Enlarge image

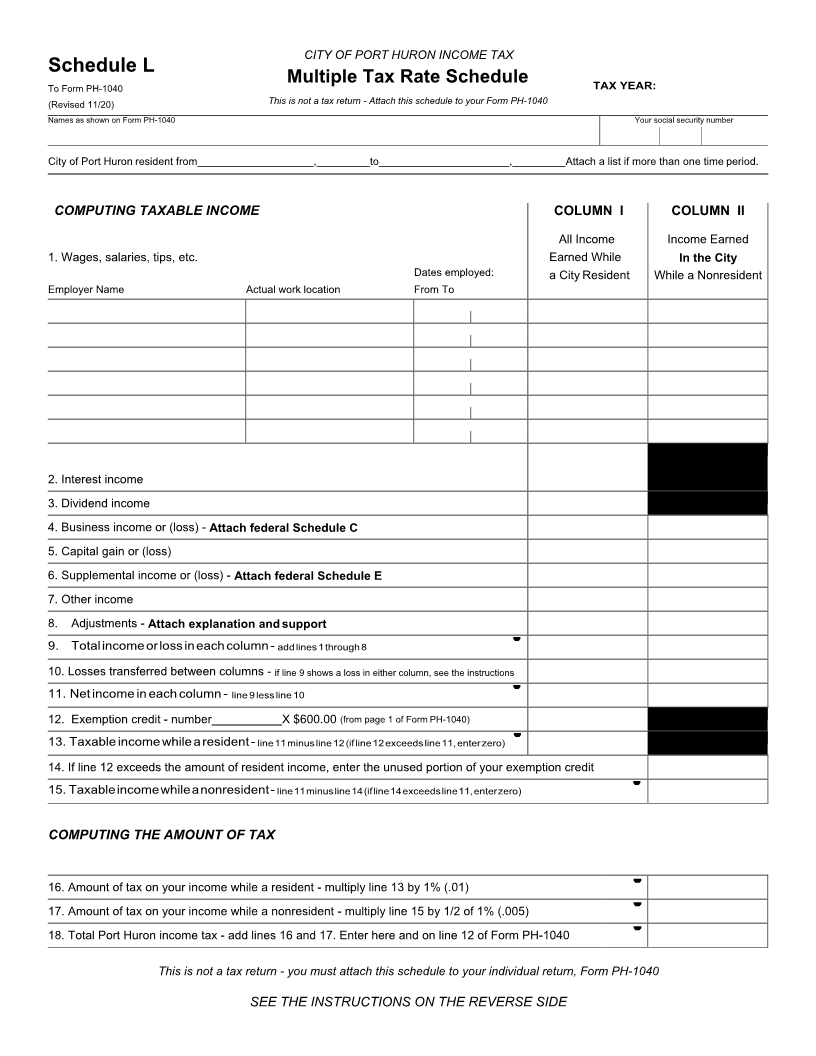

CITY OF PORT HURON INCOME TAX

Schedule L

Multiple Tax Rate Schedule

To Form PH-1040 TAX YEAR:

(Revised 11/20) This is not a tax return - Attach this schedule to your Form PH-1040

Names as shown on Form PH-1040 Your social security number

City of Port Huron resident from , to , Attach a list if more than one time period.

COMPUTING TAXABLE INCOME COLUMN I COLUMN II

All Income Income Earned

1. Wages, salaries, tips, etc. Earned While In the City

Dates employed: a City Resident While a Nonresident

Employer Name Actual work location From To

2. Interest income

3. Dividend income

4. Business income or (loss) - Attach federal Schedule C

5. Capital gain or (loss)

6. Supplemental income or (loss) - Attach federal Schedule E

7. Other income

8. Adjustments - Attach explanation and support

9. Total income or loss in each column - add lines 1 through 8 '

10. Losses transferred between columns - if line 9 shows a loss in either column, see the instructions

11. Net income in each column - line 9 less line 10 '

12. Exemption credit - number X $600.00 (from page 1 of Form PH-1040)

13. Taxable income while a resident - line 11 minus line 12 (if line 12 exceeds line 11, enter zero) '

14. If line 12 exceeds the amount of resident income, enter the unused portion of your exemption credit

15. Taxable income while a nonresident - line 11 minus line 14 (if line 14 exceeds line 11, enter zero) '

COMPUTING THE AMOUNT OF TAX

16. Amount of tax on your income while a resident - multiply line 13 by 1% (.01) '

17. Amount of tax on your income while a nonresident - multiply line 15 by 1/2 of 1% (.005) '

18. Total Port Huron income tax - add lines 16 and 17. Enter here and on line 12 of Form PH-1040 '

This is not a tax return - you must attach this schedule to your individual return, Form PH-1040

SEE THE INSTRUCTIONS ON THE REVERSE SIDE