Enlarge image

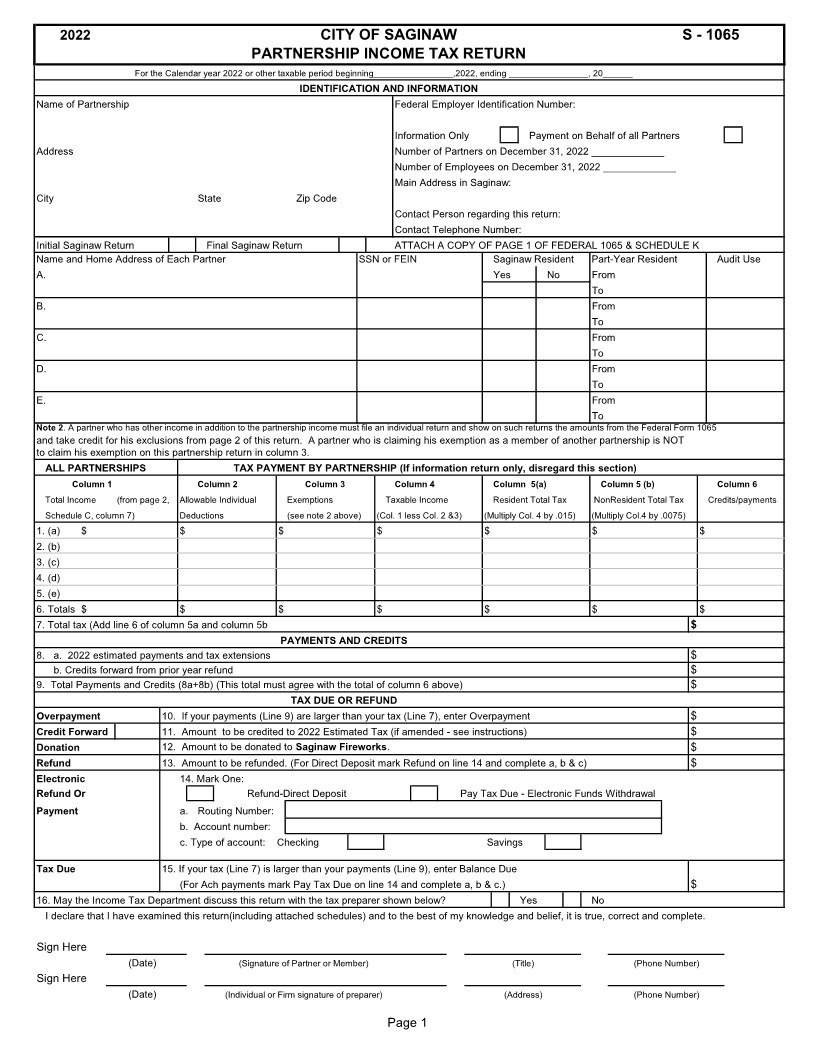

2022 CITY OF SAGINAW S - 1065

PARTNERSHIP INCOME TAX RETURN

For the Calendar year 2022 or other taxable period beginning________________,2022, ending ________________, 20______

IDENTIFICATION AND INFORMATION

Name of Partnership Federal Employer Identification Number:

Information Only Payment on Behalf of all Partners

Address Number of Partners on December 31, 2022 _____________

Number of Employees on December 31, 2022 _____________

Main Address in Saginaw:

City State Zip Code

Contact Person regarding this return:

Contact Telephone Number:

Initial Saginaw Return Final Saginaw Return ATTACH A COPY OF PAGE 1 OF FEDERAL 1065 & SCHEDULE K

Name and Home Address of Each Partner SSN or FEIN Saginaw Resident Part-Year Resident Audit Use

A. Yes No From

To

B. From

To

C. From

To

D. From

To

E. From

To

Note 2. A partner who has other income in addition to the partnership income must file an individual return and show on such returns the amounts from the Federal Form 1065

and take credit for his exclusions from page 2 of this return. A partner who is claiming his exemption as a member of another partnership is NOT

to claim his exemption on this partnership return in column 3.

ALL PARTNERSHIPS TAX PAYMENT BY PARTNERSHIP (If information return only, disregard this section)

Column 1 Column 2 Column 3 Column 4 Column 5(a) Column 5 (b) Column 6

Total Income (from page 2, Allowable Individual Exemptions Taxable Income Resident Total Tax NonResident Total Tax Credits/payments

Schedule C, column 7) Deductions (see note 2 above) (Col. 1 less Col. 2 &3) (Multiply Col. 4 by .015) (Multiply Col.4 by .0075)

1. (a) $ $ $ $ $ $ $

2. (b)

3. (c)

4. (d)

5. (e)

6. Totals $ $ $ $ $ $ $

7. Total tax (Add line 6 of column 5a and column 5b $

PAYMENTS AND CREDITS

8. a. 2022 estimated payments and tax extensions $

b. Credits forward from prior year refund $

9. Total Payments and Credits (8a+8b) (This total must agree with the total of column 6 above) $

TAX DUE OR REFUND

Overpayment 10. If your payments (Line 9) are larger than your tax (Line 7), enter Overpayment $

Credit Forward 11. Amount to be credited to 2022 Estimated Tax (if amended - see instructions) $

Donation 12. Amount to be donated to Saginaw Fireworks. $

Refund 13. Amount to be refunded. (For Direct Deposit mark Refund on line 14 and complete a, b & c) $

Electronic 14. Mark One:

Refund Or Refund-Direct Deposit Pay Tax Due - Electronic Funds Withdrawal

Payment a. Routing Number:

b. Account number:

c. Type of account: Checking Savings

Tax Due 15. If your tax (Line 7) is larger than your payments (Line 9), enter Balance Due

(For Ach payments mark Pay Tax Due on line 14 and complete a, b & c.) $

16. May the Income Tax Department discuss this return with the tax preparer shown below? Yes No

I declare that I have examined this return(including attached schedules) and to the best of my knowledge and belief, it is true, correct and complete.

Sign Here

(Date) (Signature of Partner or Member) (Title) (Phone Number)

Sign Here

(Date) (Individual or Firm signature of preparer) (Address) (Phone Number)

Page 1