Enlarge image

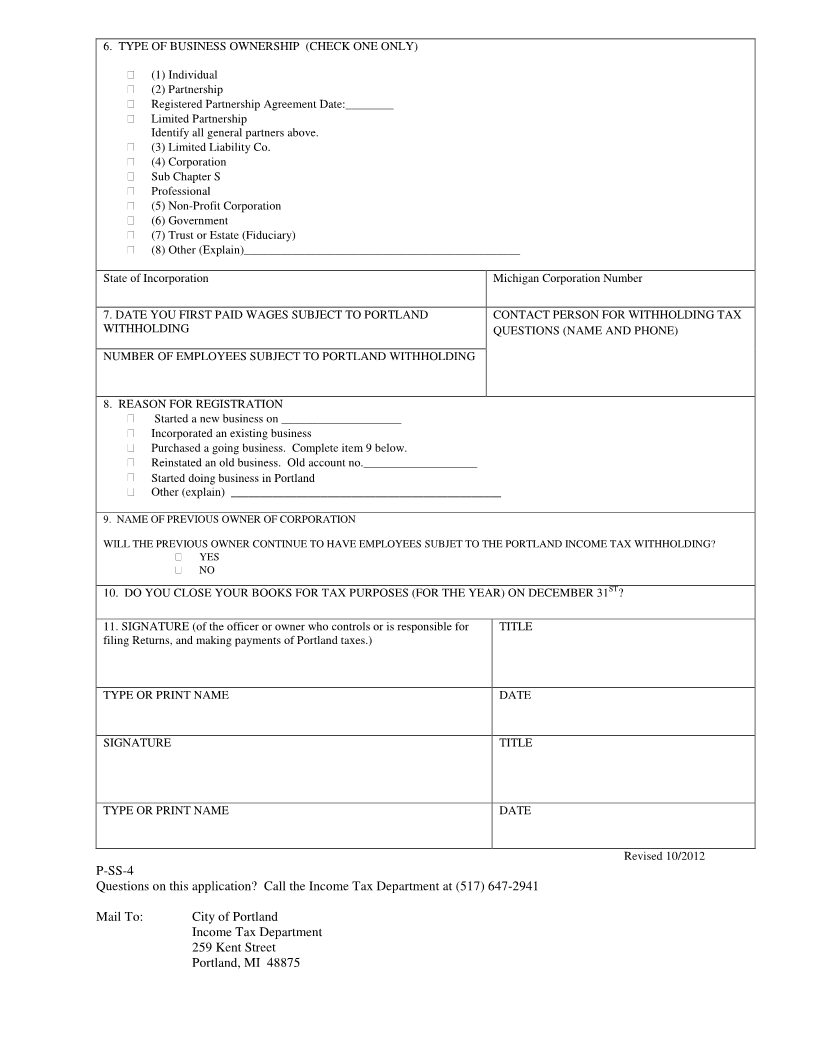

City of Portland

Income Tax Department

P-SS-4

1. FEDERAL EMPLOYER IDENTIFICATION NUMBER

Employer’s Withholding Registration

2. Complete Company Name (Include, if applicable, Corp., Inc., L.L.C., etc.)

3. Business Name, Assumed Name of DBA (If used)

LEGAL 4A. Enter Number and Street (Address to which correspondence is mailed.) Business Telephone

ADDRESS

City, State, Zip

MAILING 4B. Enter Number and Street. (Address to which tax forms are mailed.)

ADDRESS

City, State, Zip

PHYSICAL 4C Enter Number and Street. (Address of physical location in the City of Portland.)

ADDRESS IN

PORTLAND City, State, Zip

Complete all information for each owner, partner, member or corporate officer. Attach a separate list if necessary.

5A. Name (Last, First, Middle Initial) Home Telephone

Business Title Date of Birth

Residence Address (Number, Street) Social Security Number

City, State, Zip Driver License/Michigan Identification

5B. Name(Last, First, Middle Initial) Home Telephone

Business Title Date of Birth

Residence Address (Number, Street) Social Security Number

City, State, Zip Driver License/Michigan Identification

COMPLETE THIS REGISTRATION IF REQUIRED TO WITHHOLD OR VOLUNTARILY WITHHOLDING AND:

1) Started a new business; or

2) Reinstated an old business; or

3) Purchased an ongoing business; or

4) Started doing business in Portland; or

5) Changed the type of business ownership (eg: from sole proprietorship to partnership, incorporating a sole

proprietorship or partnership)

EMPLOYERS REQUIRED TO REGISTER AND WITHHOLD:

1) Employers having a location in the City of Portland; or

2) Employers doing business in the City of Portland even though they have no location in the City.

WITHHOLD TAX FROM WAGES PAID TO THE FOLLOWING EMPLOYEES:

1) All residents of the City of Portland whether or not they work in the city;

2) All non-residents of the City of Portland who work in Portland (withhold only on wages earned in Portland)

For further information refer to the Income Tax Ordinance or call the Income Tax Department at (517) 647-2941.

Tax Forms are also on our website, www.portland-michigan.org.