Enlarge image

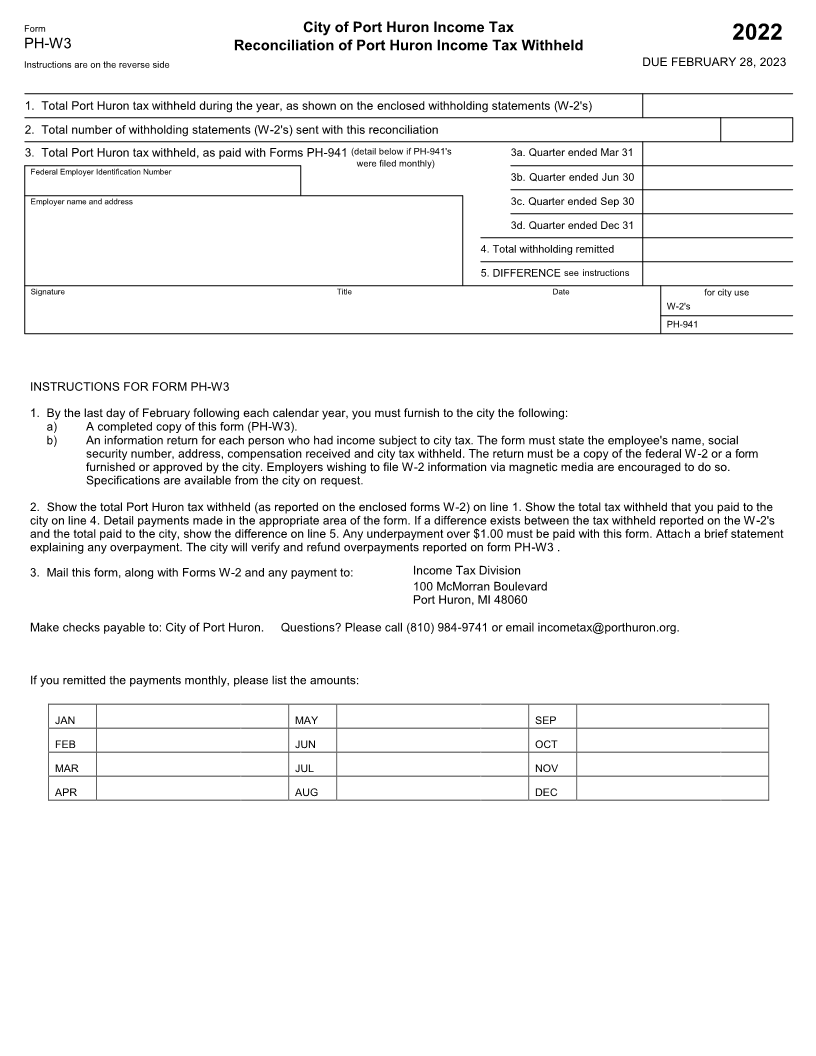

Form City of Port Huron Income Tax

202

PH-W3 Reconciliation of Port Huron Income Tax Withheld 2

Instructions are on the reverse side DUE FEBRUARY 28, 202 3

Total Port Huron tax withheld during the year, as shown on the enclosed withholding statements (W-2's)

Total number of withholding statements (W-2's) sent with this reconciliation

Total Port Huron tax withheld, as paid with Forms PH-941 (detail below if PH-941's 3a. Quarter ended Mar 31

were filed monthly)

Federal Employer Identification Number

3b. Quarter ended Jun 30

Employer name and address 3c. Quarter ended Sep 30

3d. Quarter ended Dec 31

Total withholding remitted

DIFFERENCE see instructions

Signature Title Date for city use

W-2's

PH-941

INSTRUCTIONS FOR FORM PH-W3

1. By the last day of February following each calendar year, you must furnish to the city the following:

a) A completed copy of this form (PH-W3).

b) An information return for each person who had income subject to city tax. The form must state the employee's name, social

security number, address, compensation received and city tax withheld. The return must be a copy of the federal W-2 or a form

furnished or approved by the city. Employers wishing to file W-2 information via magnetic media are encouraged to do so.

Specifications are available from the city on request.

2. Show the total Port Huron tax withheld (as reported on the enclosed forms W-2) on line 1. Show the total tax withheld that you paid to the

city on line 4. Detail payments made in the appropriate area of the form. If a difference exists between the tax withheld reported on the W-2's

and the total paid to the city, show the difference on line 5. Any underpayment over $1.00 must be paid with this form. Attach a brief statement

explaining any overpayment. The city will verify and refund overpayments reported on form PH-W3 .

3. Mail this form, along with Forms W-2 and any payment to: Income Tax Division

100 McMorran Boulevard

Port Huron, MI 48060

Make checks payable to: City of Port Huron. Questions? Please call (810) 984-9741 or email incometax@porthuron.org.

If you remitted the payments monthly, please list the amounts:

JAN MAY SEP

FEB JUN OCT

MAR JUL NOV

APR AUG DEC