Enlarge image

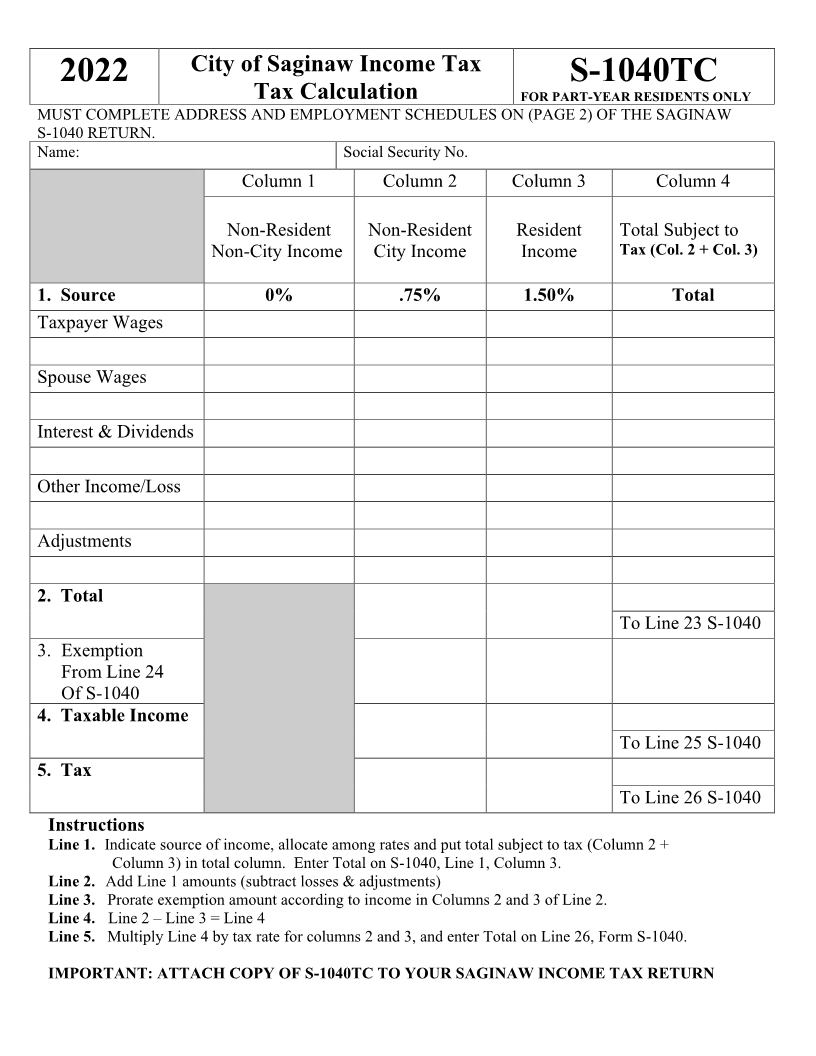

City of Saginaw Income Tax

2022 S-1040TC

Tax Calculation FOR PART-YEAR RESIDENTS ONLY

MUST COMPLETE ADDRESS AND EMPLOYMENT SCHEDULES ON (PAGE 2) OF THE SAGINAW

S-1040 RETURN.

Name: Social Security No.

Column 1 Column 2 Column 3 Column 4

Non-Resident Non-Resident Resident Total Subject to

Non-City Income City Income Income Tax (Col. 2 + Col. 3)

1. Source 0% .75% 1.50% Total

Taxpayer Wages

Spouse Wages

Interest & Dividends

Other Income/Loss

Adjustments

2. Total

To Line 23 S-1040

3. Exemption

From Line 24

Of S-1040

4. Taxable Income

To Line 25 S-1040

5. Tax

To Line 26 S-1040

Instructions

Line 1. Indicate source of income, allocate among rates and put total subject to tax (Column 2 +

Column 3) in total column. Enter Total on S-1040, Line 1, Column 3.

Line 2. Add Line 1 amounts (subtract losses & adjustments)

Line 3. Prorate exemption amount according to income in Columns 2 and 3 of Line 2.

Line 4. Line 2 – Line 3 = Line 4

Line 5. Multiply Line 4 by tax rate for columns 2 and 3, and enter Total on Line 26, Form S-1040.

IMPORTANT: ATTACH COPY OF S-1040TC TO YOUR SAGINAW INCOME TAX RETURN