Enlarge image

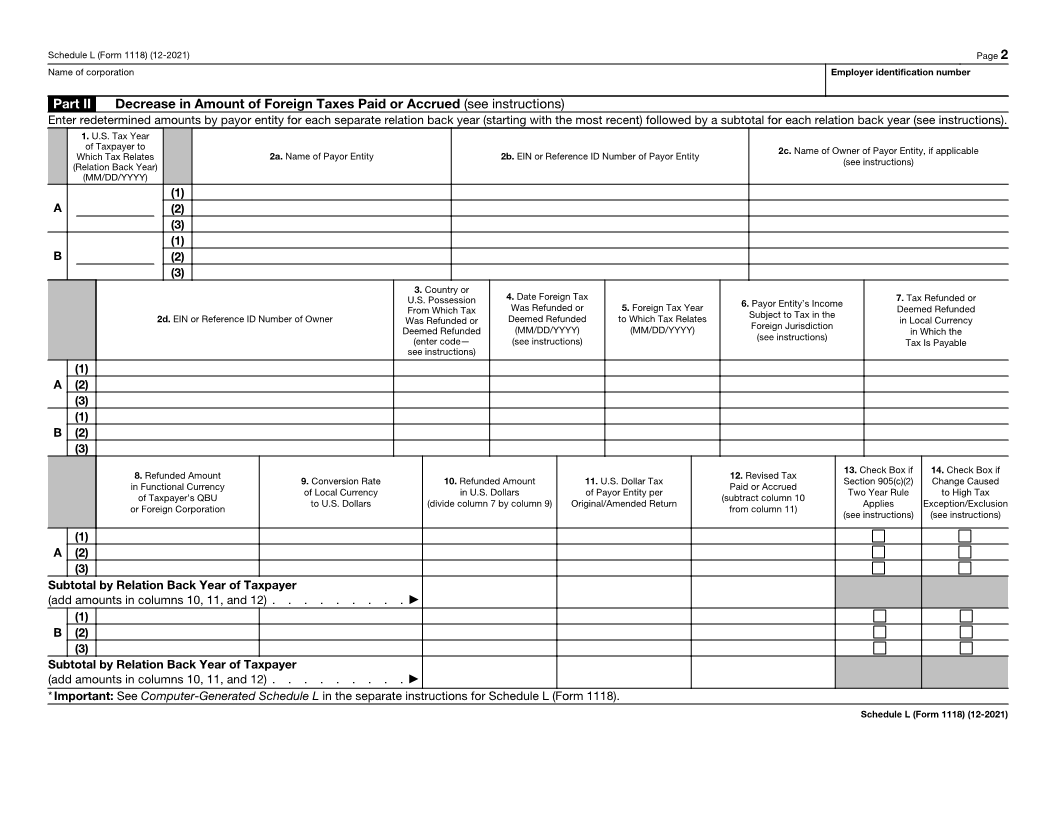

SCHEDULE L Foreign Tax Redeterminations

(Form 1118)

(December 2021) For calendar year 20 , or other tax year beginning , 20 , and ending , 20 . OMB No. 1545-0123

Department of the Treasury ▶ Attach to Form 1118.

Internal Revenue Service ▶ Go to www.irs.gov/Form1118 for instructions and the latest information.

Name of corporation Employer identification number

Use a separate Schedule L (Form 1118) for each category of income (see instructions).

a Separate category (enter code—see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

b If code 901j is entered on line a, enter the country code for the sanctioned country (see instructions) . . . . . . . . . . . . . . ▶

c If one of the RBT codes is entered on line a, enter the country code for the treaty country (see instructions) . . . . . . . . . . . . ▶

d Check this box if election made under Regulations section 1.905-5(e) to account for foreign tax redeterminations with respect to pre-2018 tax years

in foreign corporation’s last pooling year (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

Part I Increase in Amount of Foreign Taxes Accrued (see instructions)

Enter redetermined amounts by payor entity for each separate relation back year (starting with the most recent) followed by a subtotal for each relation back year (see instructions).

1. U.S. Tax Year

of Taxpayer to 2c. Name of Owner of Payor Entity, if applicable

Which Tax Relates 2a. Name of Payor Entity 2b. EIN or Reference ID Number of Payor Entity (see instructions)

(Relation Back Year)

(MM/DD/YYYY)

(1)

A (2)

(3)

(1)

B (2)

(3)

3. Country or 6. Payor Entity’s Income

U.S. Possession 4. Date Additional 5. Foreign Tax Year

2d. EIN or Reference ID Number of Owner to Which Tax Is Paid Foreign Tax Was Paid to Which Tax Relates Subject to Tax in the 7. Additional Tax Accrued

(enter code— (MM/DD/YYYY) (MM/DD/YYYY) Foreign Jurisdiction in Local Currency in Which

see instructions) (see instructions) the Tax Is Payable

(1)

A (2)

(3)

(1)

B (2)

(3)

14. Check Box if

8. Additional Tax Accrued 9. Conversion Rate 10. Additional Tax Accrued 11. U.S. Dollar Tax 12. Revised Tax Accrued 13. Check Box if Change Caused

in Functional Currency of Local Currency in U.S. Dollars of Payor Entity per (add column 10 and column 11) Contested Tax to High Tax

of Taxpayer’s QBU to U.S. Dollars (divide column 7 by column 9) Original/Amended Return (see instructions) Exception/Exclusion

or Foreign Corporation (see instructions)

(1)

A (2)

(3)

Subtotal by Relation Back Year of Taxpayer (add amounts in columns 10, 11, and▶ 12)

(1)

B (2)

(3)

Subtotal by Relation Back Year of Taxpayer (add amounts in columns 10, 11, and 12) ▶

* Important: See Computer-Generated Schedule L in the separate instructions for Schedule L (Form 1118).

For Paperwork Reduction Act Notice, see the Instructions for Form 1118. Cat. No. 75132H Schedule L (Form 1118) (12-2021)