Enlarge image

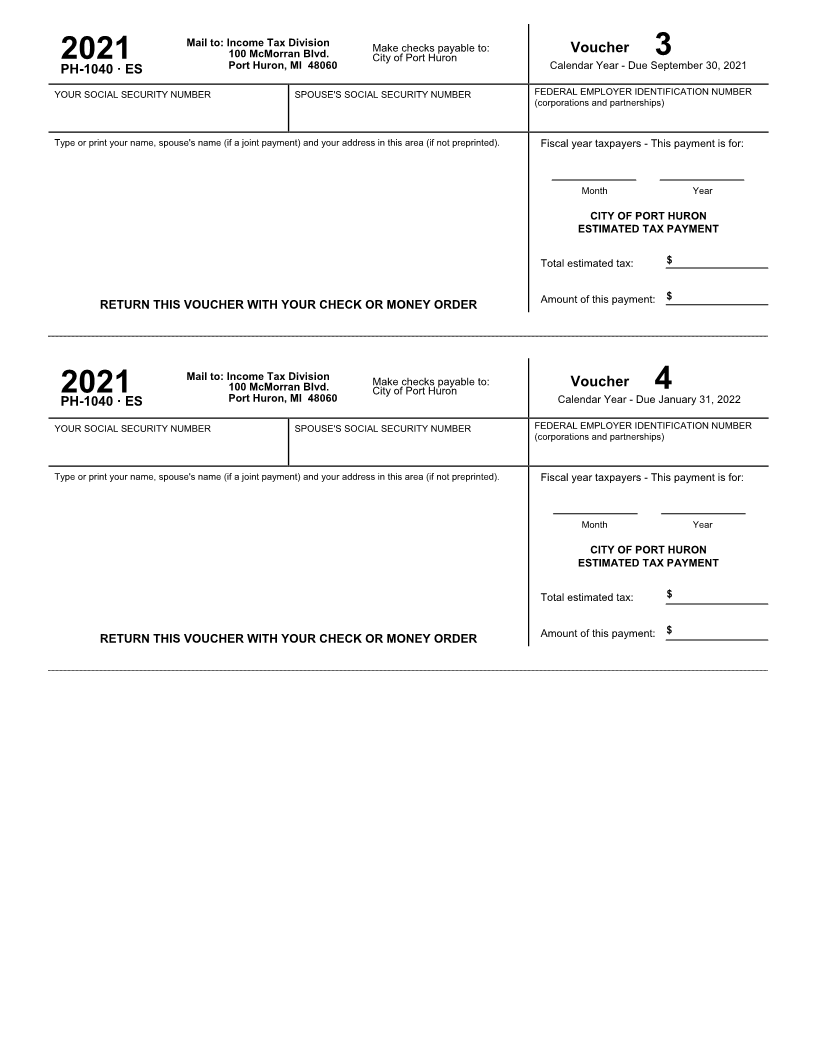

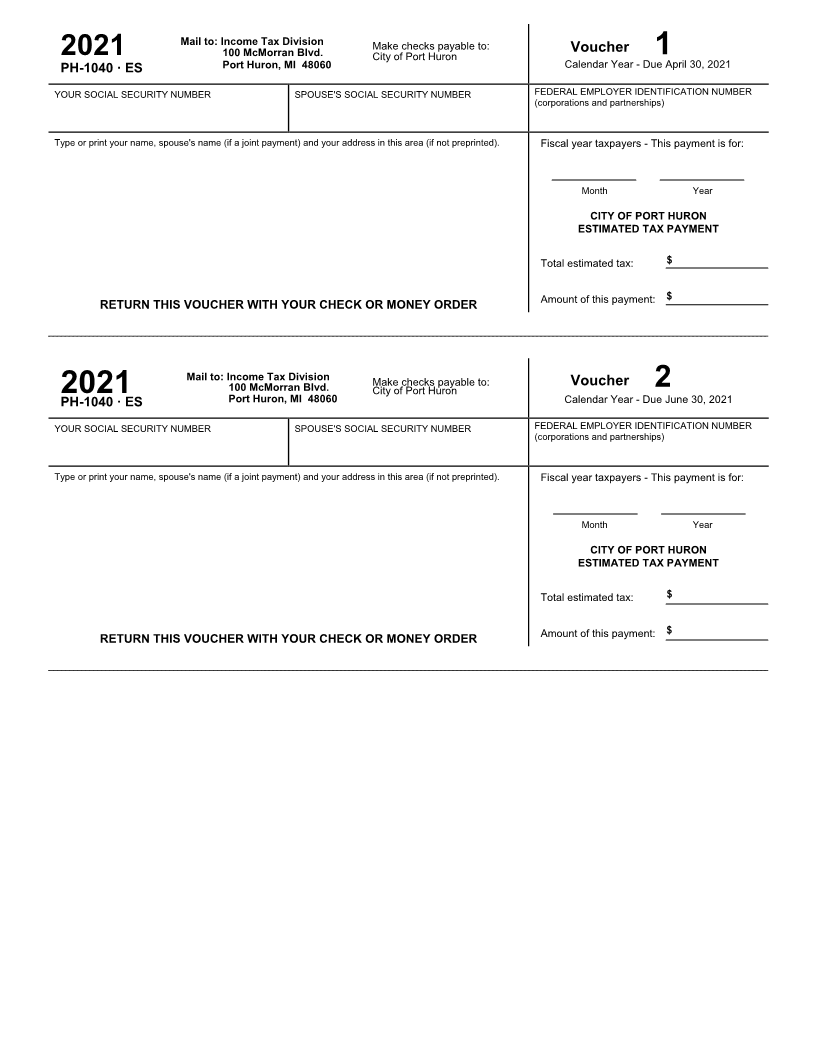

Mail to: Income Tax Division Make checks payable to:

2021 100 McMorran Blvd. City of Port Huron Voucher 1

PH-1040 · ES Port Huron, MI 48060 Calendar Year - Due April 30, 2021

YOUR SOCIAL SECURITY NUMBER SPOUSE'S SOCIAL SECURITY NUMBER FEDERAL EMPLOYER IDENTIFICATION NUMBER

(corporations and partnerships)

Type or print your name, spouse's name (if a joint payment) and your address in this area (if not preprinted). Fiscal year taxpayers - This payment is for:

Month Year

CITY OF PORT HURON

ESTIMATED TAX PAYMENT

Total estimated tax: $

Amount of this payment: $

RETURN THIS VOUCHER WITH YOUR CHECK OR MONEY ORDER

Mail to: Income Tax Division Make checks payable to:

2021 100 McMorran Blvd. City of Port Huron Voucher 2

PH-1040 · ES Port Huron, MI 48060 Calendar Year - Due June 30, 2021

YOUR SOCIAL SECURITY NUMBER SPOUSE'S SOCIAL SECURITY NUMBER FEDERAL EMPLOYER IDENTIFICATION NUMBER

(corporations and partnerships)

Type or print your name, spouse's name (if a joint payment) and your address in this area (if not preprinted). Fiscal year taxpayers - This payment is for:

Month Year

CITY OF PORT HURON

ESTIMATED TAX PAYMENT

Total estimated tax: $

Amount of this payment: $

RETURN THIS VOUCHER WITH YOUR CHECK OR MONEY ORDER