHOWN ON FORMS P-941 MARCH 31 $ DUE ON

INFORMATION (use other side if forms P-941 were filed monthly) QUARTER ENDED OR

JUNE 30

THE NAME ADDRESS AND IDENTIFICATION NUMBER ON THIS FORM MUST BE THE SAME AS USED ON QUARTER ENDED BEFORE

GROSS PAYROLL FORMS P-941 AND PW-2 OR W-2. IF NOT CORRECT , PLEASE CORRECT SEPTEMBER 30 2/28/2022

USED TO CALCULATE NAME AND ADDRESS QUARTER ENDED

DECEMBER 31

PAYROLL TAX TOTAL PAYMENTS $ (B)

TO PONTIAC

DIFFERENCE $ (A-B)

$ ____________________________ EMPLOYER IDENTIFICATION NO.

SIGNATURE TITLE DATE PHONE #