- 5 -

Enlarge image

|

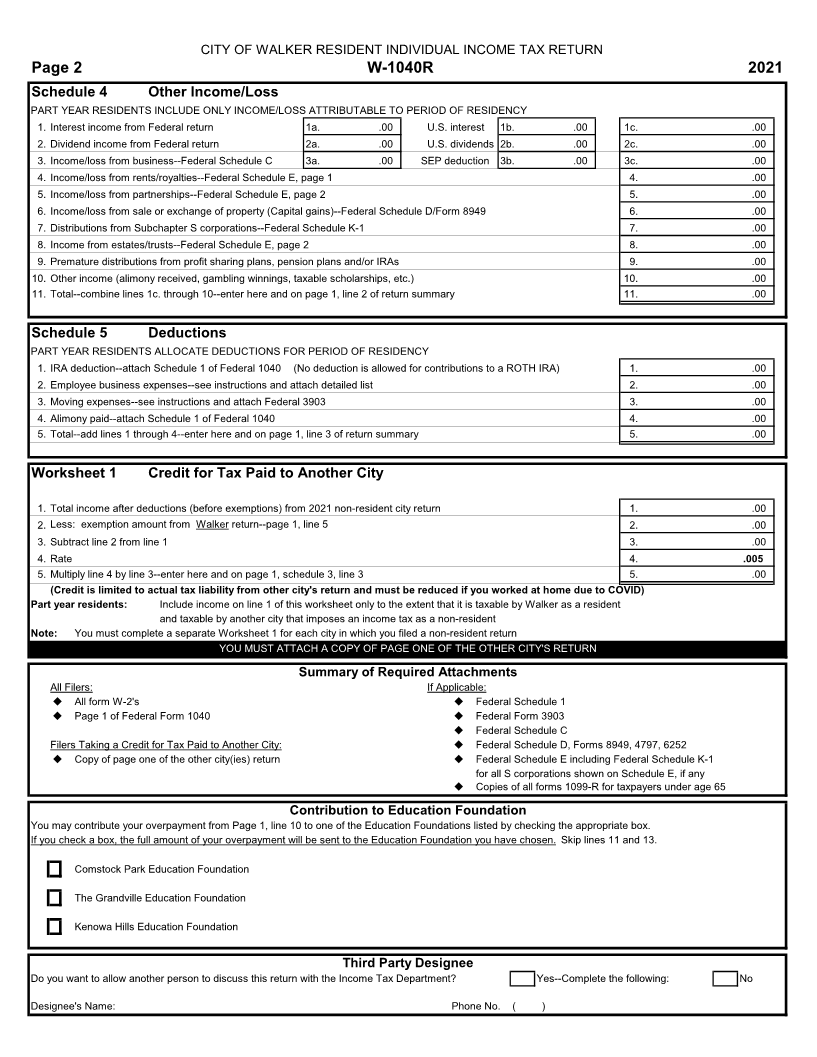

of any net operating loss carryover deducted from line 3c. You may not The only deductions allowed by the City of Walker Income Tax

deduct a carryback loss. Ordinance are as follows:

Line 4—Income/loss from rents/royalties (for filers of Federal Schedule E, • Expenses of travel, meals and lodging while away from home

page one) • Expenses as an outside salesperson who works away from his

Enter all rent and royalty income included on your Federal Schedule E, employer’s place of business (does not include driver/salesperson

page one and received while a resident of Walker. Attach a copy of whose primary duty is service and delivery).

Federal Schedule E, page one. • Expenses of transportation (but not transportation to and from

Line 5—Income/loss from partnerships (for filers of Federal Schedule E, work).

page two) • Expenses reimbursed under an expense account or other

Enter your share of the partnership income/loss on line 5 of arrangement with your employer, if the reimbursement has been

Schedule 4 as reported on Federal Schedule E, page two. Your share of included in reported gross earnings.

qualifying dividends, gains, etc. are treated as belonging to you as an You must attach a detailed list of your employee business expenses.

individual and should be reported on the appropriate Federal and Walker Line 3—Moving expenses

schedules. Moving expenses for certain Armed Forces members only into the City

Attach a copy of Federal Schedule E, page two. of Walker that qualify under the Internal Revenue Code as a deduction

If you are claiming a loss from a partnership located outside of Walker, from federal gross income may be deducted on your Walker return.

a copy of your Federal Schedule K-1 must be attached. You must attach a copy of Federal Form 3903 or a list of your moving

Line 6—Income/loss from sale or exchange of property (for filers of Federal expenses, including the distance in miles from where you moved.

Schedule D, Form 8949, Form 4797 and/or Form 6252) Line 4—Alimony deduction (CHILD SUPPORT IS NOT DEDUCTIBLE)

Enter on line 6 the gain/loss from the sale or exchange of real or Enter alimony deducted on your 2021 federal return.

tangible personal property regardless of where located. The Walker You must attach a copy of Schedule 1 of your Federal Form 1040.

Income Tax Ordinance follows the Internal Revenue Code in its treatment

of capital gains, with two exceptions: COMPLETING YOUR RETURN

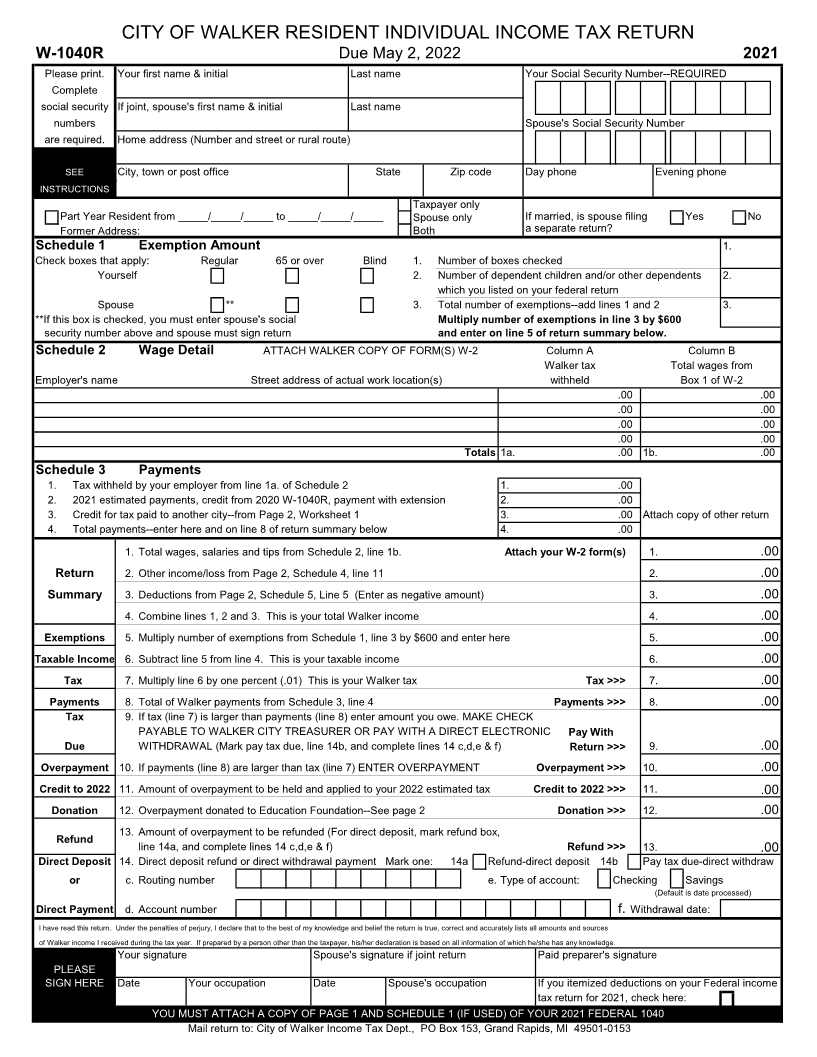

Gains on the sales of obligations of the United States are not taxable After completing schedules 1 through 5 as applicable, transfer the

on this return. results of schedules 1 through 5 to lines 1, 2, 3, 5 and 8 on the front of the

Gain or loss on property purchased prior to January 1, 1988 must be form.

determined by one of the following methods: Follow the instructions on the front of the form for lines 4, 6 and 7.

a) The basis may be the adjusted fair market value of the property Line 9—Tax due

on January 1, 1988 (December 31, 1987 closing price for traded If after computing your Walker Income tax and deducting your

securities), or payments and credits, the balance due is one dollar ($1.00) or more, it

b) Divide the number of months the property has been held since must be entered on Line 9.

January 1, 1988 by the total number of months the property was Make check or money order payable to CITY TREASURER and mail

held, and apply this fraction to the total gain or loss as reported on with this return to: WALKER CITY INCOME TAX DEPARTMENT, P.O.

your federal income tax return. BOX 153, GRAND RAPIDS, MI 49501-0153. For direct electronic

Attach Federal Schedule D and Form 8949. Also attach Form 4797 withdrawal, mark pay tax due, line 14b, and complete lines 14c, d, e and f.

and Form 6252 if applicable. Withdrawal date (line 14f) must be no later than the due date of the return.

Line 7—Distributions from Subchapter S corporations. If no date is entered, the default withdrawal date will be the date

Enter on line 7 cash or property distributions from S corporations from processed.

line 16, code D of Federal Schedule K-1. The Walker City Income Tax Line 10—Overpayment

Ordinance does not recognize Subchapter S status. Distributions from an If your total payments and credits on line 8 are more than Walker Tax

S corporation are taxable as if paid by a regular corporation as dividends. on line 7, you have overpaid your tax for 2021.

If you are a shareholder in a corporation that has elected to file under 1. If you want your overpayment to be HELD and applied to your 2022

Subchapter S of the Internal Revenue Code, you are not required to report estimated tax, enter the overpayment on line 11.

any distributed income from Federal Schedule K-1 lines 1 through 11, nor 2. If you want your overpayment to be DONATED to the Education

may you deduct your share of any loss or other deductions distributed by Foundation of your choice, enter the overpayment on line 12. Select

the corporation. the Education Foundation on page 2.

Attach copies of Federal Schedule K-1 for all S corporations listed on 3. If you want your overpayment MAILED to you, enter the overpayment

page two of your Federal Schedule E regardless of whether or not the on line 13.

S corporation made distributions. 4. If you want your overpayment REFUNDED VIA DIRECT DEPOSIT,

Line 8—Income from estates and/or trusts. enter the overpayment on line 13 and complete the routing number,

Enter on line 8 all income from estates and/or trusts reported on your type of account and account number boxes provided in line 14.

Federal Schedule E, page two. Income from an estate or trust is taxable to Refunds or credits of less than one dollar ($1.00) cannot be made.

a Walker resident regardless of the location of the estate or trust, or the THIRD PARTY DESIGNEE

location of property it may own. If you want to allow a friend, family member or any other person you

Attach a copy of Federal Schedule E, page two. choose to discuss your 2021 tax return with the Income Tax Department,

Line 9—Distributions from profit sharing plans, premature IRA distributions. give the Department any information missing from your return, receive

Enter on line 9 all early pension and profit sharing withdrawals and/or copies of notices and/or respond to notices about math errors, offsets and

distributions subject to the 10% federal penalty. Also report on line 9 return preparation, check the “Yes” box in the designated area. Enter the

premature IRA distributions subject to the 10% federal penalty. designee’s name and phone number. To designate the preparer who

Line 10—Other income. signed your return, enter “Preparer” in the space for designee’s name.

Enter on line 10 all other income reported on your federal return and ASSISTANCE

not specifically exempted by the Walker City Income Tax Ordinance. If you have questions not answered in these instructions or if you need

Examples of the types of income reported on line 10 are gambling assistance in preparing your return, call (616) 791-6880.

winnings, alimony received and miscellaneous income. We would be happy to prepare your Walker Income Tax Return free of

SCHEDULE 5—DEDUCTIONS charge. Please contact the Walker Income Tax Department at 791-6880

Part-year residents must allocate deductions the same way they allocate for an appointment.

income. The only deductions allowed by the Income Tax Ordinance are: NOTICE

Line 1—IRA deduction These instructions are an interpretation of the Walker City Income Tax

The rules governing IRA deductions on this return are the same as Ordinance. If any discrepancy exists between the instructions and the

under the Internal Revenue Code. Ordinance, the Ordinance prevails.

Contributions to ROTH IRA’s are not deductible.

Attach Schedule 1 of Federal Form 1040.

A SEP retirement plan deduction must be entered on line 1b. of

Schedule 4.

Line 2—Employee business expenses

The employee business expenses listed below are not subject to the

same reductions and limitations required under the Internal Revenue Code.

These expenses are, however, allowed only to the extent not paid or

reimbursed by your employer and only when incurred in the performance of

service for your employer.

|