Enlarge image

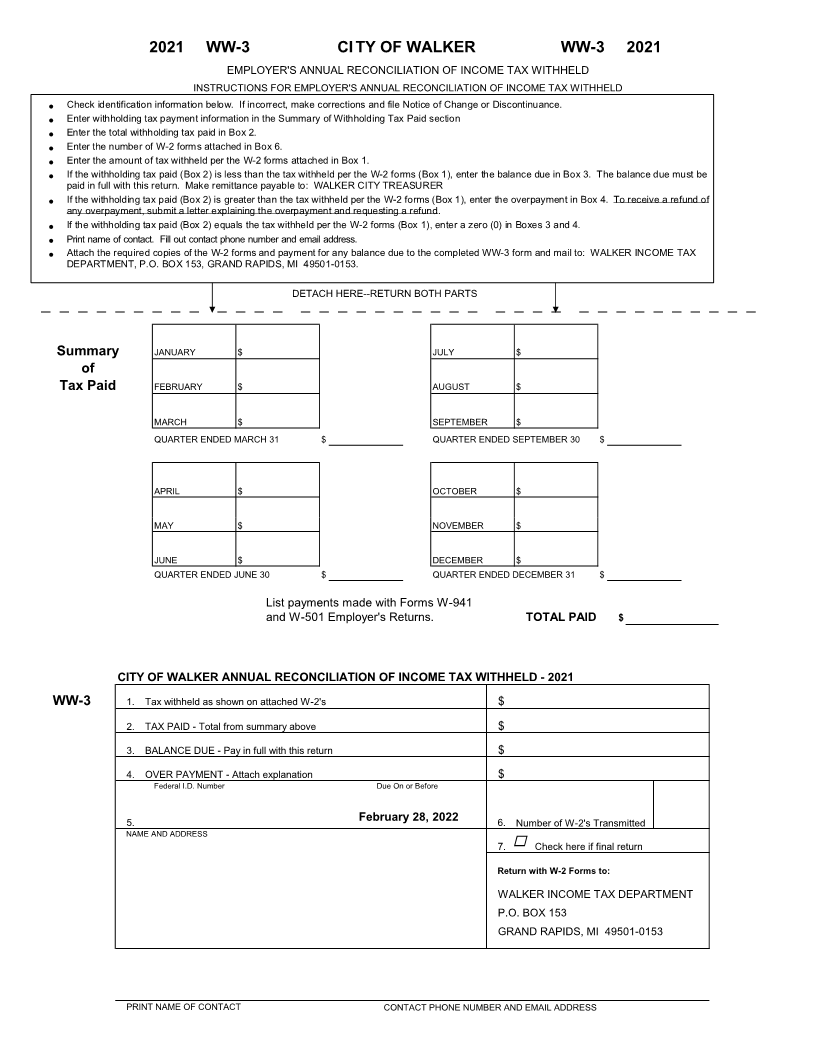

2021 WW-3 CITY OF WALKER WW-3 2021

EMPLOYER'S ANNUAL RECONCILIATION OF INCOME TAX WITHHELD

INSTRUCTIONS FOR EMPLOYER'S ANNUAL RECONCILIATION OF INCOME TAX WITHHELD

Check identification information below. If incorrect, make corrections and file Notice of Change or Discontinuance.

Enter withholding tax payment information in the Summary of Withholding Tax Paid section

Enter the total withholding tax paid in Box 2.

Enter the number of W-2 forms attached in Box 6.

Enter the amount of tax withheld per the W-2 forms attached in Box 1.

If the withholding tax paid (Box 2) is less than the tax withheld per the W-2 forms (Box 1), enter the balance due in Box 3. The balance due must be

paid in full with this return. Make remittance payable to: WALKER CITY TREASURER

If the withholding tax paid (Box 2) is greater than the tax withheld per the W-2 forms (Box 1), enter the overpayment in Box 4. To receive a refund of

any overpayment, submit a letter explaining the overpayment and requesting a refund.

If the withholding tax paid (Box 2) equals the tax withheld per the W-2 forms (Box 1), enter a zero (0) in Boxes 3 and 4.

Print name of contact. Fill out contact phone number and email address.

Attach the required copies of the W-2 forms and payment for any balance due to the completed WW-3 form and mail to: WALKER INCOME TAX

DEPARTMENT, P.O. BOX 153, GRAND RAPIDS, MI 49501-0153.

DETACH HERE--RETURN BOTH PARTS

Summary JANUARY $ JULY $

of

Tax Paid FEBRUARY $ AUGUST $

MARCH $ SEPTEMBER $

QUARTER ENDED MARCH 31 $ QUARTER ENDED SEPTEMBER 30 $

APRIL $ OCTOBER $

MAY $ NOVEMBER $

JUNE $ DECEMBER $

QUARTER ENDED JUNE 30 $ QUARTER ENDED DECEMBER 31 $

List payments made with Forms W-941

and W-501 Employer's Returns. TOTAL PAID $

CITY OF WALKER ANNUAL RECONCILIATION OF INCOME TAX WITHHELD - 2021

WW-3 1. Tax withheld as shown on attached W-2's $

2. TAX PAID - Total from summary above $

3. BALANCE DUE - Pay in full with this return $

4. OVER PAYMENT - Attach explanation $

Federal I.D. Number Due On or Before

5. February 28, 2022 6. Number of W-2's Transmitted

NAME AND ADDRESS

7. Check here if final return

Return with W-2 Forms to:

WALKER INCOME TAX DEPARTMENT

P.O. BOX 153

GRAND RAPIDS, MI 49501-0153

PRINT NAME OF CONTACT CONTACT PHONE NUMBER AND EMAIL ADDRESS