Enlarge image

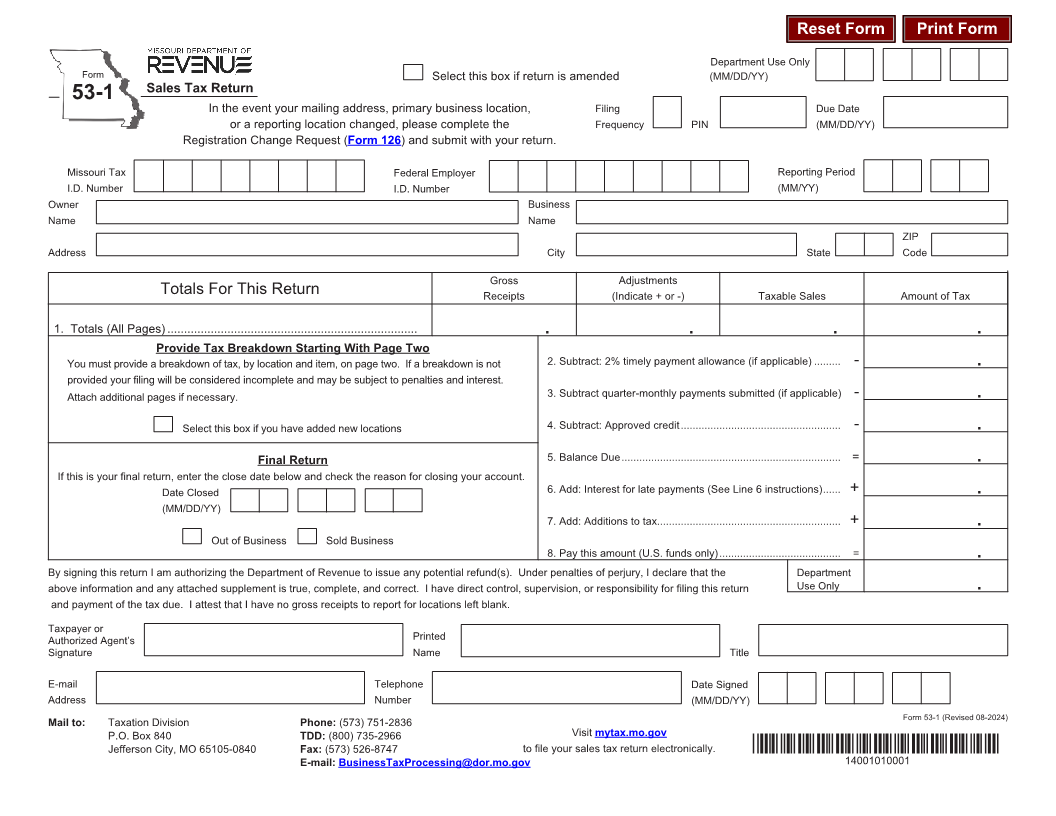

Reset Form Print Form

Department Use Only

Form Select this box if return is amended (MM/DD/YY)

Sales Tax Return

53-1

In the event your mailing address, primary business location, Filing Due Date

or a reporting location changed, please complete the Frequency PIN (MM/DD/YY)

Registration Change Request (Form 126) and submit with your return.

Missouri Tax Federal Employer Reporting Period

I.D. Number I.D. Number (MM/YY)

Owner Business

Name Name

ZIP

Address City State Code

Gross Adjustments

Totals For This Return Receipts (Indicate + or -) Taxable Sales Amount of Tax

1. Totals (All Pages) ........................................................................... . . . .

Provide Tax Breakdown Starting With Page Two

You must provide a breakdown of tax, by location and item, on page two. If a breakdown is not 2. Subtract: 2% timely payment allowance (if applicable) ......... - .

provided your filing will be considered incomplete and may be subject to penalties and interest.

Attach additional pages if necessary. 3. Subtract quarter-monthly payments submitted (if applicable) - .

Select this box if you have added new locations 4. Subtract: Approved credit ...................................................... - .

Final Return 5. Balance Due .......................................................................... = .

If this is your final return, enter the close date below and check the reason for closing your account.

Date Closed 6. Add: Interest for late payments (See Line 6 instructions) ...... + .

(MM/DD/YY)

7. Add: Additions to tax.............................................................. + .

Out of Business Sold Business

8. Pay this amount (U.S. funds only) ......................................... = .

By signing this return I am authorizing the Department of Revenue to issue any potential refund(s). Under penalties of perjury, I declare that the Department

above information and any attached supplement is true, complete, and correct. I have direct control, supervision, or responsibility for filing this return Use Only .

and payment of the tax due. I attest that I have no gross receipts to report for locations left blank.

Taxpayer or

Authorized Agent’s Printed

Signature Name Title

E-mail Telephone Date Signed

Address Number (MM/DD/YY)

Form 53-1 (Revised 08-2024)

Mail to: Taxation Division Phone: (573) 751-2836

P.O. Box 840 TDD: (800) 735-2966 Visit mytax.mo.gov

Jefferson City, MO 65105-0840 Fax: (573) 526-8747 to file your sales tax return electronically. *14001010001*

E-mail: BusinessTaxProcessing@dor.mo.gov 14001010001