Enlarge image

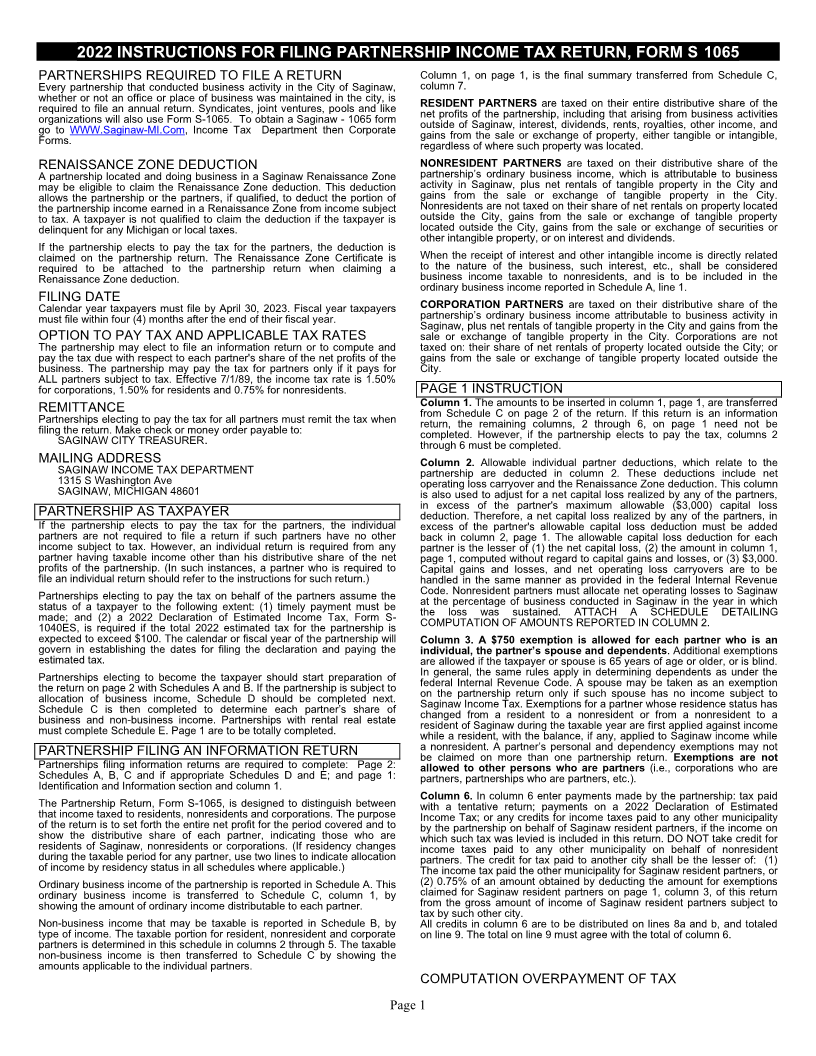

2022 INSTRUCTIONS FOR FILING PARTNERSHIP INCOME TAX RETURN, FORM S -1065

PARTNERSHIPS REQUIRED TO FILE A RETURN Column 1, on page 1, is the final summary transferred from Schedule C,

Every partnership that conducted business activity in the City of Saginaw, column 7.

whether or not an office or place of business was maintained in the city, is RESIDENT

required to file an annual return. Syndicates, joint ventures, pools and like net PARTNERS are taxed on their entire distributive share of the

organizations will also use Form S-1065. To obtain a Saginaw - 1065 form outside profits of the partnership, including that arising from business activities

go to WWW.Saginaw-MI.Com, Income Tax Department then Corporate gains of Saginaw, interest, dividends, rents, royalties, other income, and

of where such property was located.

Forms. regardless from the sale or exchange of property, either tangible or intangible,

RENAISSANCE ZONE DEDUCTION NONRESIDENT PARTNERS are taxed on their distributive share of the

A partnership located and doing business in a Saginaw Renaissance Zone partnership’s ordinary business income, which is attributable to business

may be eligible to claim the Renaissance Zone deduction. This deduction activity in Saginaw, plus net rentals of tangible property in the City and

allows the partnership or the partners, ifqualified, to deduct the portion of gains from the sale or exchange of tangible property in the City.

the partnership income earned in a Renaissance Zone from income subject Nonresidents are not taxed on their share of net rentals on property located

to tax. A taxpayer is not qualified to claim the deduction ifthe taxpayer is outside the City, gains from the sale or exchange of tangible property

delinquent for any Michigan or local taxes. located outside the City, gains from the sale or exchange of securities or

other intangible property, or on interest and dividends.

If the partnership elects to pay the tax for the partners, the deduction is

claimed on the partnership return. The Renaissance Zone Certificate is When the receipt of interest and other intangible income is directly related

required to be attached to the partnership return when claiming a to the nature of the business, such interest, etc., shall be considered

Renaissance Zone deduction. business income taxable to nonresidents, and is to be included in the

ordinary business income reported in Schedule A, line 1.

FILING DATE CORPORATION are

Calendar year taxpayers must file by April 30, 2023. Fiscal year taxpayers PARTNERS taxed on their distributive share of the

must partnership’s ordinary business income attributable to business activity in

file within four (4) months after the end of their fiscal year. Saginaw, plus net rentals of tangible property in the City and gains from the

OPTION TO PAY TAX AND APPLICABLE TAX RATES sale or exchange of tangible property in the City. Corporations are not

The partnership may elect to file an information return or to compute and taxed on: their share of net rentals of property located outside the City; or

pay the tax due with respect to each partner's share of the net profits of the gains from the sale or exchange of tangible property located outside the

business. The partnership may pay the tax for partners only if it pays for City.

ALL partners subject to tax. Effective 7/1/89, the income tax rate is 1.50%

for corporations, 1.50% for residents and 0.75% for nonresidents. PAGE 1 INSTRUCTION

REMITTANCE Column 1. The amounts to be inserted in column 1, page 1, are transferred

Partnerships from Schedule C on page 2 of the return. If this return is an information

filing electing to pay the tax for all partners must remit the tax when return, the remaining columns, 2 through 6, on page 1 need not be

SAGINAW the return. Make check or money order payable to: completed. However, if the partnership elects to pay the tax, columns 2

CITY TREASURER . through 6 must be completed.

MAILING ADDRESS Column 2. Allowable individual partner deductions, which relate to the

SAGINAW INCOME TAX DEPARTMENT partnership are deducted in column 2. These deductions include net

1315 S Washington Ave operating loss carryover and the Renaissance Zone deduction. This column

SAGINAW, MICHIGAN 48601 is also used to adjust for a net capital loss realized by any of the partners,

in excess of the partner's maximum allowable ($3,000) capital loss

PARTNERSHIP AS TAXPAYER deduction. Therefore, a net capital loss realized by any of the partners, in

If the partnership elects to pay the tax for the partners, the individual excess of the partner's allowable capital loss deduction must be added

partners are not required to file a return if such partners have no other back in column 2, page 1. The allowable capital loss deduction for each

income subject to tax. However, an individual return is required from any partner is the lesser of (1) the net capital loss, (2) the amount in column 1,

partner having taxable income other than his distributive share of the net page 1, computed without regard to capital gains and losses, or (3) $3,000.

profits of the partnership. (In such instances, a partner who is required to Capital gains and losses, and net operating loss carryovers are to be

file an individual return should refer to the instructions for such return.) handled in the same manner as provided in the federal Internal Revenue

Partnerships Code. Nonresident partners must allocate net operating losses to Saginaw

status electing to pay the tax on behalf of the partners assume the at the percentage of business conducted in Saginaw in the year in which

made; of a taxpayer to the following extent: (1) timely payment must be the loss was sustained. ATTACH A SCHEDULE DETAILING

1040ES, and (2) a 2022 Declaration of Estimated Income Tax, Form S- COMPUTATION OF AMOUNTS REPORTED IN COLUMN 2.

is required if the total 2022 estimated tax for the partnership is

expected to exceed $100. The calendar or fiscal year of the partnership will Column 3. A $750 exemption is allowed for each partner who is an

govern in establishing the dates for filing the declaration and paying the individual, the partner’s spouse and dependents . Additional exemptions

estimated tax. are allowed if the taxpayer or spouse is 65 years of age or older, or is blind.

Partnerships In general, the same rules apply in determining dependents as under the

the electing to become the taxpayer should start preparation of federal Internal Revenue Code. A spouse may be taken as an exemption

allocation return on page 2 with Schedules A and B. If the partnership is subject to on the partnership return only if such spouse has no income subject to

Schedule of business income, Schedule D should be completed next. Saginaw Income Tax. Exemptions for a partner whose residence status has

business C is then completed to determine each partner’s changed from a resident to a nonresident or from a nonresident to a share of

must and non-business income. Partnerships with rental real estate resident of Saginaw during the taxable year are first applied against income

complete Schedule E. Page 1 are to be totally completed. while a resident, with the balance, if any, applied to Saginaw income while

PARTNERSHIP FILING AN INFORMATION RETURN a nonresident. A partner’s personal and dependency exemptions may not

be claimed on more than one partnership return. Exemptions are not

Partnerships filing information returns are required to complete: Page 2: allowed to other persons who are partners (i.e., corporations who are

Schedules A, B, C and if appropriate Schedules D and E; and page 1: partners, partnerships who are partners, etc.).

Identification and Information section and column 1.

Column 6. In column 6 enter payments made by the partnership: tax paid

The Partnership Return, Form S-1065, is designed to distinguish between with a tentative return; payments on a 2022 Declaration of Estimated

that income taxed to residents, nonresidents and corporations. The purpose Income Tax; or any credits for income taxes paid to any other municipality

of the return is to set forth the entire net profit for the period covered and to by the partnership on behalf of Saginaw resident partners, if the income on

show the distributive share of each partner, indicating those who are which such tax was levied is included in this return. DO NOT take credit for

residents of Saginaw, nonresidents or corporations. (If residency changes income taxes paid to any other municipality on behalf of nonresident

during the taxable period for any partner, use two lines to indicate allocation partners. The credit for tax paid to another city shall be the lesser of: (1)

of income by residency status in all schedules where applicable.) The income tax paid the other municipality for Saginaw resident partners, or

Ordinary (2) 0.75% of an amount obtained by deducting the amount for exemptions

business income of the partnership is reported in Schedule A. This

ordinary business income is transferred to Schedule C, column 1, by claimed for Saginaw resident partners on page 1, column 3, of this return

showing the amount of ordinary income distributable to each partner. from the gross amount of income of Saginaw resident partners subject to

tax by such other city.

Non-business income that may be taxable is reported in Schedule B, by All credits in column 6 are to be distributed on lines 8a and b, and totaled

type of income. The taxable portion for resident, nonresident and corporate on line 9. The total on line 9 must agree with the total of column 6.

partners is determined in this schedule in columns 2 through 5. The taxable

non-business income is then transferred to Schedule C by showing the

amounts applicable to the individual partners.

COMPUTATION OVERPAYMENT OF TAX

Page 1