Enlarge image

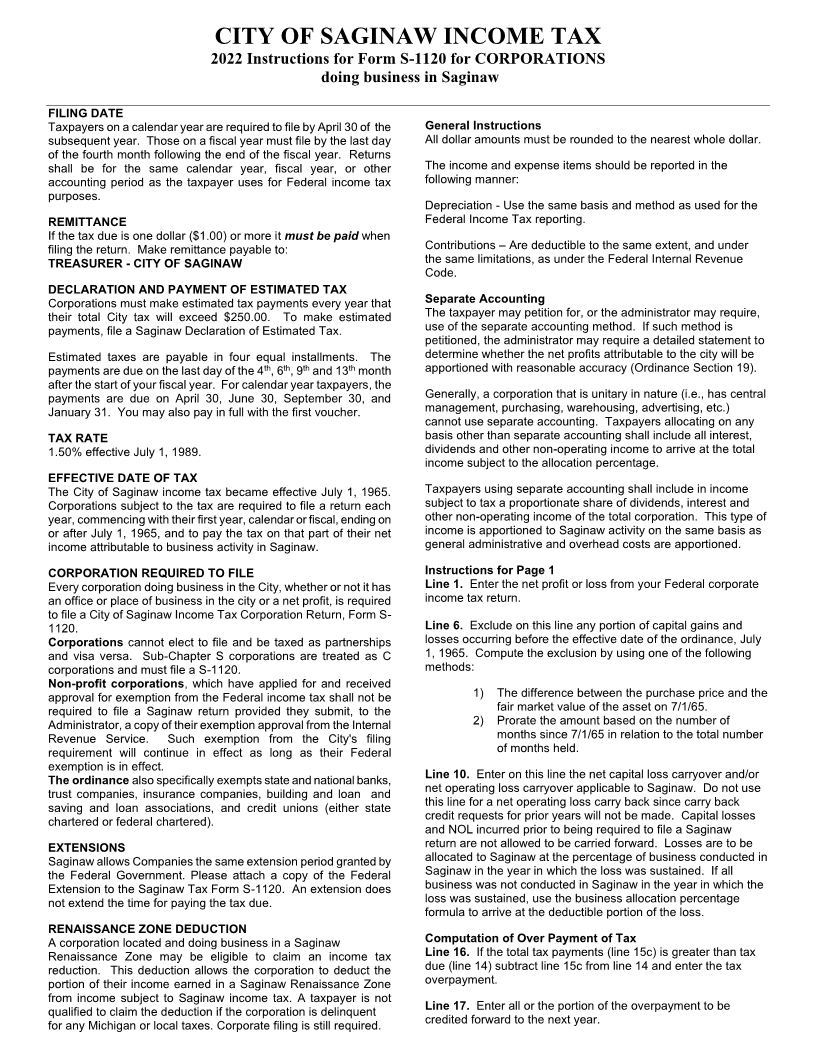

CITY OF SAGINAW INCOME TAX

2022 Instructions for Form S-1120 for CORPORATIONS

doing business in Saginaw

FILING DATE

Taxpayers on a calendar year are required to file by April 30 theof General Instructions

subsequent year. Those on a fiscal year must file by the last day All dollar amounts must be rounded to the nearest whole dollar.

of the fourth month following the end of the fiscal year. Returns

shall be for the same calendar year, fiscal year, or other The income and expense items should be reported in the

accounting period as the taxpayer uses for Federal income tax following manner:

purposes.

Depreciation - Use the same basis and method as used for the

REMITTANCE Federal Income Tax reporting.

If the tax due is one dollar ($1.00) or more it must be paid when

filing the return. Make remittance payable to: Contributions – Are deductible to the same extent, and under

TREASURER - CITY OF SAGINAW the same limitations, as under the Federal Internal Revenue

Code.

DECLARATION AND PAYMENT OF ESTIMATED TAX

Corporations must make estimated tax payments every year that Separate Accounting

their total City tax will exceed $250.00. To make estimated The taxpayer may petition for, or the administrator may require,

payments, file a Saginaw Declaration of Estimated Tax. use of the separate accounting method. If such method is

petitioned, the administrator may require a detailed statement to

Estimated taxes are payable in four equal installments. The determine whether the net profits attributable to the city will be

payments are due on the last day of the 4th, 6th, 9th and 13th month apportioned with reasonable accuracy (Ordinance Section 19).

after the start of your fiscal year. For calendar year taxpayers, the

payments are due on April 30, June 30, September 30, and Generally, a corporation that is unitary in nature (i.e., has central

January 31. You may also pay in full with the first voucher. management, purchasing, warehousing, advertising, etc.)

cannot use separate accounting. Taxpayers allocating on any

TAX RATE basis other than separate accounting shall include all interest,

1.50% effective July 1, 1989. dividends and other non-operating income to arrive at the total

income subject to the allocation percentage.

EFFECTIVE DATE OF TAX

The City of Saginaw income tax became effective July 1, 1965. Taxpayers using separate accounting shall include in income

Corporations subject to the tax are required to file a return each subject to tax a proportionate share of dividends, interest and

year, commencing with their first year, calendar or fiscal, ending on other non-operating income of the total corporation. This type of

or after July 1, 1965, and to pay the tax on that part of their net income is apportioned to Saginaw activity on the same basis as

income attributable to business activity in Saginaw. general administrative and overhead costs are apportioned.

CORPORATION REQUIRED TO FILE Instructions for Page 1

Every corporation doing business in the City, whether or not it has Line 1. Enter the net profit or loss from your Federal corporate

an office or place of business in the city or a net profit, is required income tax return.

to file a City of Saginaw Income Tax Corporation Return, Form S-

1120. Line 6. Exclude on this line any portion of capital gains and

Corporations cannot elect to file and be taxed as partnerships losses occurring before the effective date of the ordinance, July

and visa versa. Sub-Chapter S corporations are treated as C 1, 1965. Compute the exclusion by using one of the following

corporations and must file a S-1120. methods:

Non-profit corporations , which have applied for and received

approval for exemption from the Federal income tax shall not be 1) The difference between the purchase price and the

required to file a Saginaw return provided they submit, to the fair market value of the asset on 7/1/65.

Administrator, a copy of their exemption approval from the Internal 2) Prorate the amount based on the number of

Revenue Service. Such exemption from the City's filing months since 7/1/65 in relation to the total number

requirement will continue in effect as long as their Federal of months held.

exemption is in effect.

The ordinance also specifically exempts state and national banks, Line 10. Enter on this line the net capital loss carryover and/or

trust companies, insurance companies, building and loan and net operating loss carryover applicable to Saginaw. Do not use

saving and loan associations, and credit unions (either state this line for a net operating loss carry back since carry back

chartered or federal chartered). credit requests for prior years will not be made. Capital losses

and NOL incurred prior to being required to file a Saginaw

EXTENSIONS return are not allowed to be carried forward. Losses are to be

Saginaw allows Companies the same extension period granted by allocated to Saginaw at the percentage of business conducted in

the Federal Government. Please attach a copy of the Federal Saginaw in the year in which the loss was sustained. If all

Extension to the Saginaw Tax Form S-1120. An extension does business was not conducted in Saginaw in the year in which the

not extend the time for paying the tax due. loss was sustained, use the business allocation percentage

formula to arrive at the deductible portion of the loss.

RENAISSANCE ZONE DEDUCTION

A corporation located and doing business in a Saginaw Computation of Over Payment of Tax

Renaissance Zone may be eligible to claim an income tax Line 16. If the total tax payments (line 15c) is greater than tax

reduction. This deduction allows the corporation to deduct the due (line 14) subtract line 15c from line 14 and enter the tax

portion of their income earned in a Saginaw Renaissance Zone overpayment.

from income subject to Saginaw income tax. A taxpayer is not

qualified to claim the deduction if the corporation is delinquent Line 17. Enter all or the portion of the overpayment to be

for any Michigan or local taxes. Corporate filing is still required. credited forward to the next year.