Enlarge image

Initial and Annual Statement of OMB No. 1545-0123

Form 8997 Qualified Opportunity Fund (QOF) Investments

▶

Department of the Treasury Go to www.irs.gov/Form8997 for the latest information. Attachment 2021

Internal Revenue Service ▶ Attach to your tax return. Sequence No. 997

Name Tax identification number (see instructions)

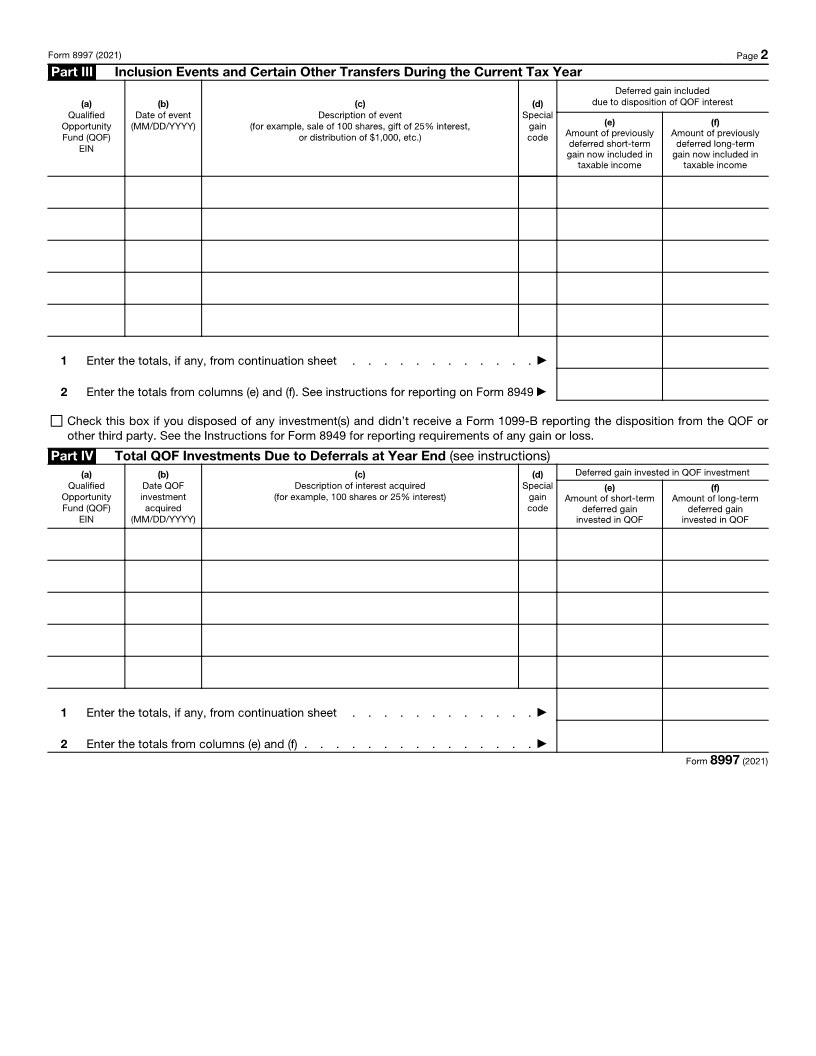

Part I Total QOF Investment Holdings Due to Deferrals Prior to Beginning of Tax Year

If different from last year’s ending QOF investment holdings, attach explanation.

(a) (b) (c) (d) Deferred gain held in QOF

Qualified Date QOF Description of QOF investment Special (e) (f)

Opportunity investment (for example, 100 shares or 25% interest) gain Amount of short-term Amount of long-term

Fund (QOF) acquired code deferred gain deferred gain

EIN (MM/DD/YYYY) remaining in QOF remaining in QOF

1 Enter the totals, if any, from continuation sheet . . . . . . . . . . . . ▶

2 Enter the totals from columns (e) and (f) . . . . . . . . . . . . . . . ▶

Part II Current Tax Year Capital Gains Deferred by Investing in QOF

(a) (b) (c) (d) Deferred gain invested in QOF

Qualified Date QOF Description of interest acquired Special (e) (f)

Opportunity investment (for example, 100 shares or 25% interest) gain Amount of short-term Amount of long-term

Fund (QOF) acquired code deferred gain deferred gain

EIN (MM/DD/YYYY) remaining in QOF remaining in QOF

1 Enter the totals, if any, from continuation sheet . . . . . . . . . . . . ▶

2 Enter the totals from columns (e) and (f). See instructions for reporting on Form 8949 ▶

Applicability of Special Rules Regarding the Waiver of Certain Treaty Benefits

Are you a foreign eligible taxpayer whose tax year began after March 13, 2020? See instructions for more information.

Yes. You may not elect to defer tax on an eligible gain by investing in a QOF unless you check “Yes” in response to the next question.

No. Skip the next question and go to Part III.

If you are a foreign eligible taxpayer, see the instructions to determine if you are required to attach a written statement for the portion

of your first tax year ending after December 21, 2017, and all tax years that began after December 21, 2017, and on or before March

13, 2020.

Waiver of Treaty Benefits on Future Inclusions by a Foreign Eligible Taxpayer (for Tax Years Beginning After

March 13, 2020, Only)

Do you hereby irrevocably waive any benefits available under an applicable U.S. income tax convention that would exempt gains

that you are deferring by investing in a QOF from being subject to federal income tax at the time of inclusion? See instructions for

more information.

Yes. Report the deferral of the eligible gain in Part II and on Form 8949.

No. You may not elect to defer tax on an eligible gain by investing in a QOF. Do not report the deferral of any otherwise

eligible gain in Part II or on Form 8949.

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 37821R Form 8997 (2021)