Enlarge image

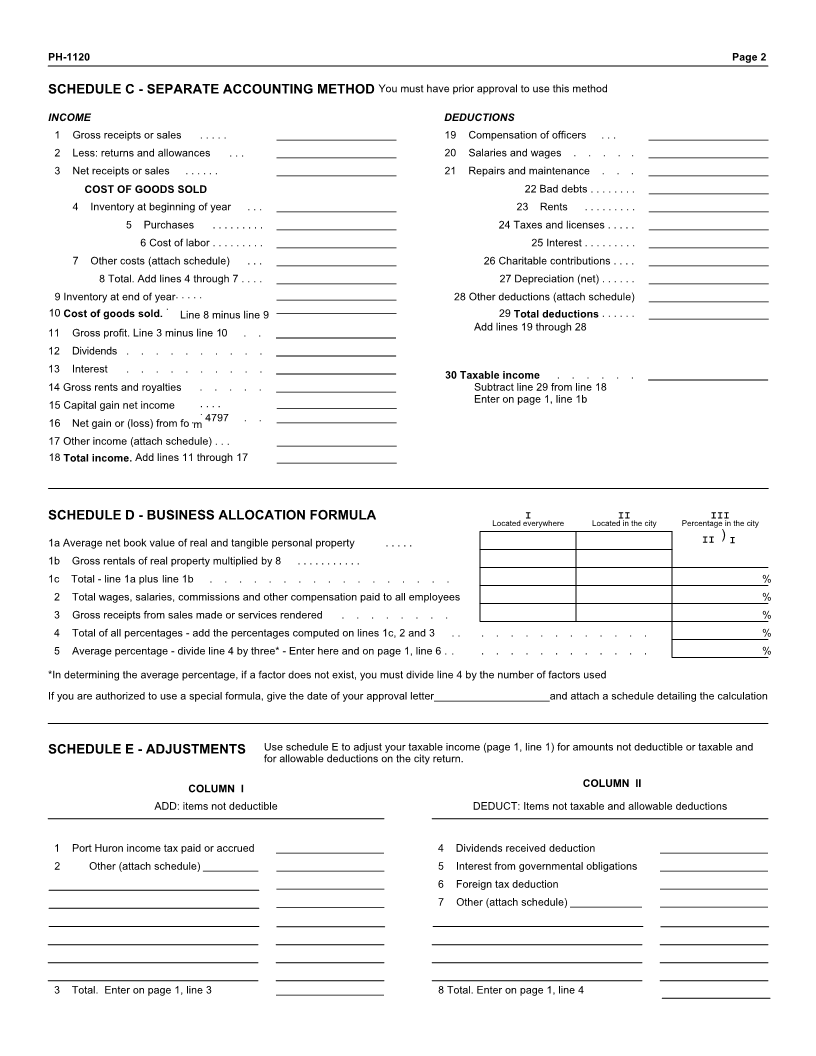

PH-1120 CITY OF PORT HURON INCOME TAX - CORPORATION RETURN

For calendar year 2020 or tax year beginning: and ending: 2020

Name Federal employer identification number FEIN

Address line 1

Number of Port Huron locations included in this return

Address line 2 (if needed)

Nature of business

City or town, state, and ZIP code Person in charge of records

Telephone number

1a Taxable income before net operating loss deduction and special deductions.

From your federal return 1120 or 1120S. Attach a copy of pages 1 through 5 of your federal return 1a

1b Income from page 2, Schedule C, line 30. You must have approval to use the separate accounting method 1b

2 Adjustment for the portion of capital gains occurring before January 1, 1969. - See the instructions . . . 2

3 Enter items not deductible on the city return (page 2, Schedule E, column I, line 3) . . . . . . . . 3

4 Enter items not taxable on the city return and allowable deductions (page 2, Schedule E, column II, line 8) 4

5 Total (add lines 1a or 1b through line 3 and subtract line 4) . . . . . . . . . . . . . . . . 5

6 Allocation percentage (page 2, schedule D) If all business was in Port Huron, enter 100%, do not use Sch. D 6

7 Total income - Multiply line 5 by the percentage in line 6. Enter the result on this line . . . . . . . . 7

8 Less: the applicable portion of any net operating loss carry over . . . . . . . . . . . . . . . 8

9 Taxable income. line 7 less line 8 . . . . . . . . . . . . . . . . . . . . . . . . 9

10 City of Port Huron Tax. If line 9 is more than zero, multiply line 9 by 1% (.01) . . . . . . . . . . 10

PAYMENTS AND BALANCE DUE OR REFUND

11 Estimated tax payments, extension payments and amounts carried forward from last year . . . . . . 11

12 Other credits. - explain and support the amount claimed . . . . . . . . . . . . . . . . . 12

13 Total payments and credits. Add lines 11 and 12 . . . . . . . . . . . . . . . . . . 13

14 Tax due. If line 10 is more than line 13, subtract line 13 from line 10 ................................. This is your TAX DUE 14

15 Overpayment. If line 13 is more than line 10, subtract line 10 from line 13. This is the amount you overpaid 15

16 Amount of line 15 you want: Credited to 2021 estimated taxes ' Refunded ' 16

Date and where incorporated

Name and address of resident agent in Michigan

Is this a consolidation return? YES NO If yes, in an attached statement list the names and addresses of the corporations included in the

return showing the percentage owned of the voting stock in each corporation

If 50% or more of the voting stock in this corporation is owned by an corporation, individual, trust, partnership or other entity, in an attached statement

list the name, address and percentage owned by the entity.

I declare, under penalty of perjury, that the information in this return and attachments is true and I declare under penalty of perjury, that this return is based on all

complete to the best of my knowledge. information of which I have knowledge.

Signature of officer Date

Preparer's name, address and ID number

X

Title

Make checks payable to: City of Port Huron

Mail to: Income Tax Division Preparer's signature Date

100 McMorran Blvd.

Port Huron, MI 48060 X