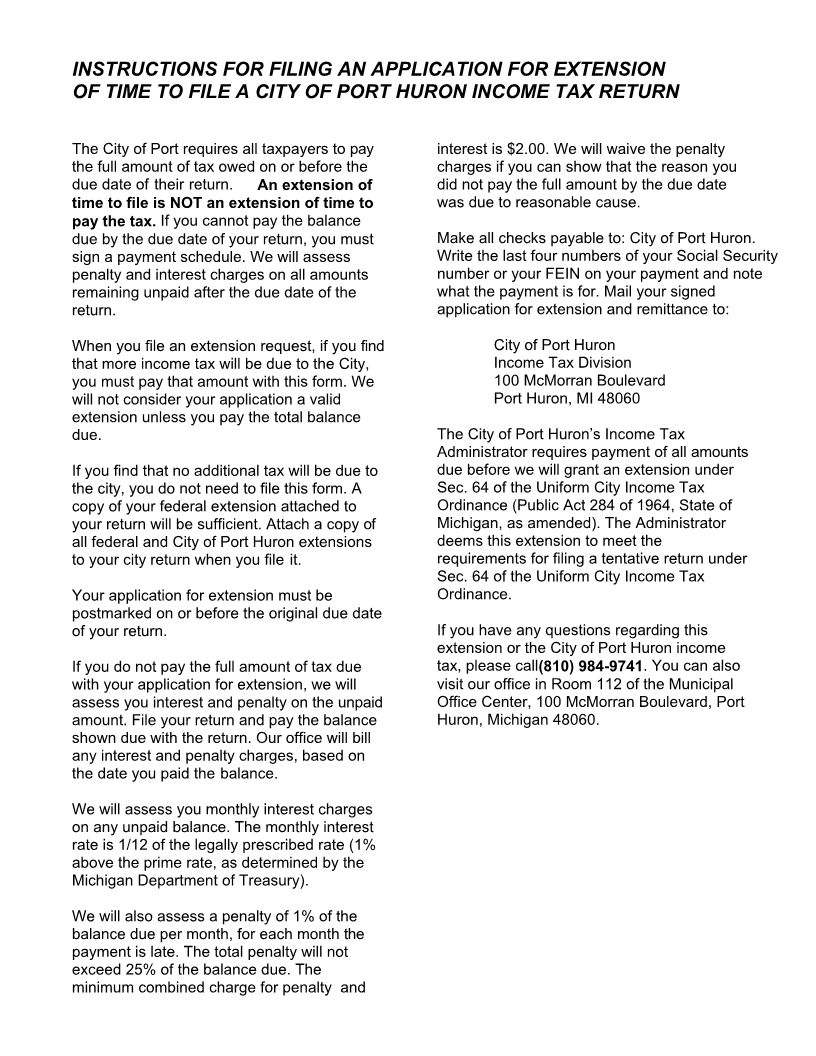

Enlarge image

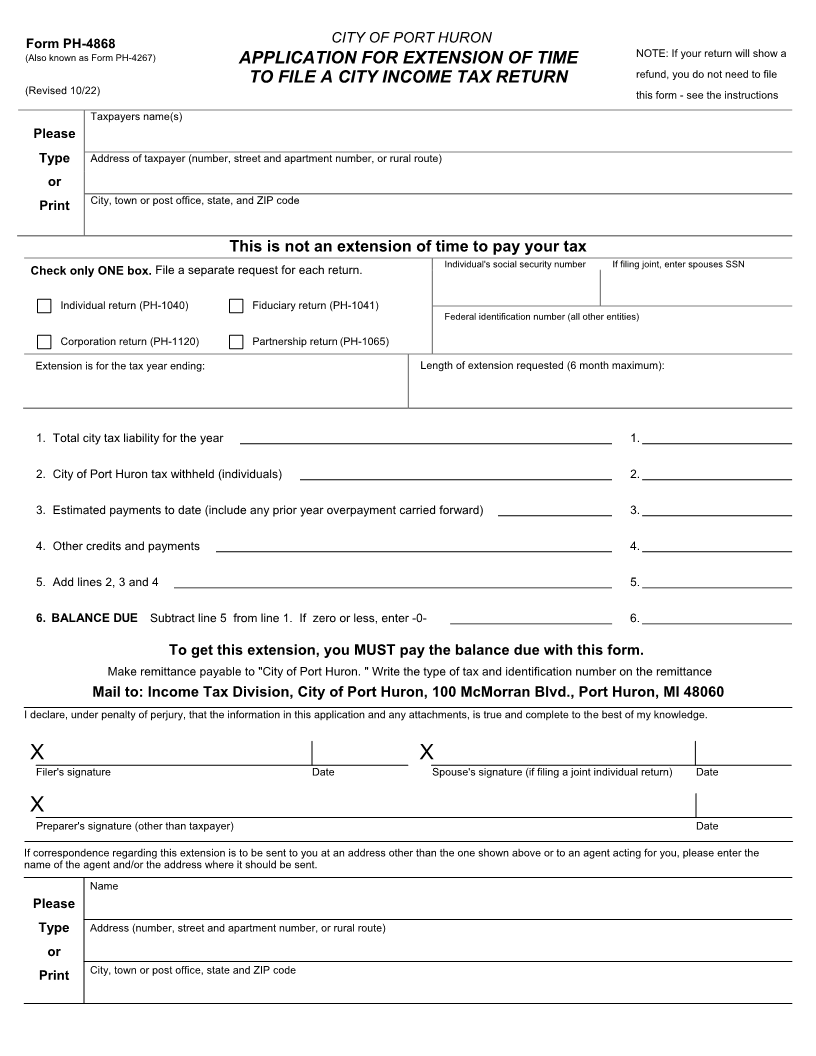

Form PH-4868 CITY OF PORT HURON

NOTE: If your return will show a

(Also known as Form PH-4267) APPLICATION FOR EXTENSION OF TIME

TO FILE A CITY INCOME TAX RETURN refund, you do not need to file

(Revised 1 /2 )0 2 this form - see the instructions

Taxpayers name(s)

Please

Type Address of taxpayer (number, street and apartment number, or rural route)

or

Print City, town or post office, state, and ZIP code

This is not an extension of time to pay your tax

Individual's social security number If filing joint, enter spouses SSN

Check only ONE box. File a separate request for each return.

Individual return (PH-1040) Fiduciary return (PH-1041)

Federal identification number (all other entities)

Corporation return (PH-1120) Partnership return (PH-1065)

Extension is for the tax year ending: Length of extension requested (6 month maximum):

1. Total city tax liability for the year 1.

2. City of Port Huron tax withheld (individuals) 2.

3. Estimated payments to date (include any prior year overpayment carried forward) 3.

4. Other credits and payments 4.

5. Add lines 2, 3 and 4 5.

6. BALANCE DUE Subtract line 5 from line 1. If zero or less, enter -0- 6.

To get this extension, you MUST pay the balance due with this form.

Make remittance payable to "City of Port Huron. " Write the type of tax and identification number on the remittance

Mail to: Income Tax Division, City of Port Huron, 100 McMorran Blvd., Port Huron, MI 48060

I declare, under penalty of perjury, that the information in this application and any attachments, is true and complete to the best of my knowledge.

X X

Filer's signature Date Spouse's signature (if filing a joint individual return) Date

X

Preparer's signature (other than taxpayer) Date

If correspondence regarding this extension is to be sent to you at an address other than the one shown above or to an agent acting for you, please enter the

name of the agent and/or the address where it should be sent.

Name

Please

Type Address (number, street and apartment number, or rural route)

or

City, town or post office, state and ZIP code

Print