Enlarge image

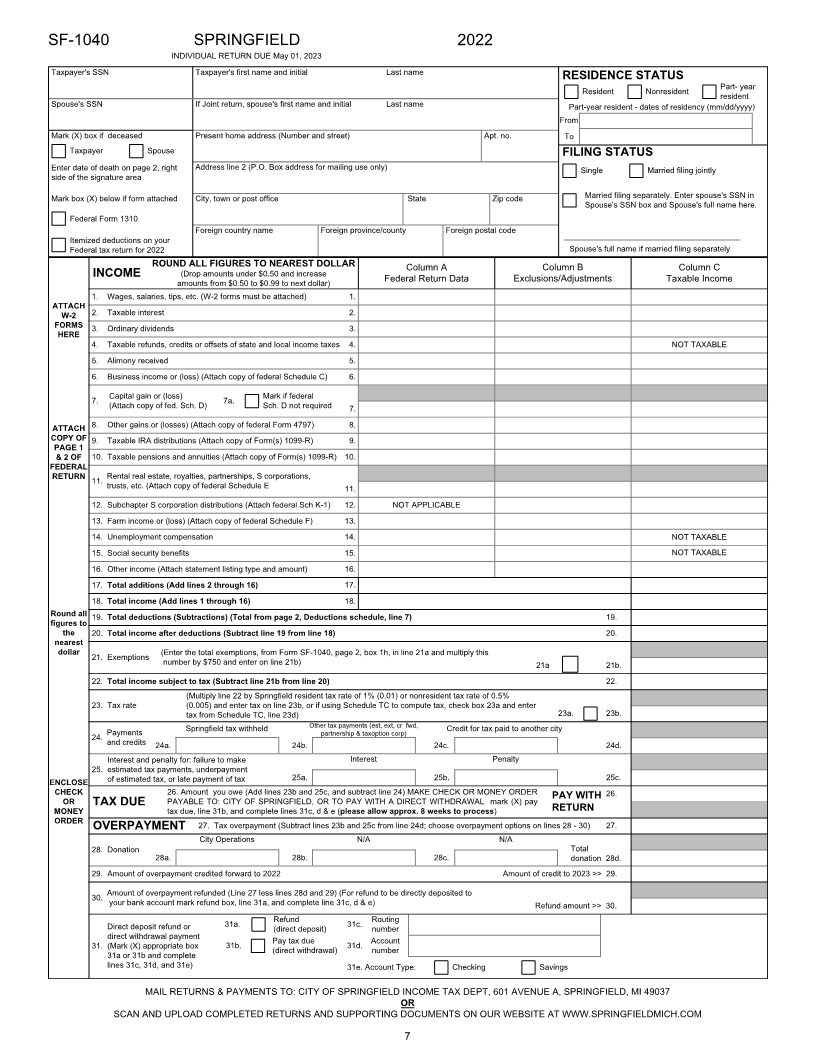

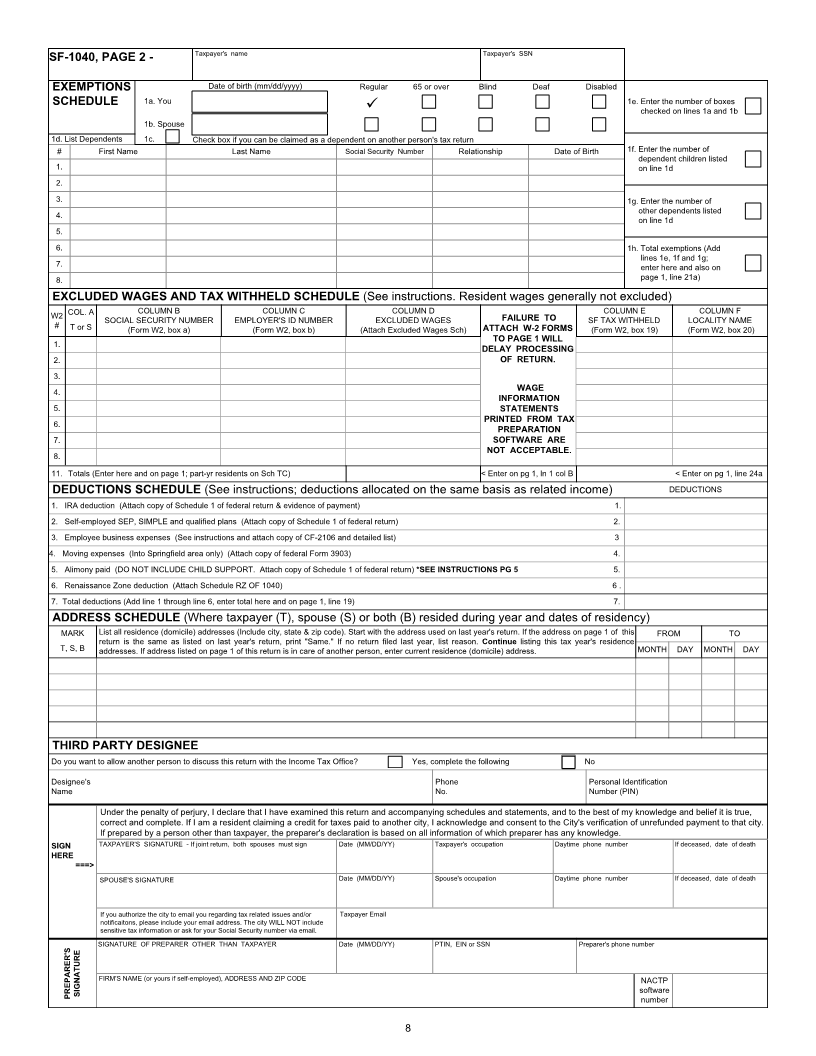

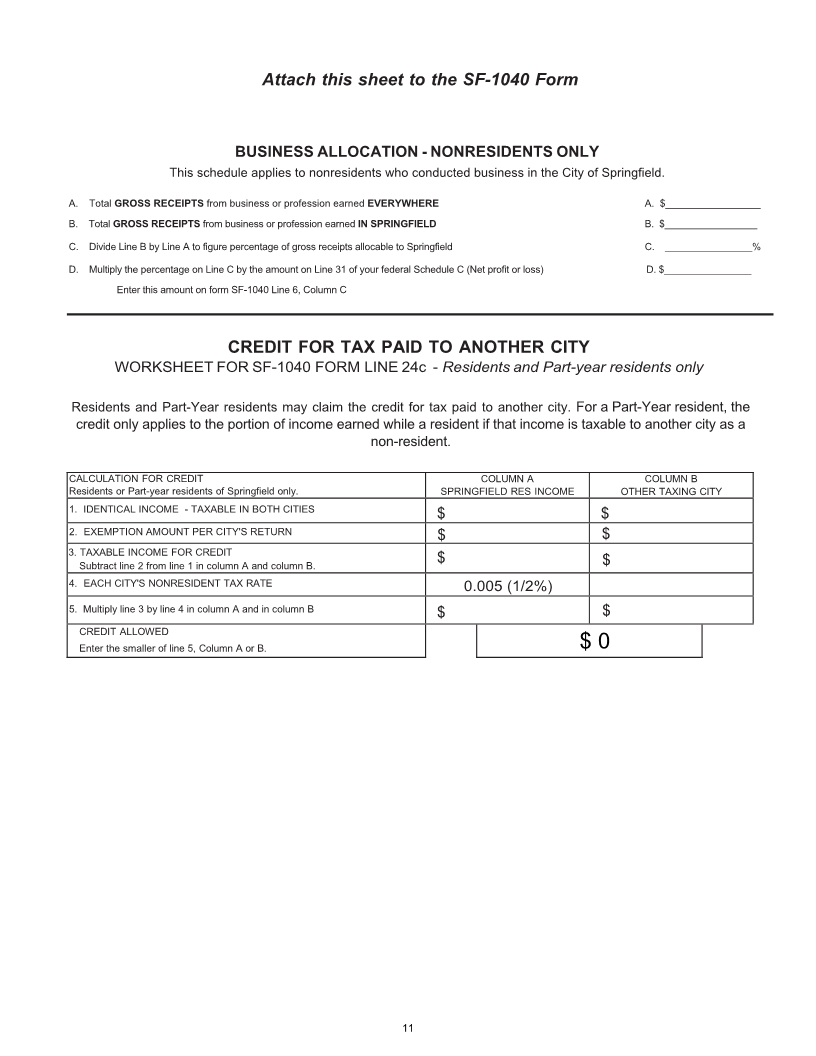

2022

Individual Tax Return Form SF-1040

Returns and Payments due May 01 , 2023

Remittance:

Mail completed returns and payments to: Due Date and Extensions:

Returns and payments of any balance due are due on or

before May 01, 2023. If the due date falls on a weekend or a

City of Springfield Income Tax Department

601 Avenue A holiday, the due date becomes the next business day. The due

Springfield, MI 49037-7774 date of the annual income tax return may be extended for a

period not to exceed six months. Applying for a federal

Make checks and money orders payable to: extension does not automatically satisfy the requirement

City of Springfield. No payment is necessary if tax due is less for filing a Springfield extension. Application for an

than $1.00. extension must be filed with the city and tentative tax due must

be paid (MCL 141.664). Filing an extension with payment is

For faster processing, you may also your completed return and not a substitute for making estimated tax payments. An

upload it using our upload form and/or pay tax due on the extension does not extend the time for paying tax due.

income tax page of our website at www.springfieldmich.com.

Amended Returns:

File amended returns using form SF-1040X, available on our

Who must file a return:

Any person having income taxable to the City of Springfield in website. If a change on your federal return affects Springfield

excess of the personal and dependent exemption amounts taxable income, you must file an amended return within 90

must file a return, even if you do not file a state or federal tax days of the change. All schedules supporting the changes, as

return. You are required to file a return and pay tax due even if well as an explanation for each change, should accompany the

your employer did not withhold Springfield tax from your filing.

paycheck. If you work for an employer that does not withhold

Charges for Late Payments

Springfield tax from your paycheck, you may be required to

All taxes remaining unpaid after the original due date of the

pay estimated income tax payments (See “Estimated Tax

return are subject to interest at the rate of 1% above the

Payments” section below). adjusted prime rate on an annual basis, and to penalty at a

Estimated Tax Payments rate of 1% per month, not to exceed 25% of the tax. The

When your balance due in excess of withholding and credits minimum charge for penalty and interest is $2.00.

exceeds $100, you may be required to make quarterly

Return Assistance:

estimated tax payments. Additional instructions as well as

For questions not answered in the instructions, call us at

vouchers to remit with your payment can be found on our

(269) 965-8324, e-mail us at incometax@springfieldmich.com,

website. Quarterly payments are due 4/30, 6/30, and 9/30 of

or visit our office at the address listed above.

the tax year, and 1/31 of the following year. Failure to make

required estimated tax payments or underpayment of

estimated tax payments will result in assessment of

penalty and interest. If you have made estimated tax

payments and do not owe more tax for the year, you still must

file a tax return.

For additional forms or to pay tax due online, visit our website at www.springfieldmich.com.

We accept credit and debit cards, as well as e-checks.

A 3% fee (min of $1.50) applies to debit and credit cards, however e-checks are free!