Enlarge image

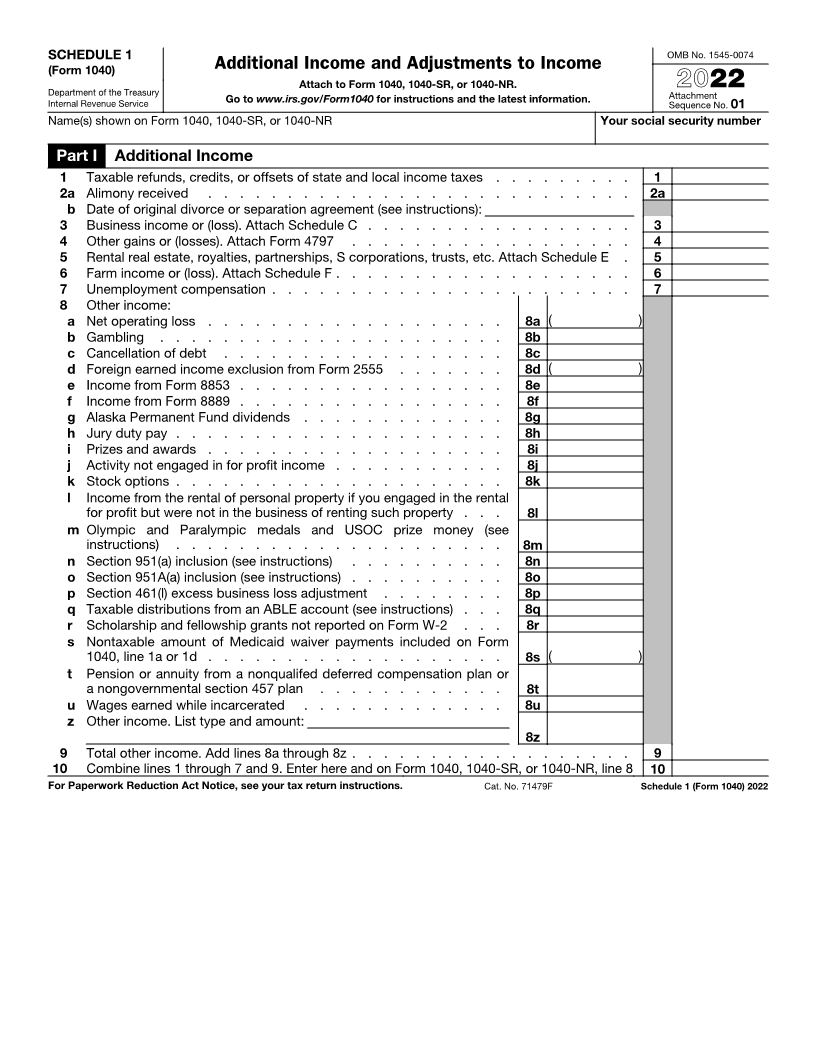

SCHEDULE 1 OMB No. 1545-0074

(Form 1040) Additional Income and Adjustments to Income

Attach to Form 1040, 1040-SR, or 1040-NR.

Department of the Treasury Attachment 2022

Internal Revenue Service Go to www.irs.gov/Form1040 for instructions and the latest information. Sequence No. 01

Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number

Part I Additional Income

1 Taxable refunds, credits, or offsets of state and local income taxes . . . . . . . . . 1

2a Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b Date of original divorce or separation agreement (see instructions):

3 Business income or (loss). Attach Schedule C . . . . . . . . . . . . . . . . . 3

4 Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . . . 4

5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E . 5

6 Farm income or (loss). Attach Schedule F . . . . . . . . . . . . . . . . . . . 6

7 Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . 7

8 Other income:

a Net operating loss . . . . . . . . . . . . . . . . . . . 8a ( )

b Gambling . . . . . . . . . . . . . . . . . . . . . . 8b

c Cancellation of debt . . . . . . . . . . . . . . . . . . 8c

d Foreign earned income exclusion from Form 2555 . . . . . . . 8d ( )

e Income from Form 8853 . . . . . . . . . . . . . . . . . 8e

f Income from Form 8889 . . . . . . . . . . . . . . . . . 8f

g Alaska Permanent Fund dividends . . . . . . . . . . . . . 8g

h Jury duty pay . . . . . . . . . . . . . . . . . . . . . 8h

i Prizes and awards . . . . . . . . . . . . . . . . . . . 8i

j Activity not engaged in for profit income . . . . . . . . . . . 8j

k Stock options . . . . . . . . . . . . . . . . . . . . . 8k

l Income from the rental of personal property if you engaged in the rental

for profit but were not in the business of renting such property . . . 8l

m Olympic and Paralympic medals and USOC prize money (see

instructions) . . . . . . . . . . . . . . . . . . . . . 8m

n Section 951(a) inclusion (see instructions) . . . . . . . . . . 8n

o Section 951A(a) inclusion (see instructions) . . . . . . . . . . 8o

p Section 461(l) excess business loss adjustment . . . . . . . . 8p

q Taxable distributions from an ABLE account (see instructions) . . . 8q

r Scholarship and fellowship grants not reported on Form W-2 . . . 8r

s Nontaxable amount of Medicaid waiver payments included on Form

1040, line 1a or 1d . . . . . . . . . . . . . . . . . . . 8s ( )

t Pension or annuity from a nonqualifed deferred compensation plan or

a nongovernmental section 457 plan . . . . . . . . . . . . 8t

u Wages earned while incarcerated . . . . . . . . . . . . . 8u

z Other income. List type and amount:

8z

9 Total other income. Add lines 8a through 8z . . . . . . . . . . . . . . . . . . 9

10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 10

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040) 2022