Enlarge image

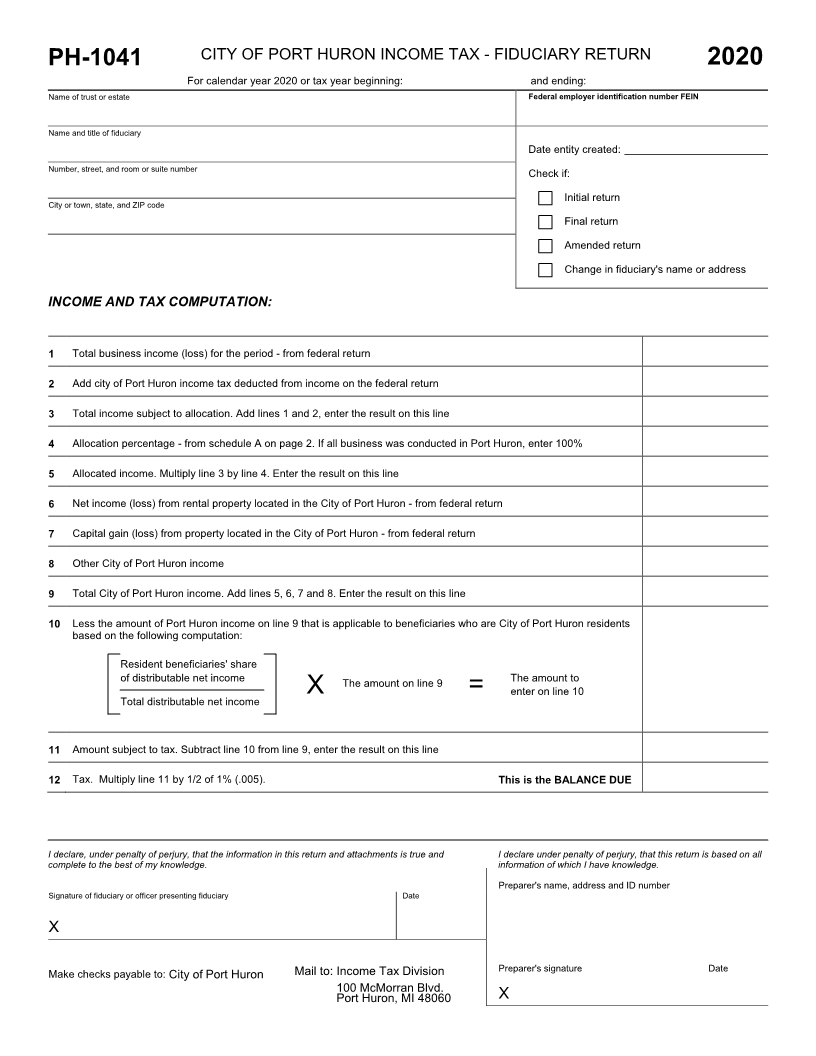

CITY OF PORT HURON INCOME TAX - FIDUCIARY RETURN

PH-1041 2020

For calendar year 2020 or tax year beginning: and ending:

Name of trust or estate Federal employer identification number FEIN

Name and title of fiduciary

Date entity created:

Number, street, and room or suite number Check if:

City or town, state, and ZIP code Initial return

Final return

Amended return

Change in fiduciary's name or address

INCOME AND TAX COMPUTATION:

1 Total business income (loss) for the period - from federal return

2 Add city of Port Huron income tax deducted from income on the federal return

3 Total income subject to allocation. Add lines 1 and 2, enter the result on this line

4 Allocation percentage - from schedule A on page 2. If all business was conducted in Port Huron, enter 100%

5 Allocated income. Multiply line 3 by line 4. Enter the result on this line

6 Net income (loss) from rental property located in the City of Port Huron - from federal return

7 Capital gain (loss) from property located in the City of Port Huron - from federal return

8 Other City of Port Huron income

9 Total City of Port Huron income. Add lines 5, 6, 7 and 8. Enter the result on this line

10 Less the amount of Port Huron income on line 9 that is applicable to beneficiaries who are City of Port Huron residents

based on the following computation:

Resident beneficiaries' share

of distributable net income The amount on line 9 The amount to

X = enter on line 10

Total distributable net income

11 Amount subject to tax. Subtract line 10 from line 9, enter the result on this line

12 Tax. Multiply line 11 by 1/2 of 1% (.005). This is the BALANCE DUE

I declare, under penalty of perjury, that the information in this return and attachments is true and I declare under penalty of perjury, that this return is based on all

complete to the best of my knowledge. information of which I have knowledge.

Preparer's name, address and ID number

Signature of fiduciary or officer presenting fiduciary Date

X

Make checks payable to: City of Port Huron Mail to: Income Tax Division Preparer's signature Date

100 McMorran Blvd.

Port Huron, MI 48060 X