- 3 -

Enlarge image

|

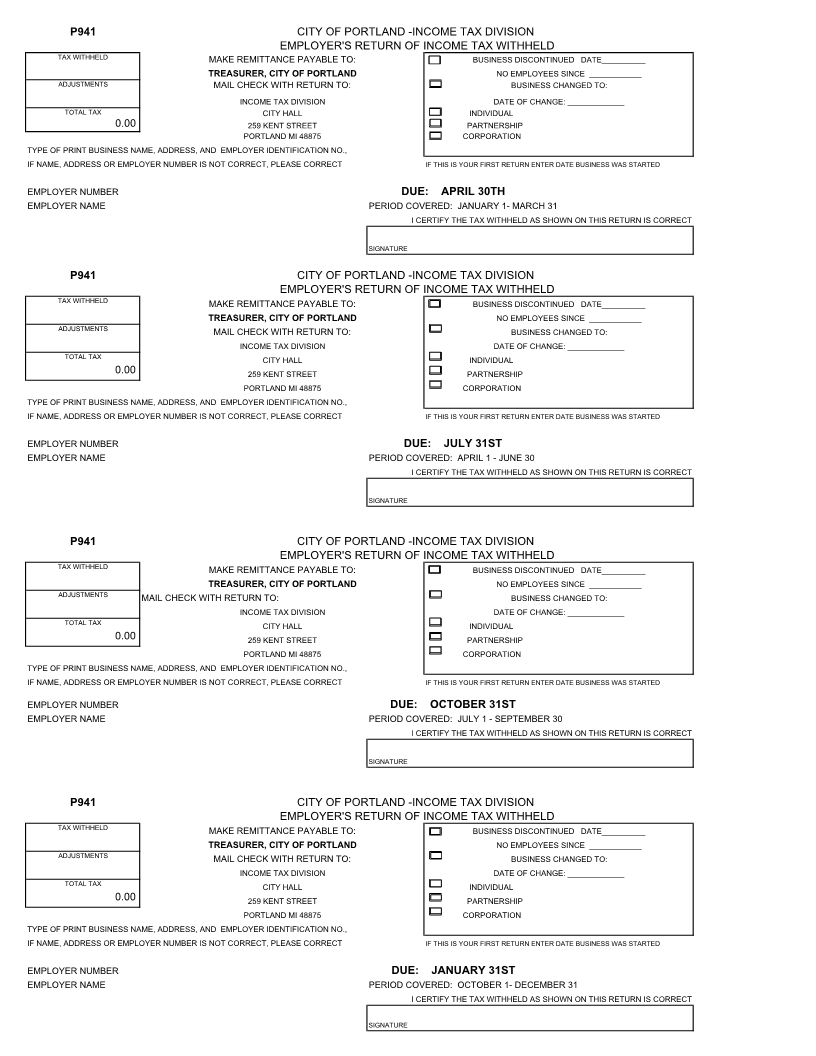

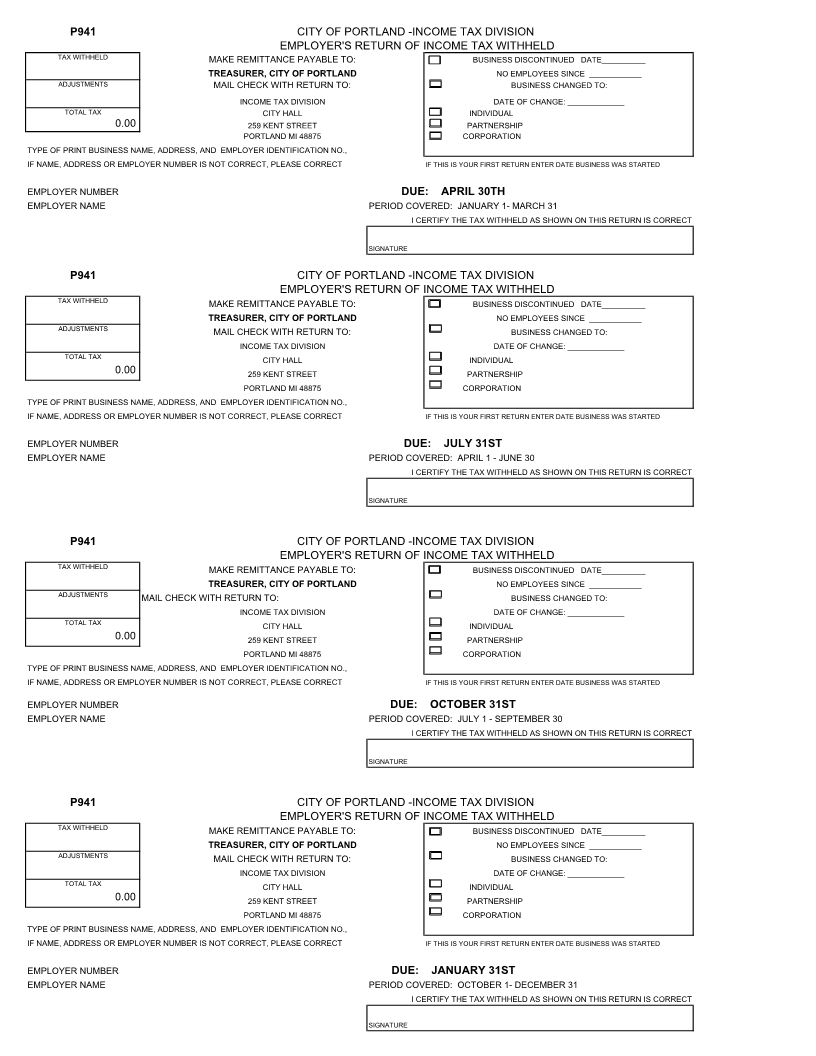

P941 CITY OF PORTLAND -INCOME TAX DIVISION

EMPLOYER'S RETURN OF INCOME TAX WITHHELD

TAX WITHHELD MAKE REMITTANCE PAYABLE TO: BUSINESS DISCONTINUED DATE__________

TREASURER, CITY OF PORTLAND NO EMPLOYEES SINCE ____________

ADJUSTMENTS MAIL CHECK WITH RETURN TO: BUSINESS CHANGED TO:

INCOME TAX DIVISION DATE OF CHANGE: _____________

TOTAL TAX CITY HALL INDIVIDUAL

0.00 259 KENT STREET PARTNERSHIP

PORTLAND MI 48875 CORPORATION

TYPE OF PRINT BUSINESS NAME, ADDRESS, AND EMPLOYER IDENTIFICATION NO.,

IF NAME, ADDRESS OR EMPLOYER NUMBER IS NOT CORRECT, PLEASE CORRECT IF THIS IS YOUR FIRST RETURN ENTER DATE BUSINESS WAS STARTED

EMPLOYER NUMBER DUE: APRIL 30TH

EMPLOYER NAME PERIOD COVERED: JANUARY 1- MARCH 31

I CERTIFY THE TAX WITHHELD AS SHOWN ON THIS RETURN IS CORRECT

SIGNATURE

P941 CITY OF PORTLAND -INCOME TAX DIVISION

EMPLOYER'S RETURN OF INCOME TAX WITHHELD

TAX WITHHELD MAKE REMITTANCE PAYABLE TO: BUSINESS DISCONTINUED DATE__________

TREASURER, CITY OF PORTLAND NO EMPLOYEES SINCE ____________

ADJUSTMENTS MAIL CHECK WITH RETURN TO: BUSINESS CHANGED TO:

INCOME TAX DIVISION DATE OF CHANGE: _____________

TOTAL TAX CITY HALL INDIVIDUAL

0.00 259 KENT STREET PARTNERSHIP

PORTLAND MI 48875 CORPORATION

TYPE OF PRINT BUSINESS NAME, ADDRESS, AND EMPLOYER IDENTIFICATION NO.,

IF NAME, ADDRESS OR EMPLOYER NUMBER IS NOT CORRECT, PLEASE CORRECT IF THIS IS YOUR FIRST RETURN ENTER DATE BUSINESS WAS STARTED

EMPLOYER NUMBER DUE: JULY 31ST

EMPLOYER NAME PERIOD COVERED: APRIL 1 - JUNE 30

I CERTIFY THE TAX WITHHELD AS SHOWN ON THIS RETURN IS CORRECT

SIGNATURE

P941 CITY OF PORTLAND -INCOME TAX DIVISION

EMPLOYER'S RETURN OF INCOME TAX WITHHELD

TAX WITHHELD MAKE REMITTANCE PAYABLE TO: BUSINESS DISCONTINUED DATE__________

TREASURER, CITY OF PORTLAND NO EMPLOYEES SINCE ____________

ADJUSTMENTS MAIL CHECK WITH RETURN TO: BUSINESS CHANGED TO:

INCOME TAX DIVISION DATE OF CHANGE: _____________

TOTAL TAX CITY HALL INDIVIDUAL

0.00 259 KENT STREET PARTNERSHIP

PORTLAND MI 48875 CORPORATION

TYPE OF PRINT BUSINESS NAME, ADDRESS, AND EMPLOYER IDENTIFICATION NO.,

IF NAME, ADDRESS OR EMPLOYER NUMBER IS NOT CORRECT, PLEASE CORRECT IF THIS IS YOUR FIRST RETURN ENTER DATE BUSINESS WAS STARTED

EMPLOYER NUMBER DUE: OCTOBER 31ST

EMPLOYER NAME PERIOD COVERED: JULY 1 - SEPTEMBER 30

I CERTIFY THE TAX WITHHELD AS SHOWN ON THIS RETURN IS CORRECT

SIGNATURE

P941 CITY OF PORTLAND -INCOME TAX DIVISION

EMPLOYER'S RETURN OF INCOME TAX WITHHELD

TAX WITHHELD MAKE REMITTANCE PAYABLE TO: BUSINESS DISCONTINUED DATE__________

TREASURER, CITY OF PORTLAND NO EMPLOYEES SINCE ____________

ADJUSTMENTS MAIL CHECK WITH RETURN TO: BUSINESS CHANGED TO:

INCOME TAX DIVISION DATE OF CHANGE: _____________

TOTAL TAX CITY HALL INDIVIDUAL

0.00 259 KENT STREET PARTNERSHIP

PORTLAND MI 48875 CORPORATION

TYPE OF PRINT BUSINESS NAME, ADDRESS, AND EMPLOYER IDENTIFICATION NO.,

IF NAME, ADDRESS OR EMPLOYER NUMBER IS NOT CORRECT, PLEASE CORRECT IF THIS IS YOUR FIRST RETURN ENTER DATE BUSINESS WAS STARTED

EMPLOYER NUMBER DUE: JANUARY 31ST

EMPLOYER NAME PERIOD COVERED: OCTOBER 1- DECEMBER 31

I CERTIFY THE TAX WITHHELD AS SHOWN ON THIS RETURN IS CORRECT

SIGNATURE

|