Enlarge image

2023 CITY OF SAGINAW 2023

DECLARATION OF ESTIMATED INCOME TAX

FORM S-1040ES

FOR INDIVIDUALS, CORPORATIONS AND PARTNERSHIPS

INSTRUCTIONS FOR SAGINAW DECLARATION OF ESTIMATED INCOME TAX

WHO MUST MAKE A DECLARATION

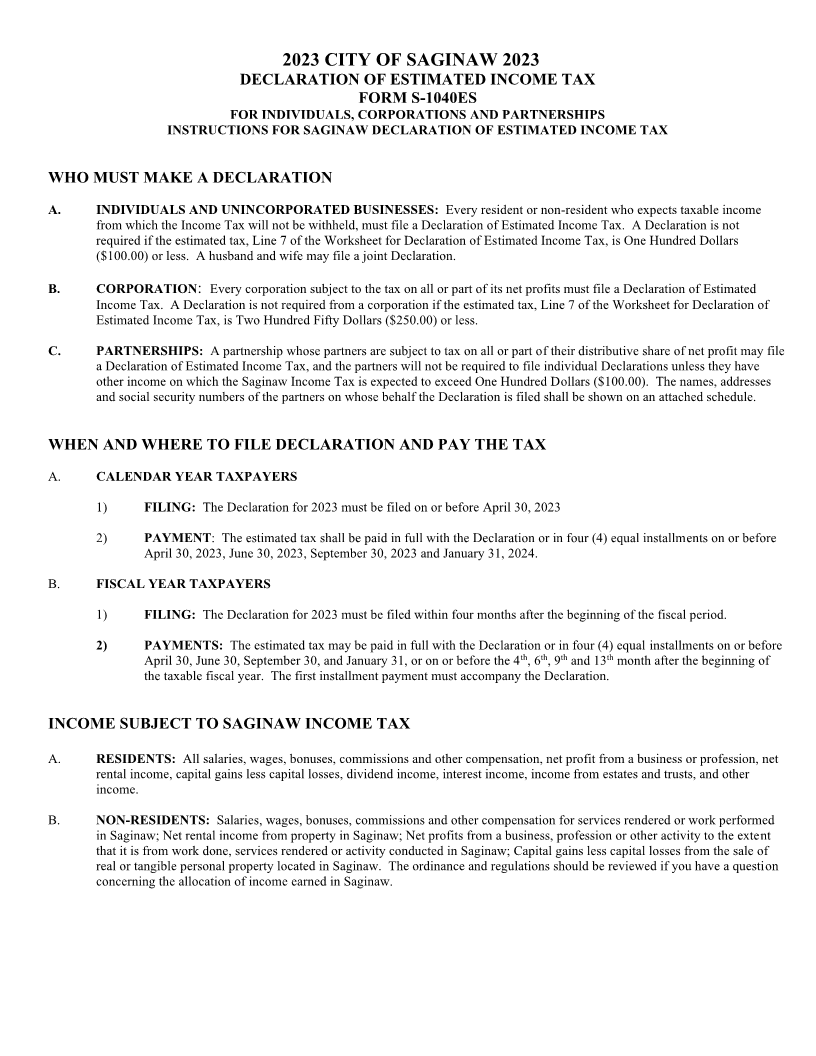

A. INDIVIDUALS AND UNINCORPORATED BUSINESSES: Every resident or non-resident who expects taxable income

from which the Income Tax will not be withheld, must file a Declaration of Estimated Income Tax. A Declaration is not

required if the estimated tax, Line 7 of the Worksheet for Declaration of Estimated Income Tax, is One Hundred Dollars

($100.00) or less. A husband and wife may file a joint Declaration.

B. CORPORATION: Every corporation subject to the tax on all or part of its net profits must file a Declaration of Estimated

Income Tax. A Declaration is not required from a corporation if the estimated tax, Line 7 of the Worksheet for Declaration of

Estimated Income Tax, is Two Hundred Fifty Dollars ($250.00) or less.

C. PARTNERSHIPS: A partnership whose partners are subject to tax on all or part of their distributive share of net profit may file

a Declaration of Estimated Income Tax, and the partners will not be required to file individual Declarations unless they have

other income on which the Saginaw Income Tax is expected to exceed One Hundred Dollars ($100.00). The names, addresses

and social security numbers of the partners on whose behalf the Declaration is filed shall be shown on an attached schedule.

WHEN AND WHERE TO FILE DECLARATION AND PAY THE TAX

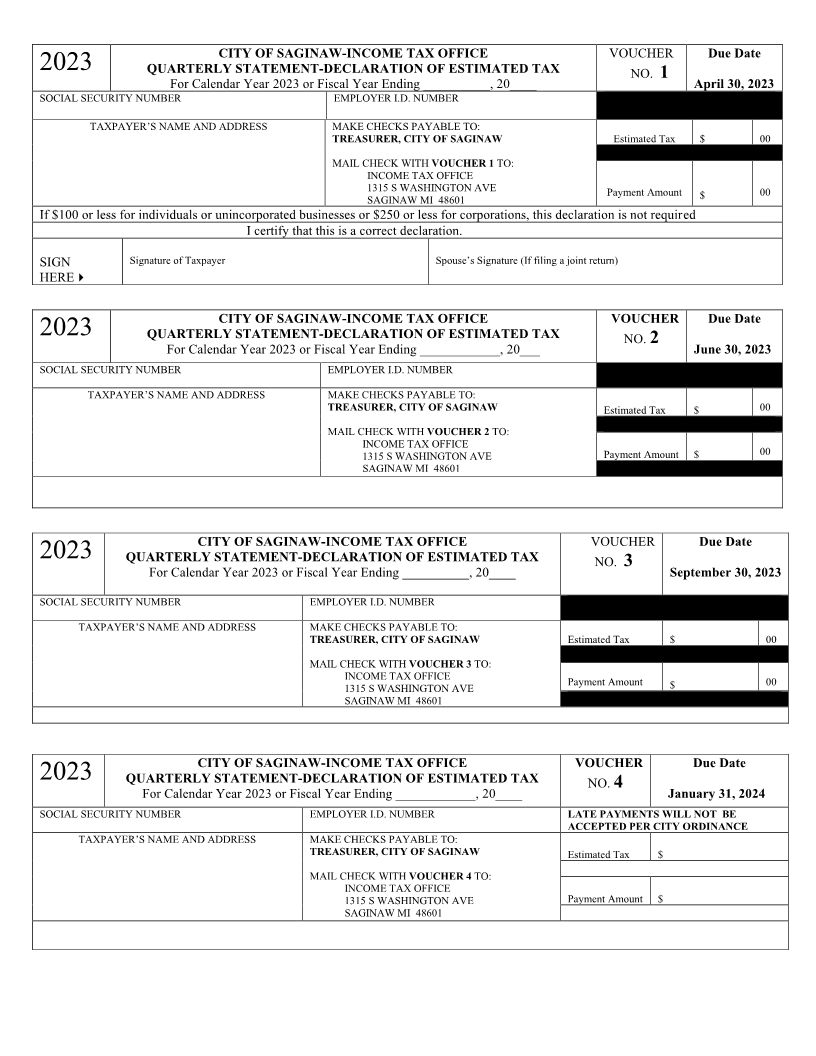

A. CALENDAR YEAR TAXPAYERS

1) FILING: The Declaration for 2023 must be filed on or before April 30, 2023

2) PAYMENT: The estimated tax shall be paid in full with the Declaration or in four (4) equal installments on or before

April 30, 2023, June 30, 2023, September 30, 2023 and January 31, 2024.

B. FISCAL YEAR TAXPAYERS

1) FILING: The Declaration for 2023 must be filed within four months after the beginning of the fiscal period.

2) PAYMENTS: The estimated tax may be paid in full with the Declaration or in four (4) equal installments on or before

April 30, June 30, September 30, and January 31, or on or before the 4th, 6 ,th9 th and 13th month after the beginning of

the taxable fiscal year. The first installment payment must accompany the Declaration.

INCOME SUBJECT TO SAGINAW INCOME TAX

A. RESIDENTS: All salaries, wages, bonuses, commissions and other compensation, net profit from a business or profession, net

rental income, capital gains less capital losses, dividend income, interest income, income from estates and trusts, and other

income.

B. NON-RESIDENTS: Salaries, wages, bonuses, commissions and other compensation for services rendered or work performed

in Saginaw; Net rental income from property in Saginaw; Net profits from a business, profession or other activity to the extent

that it is from work done, services rendered or activity conducted in Saginaw; Capital gains less capital losses from the sale of

real or tangible personal property located in Saginaw. The ordinance and regulations should be reviewed if you have a question

concerning the allocation of income earned in Saginaw.