Enlarge image

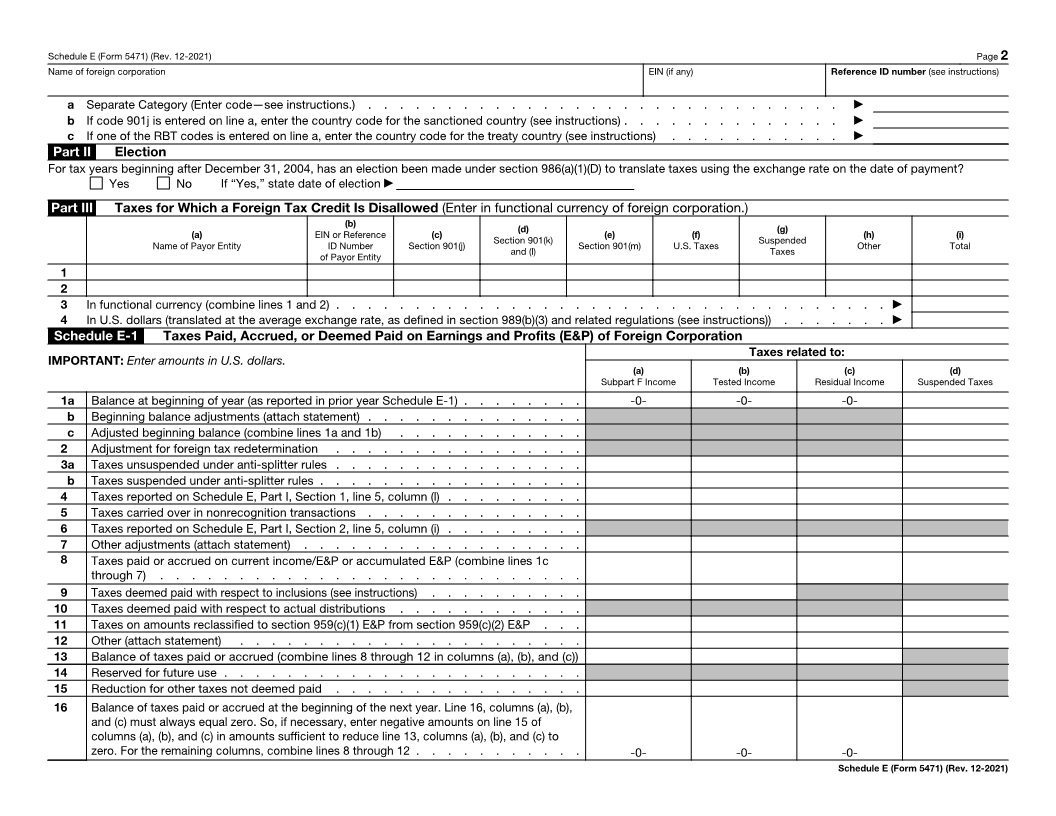

SCHEDULE E Income, War Profits, and Excess Profits Taxes Paid or Accrued

(Form 5471)

(Rev. December 2021) ▶ Attach to Form 5471. OMB No. 1545-0123

Department of the Treasury ▶ Go to www.irs.gov/Form5471 for instructions and the latest information.

Internal Revenue Service

Name of person filing Form 5471 Identifying number

Name of foreign corporation EIN (if any) Reference ID number (see instructions)

a Separate Category (Enter code—see instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

b If code 901j is entered on line a, enter the country code for the sanctioned country (see instructions) . . . . . . . . . . . . . . ▶

c If one of the RBT codes is entered on line a, enter the country code for the treaty country (see instructions) . . . . . . . . . . . ▶

Part I Taxes for Which a Foreign Tax Credit Is Allowed

Section 1 — Taxes Paid or Accrued Directly by Foreign Corporation

(b)

(a) EIN or Reference (c) (d) (e) (f)

Country or U.S. Possession

Name of Payor Entity ID Number Unsuspended to Which Tax Is Paid Foreign Tax Year of Payor U.S. Tax Year of Payor Entity

of Payor Entity Taxes (Enter code—see instructions. Entity to Which Tax Relates to Which Tax Relates

Use a separate line for each.) (Year/Month/Day) (Year/Month/Day)

1

2

3

4

(g) (h) (i) (j) (k) (l) (m)

Income Subject to Tax If taxes are paid on Local Currency in Tax Paid or Accrued Conversion Rate In U.S. Dollars In Functional Currency

in the Foreign Jurisdiction U.S. source income, Which Tax Is Payable (in local currency in which to U.S. Dollars (divide column (j) of Foreign Corporation

(see instructions) check box (enter code—see instructions) the tax is payable) by column (k))

1

2

3

4

5 Total (combine lines 1 through 4 of column (l)). Also report amount on Schedule E-1, line 4 . . . . . . . . . ▶

6 Total (combine lines 1 through 4 of column (m)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

Section 2 — Taxes Deemed Paid by Foreign Corporation

(b)

(a) EIN or Reference ID (c) (d) (e)

Name of Lower-Tier Distributing Foreign Corporation Number of Lower-Tier Country or U.S. Possession to Which Tax Is Paid PTEP Group Annual PTEP Account

Distributing Foreign (Enter code—see instructions. Use a separate line for each.) (enter code) (enter year)

Corporation

1

2

3

4

(f) (g) (h) (i)

PTEP Distributed Total Amount of PTEP in the PTEP Group Total Amount of the PTEP Group Taxes Foreign Income Taxes Properly Attributable

(enter amount in functional currency) (in functional currency) With Respect to PTEP Group (USD) to PTEP and not Previously Deemed Paid

((column (f)/column (g)) x column (h)) (USD)

1

2

3

4

5 Total (combine lines 1 through 4 of column (i)). Also report amount on Schedule E-1, line 6 . . . . . . . . . . . ▶

For Paperwork Reduction Act Notice, see instructions. Cat. No. 71397A Schedule E (Form 5471) (Rev. 12-2021)