Enlarge image

Userid: CPM Schema: Leadpct: 100% Pt. size: 10 Draft Ok to Print

notice

Fileid: … es/N1036/201812/A/XML/Cycle04/source (Init. & Date) _______

AH XSL/XML

Page 1 of 4 8:54 - 3-Dec-2018

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Notice 1036 Internal Revenue Service

(Rev. December 2018)

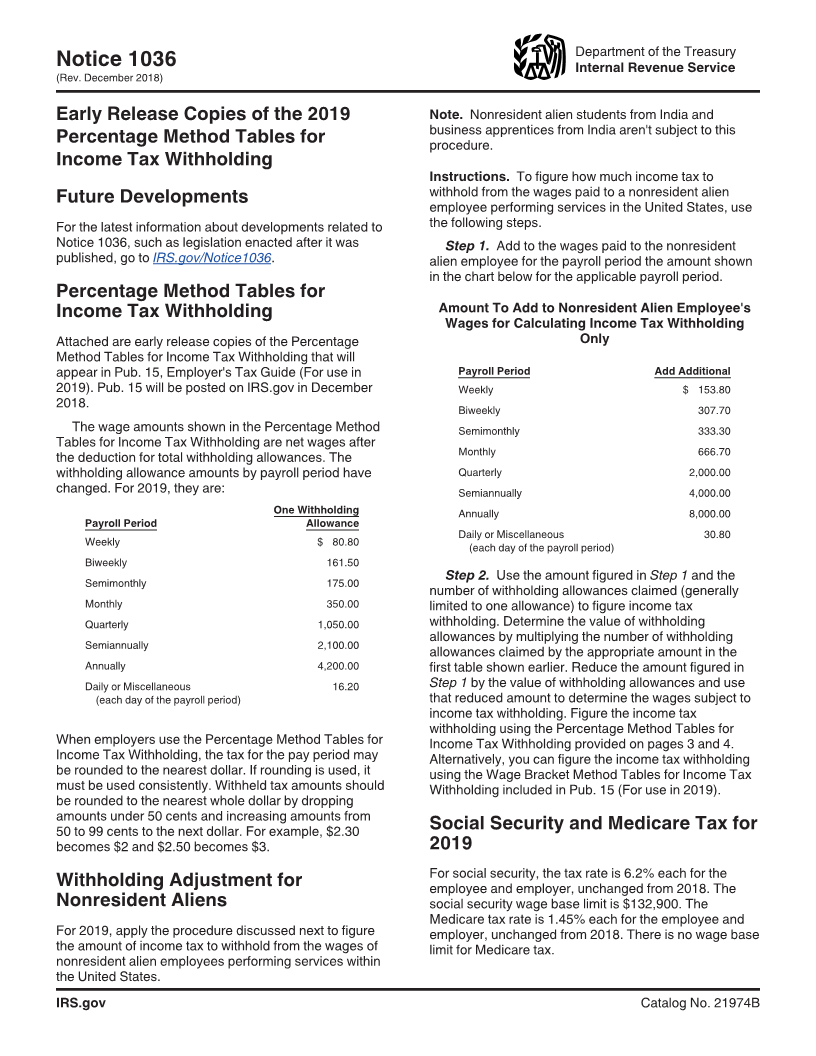

Early Release Copies of the 2019 Note. Nonresident alien students from India and

business apprentices from India aren't subject to this

Percentage Method Tables for procedure.

Income Tax Withholding

Instructions. To figure how much income tax to

withhold from the wages paid to a nonresident alien

Future Developments

employee performing services in the United States, use

For the latest information about developments related to the following steps.

Notice 1036, such as legislation enacted after it was Step 1. Add to the wages paid to the nonresident

published, go to IRS.gov/Notice1036. alien employee for the payroll period the amount shown

in the chart below for the applicable payroll period.

Percentage Method Tables for

Income Tax Withholding Amount To Add to Nonresident Alien Employee's

Wages for Calculating Income Tax Withholding

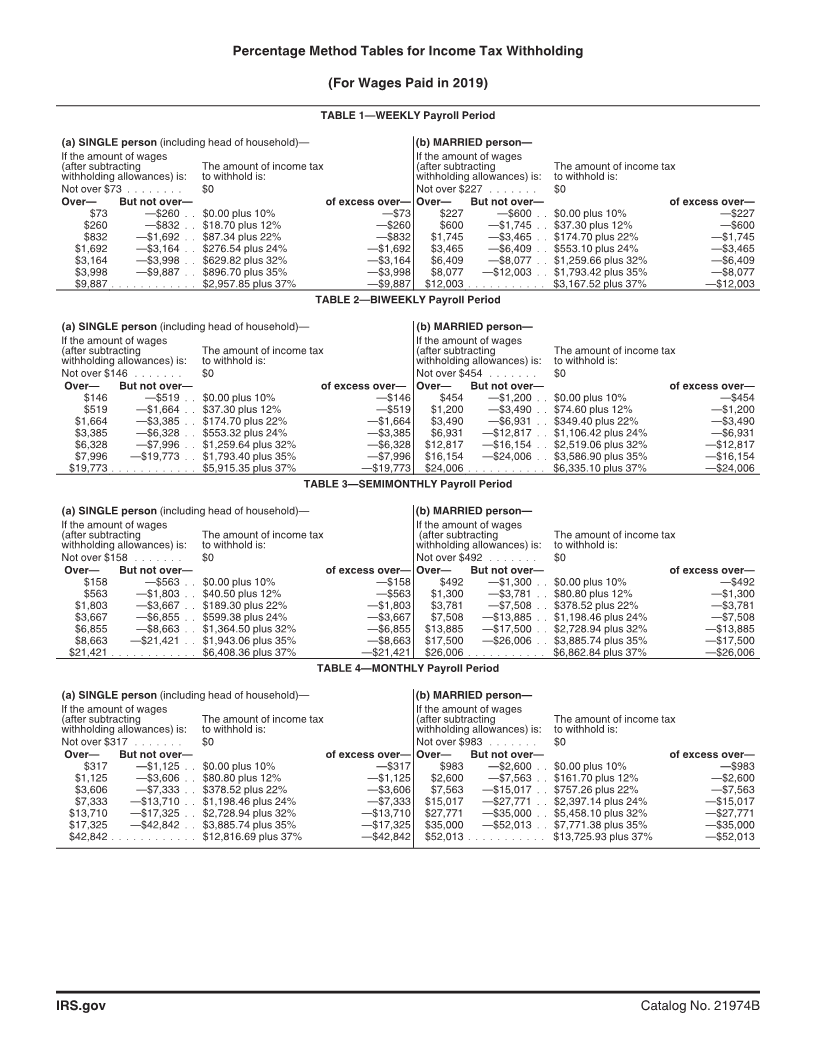

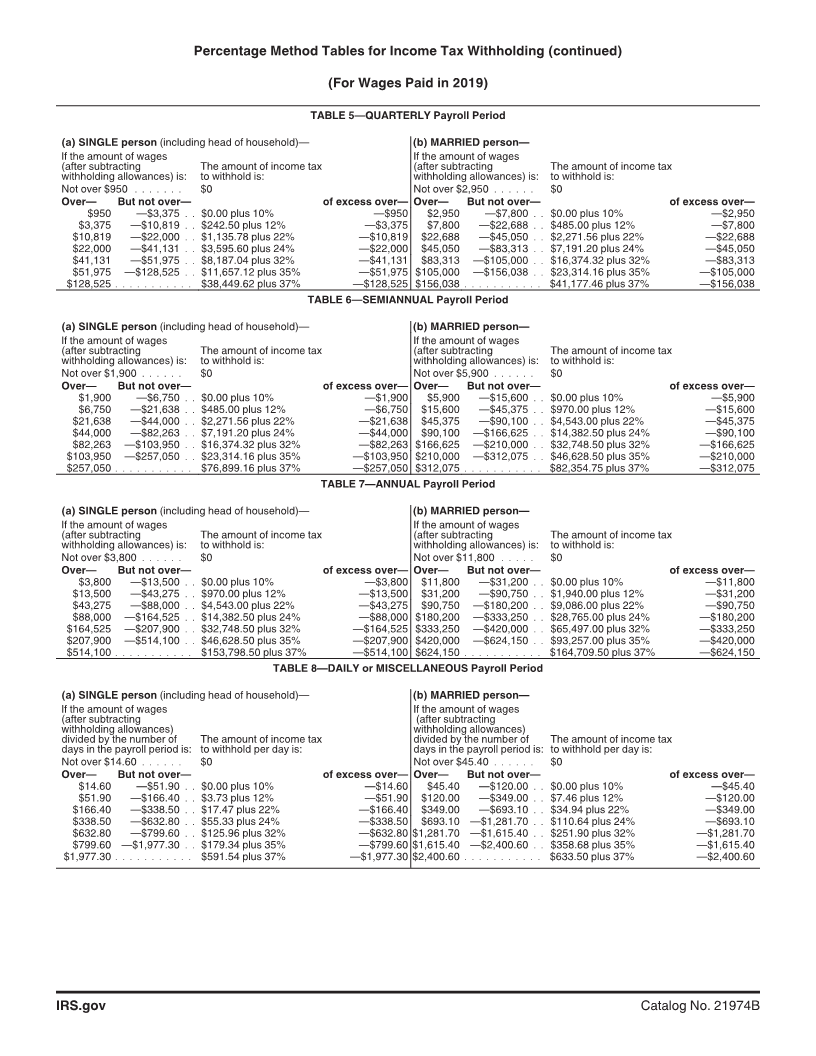

Attached are early release copies of the Percentage Only

Method Tables for Income Tax Withholding that will

appear in Pub. 15, Employer's Tax Guide (For use in Payroll Period Add Additional

2019). Pub. 15 will be posted on IRS.gov in December Weekly $ 153.80

2018. Biweekly 307.70

The wage amounts shown in the Percentage Method Semimonthly 333.30

Tables for Income Tax Withholding are net wages after

Monthly 666.70

the deduction for total withholding allowances. The

withholding allowance amounts by payroll period have Quarterly 2,000.00

changed. For 2019, they are: Semiannually 4,000.00

One Withholding Annually 8,000.00

Payroll Period Allowance

Daily or Miscellaneous 30.80

Weekly $ 80.80 (each day of the payroll period)

Biweekly 161.50

Semimonthly 175.00 Step 2. Use the amount figured in Step 1 and the

number of withholding allowances claimed (generally

Monthly 350.00 limited to one allowance) to figure income tax

Quarterly 1,050.00 withholding. Determine the value of withholding

allowances by multiplying the number of withholding

Semiannually 2,100.00

allowances claimed by the appropriate amount in the

Annually 4,200.00 first table shown earlier. Reduce the amount figured in

Daily or Miscellaneous 16.20 Step 1 by the value of withholding allowances and use

(each day of the payroll period) that reduced amount to determine the wages subject to

income tax withholding. Figure the income tax

withholding using the Percentage Method Tables for

When employers use the Percentage Method Tables for Income Tax Withholding provided on pages 3 and 4.

Income Tax Withholding, the tax for the pay period may Alternatively, you can figure the income tax withholding

be rounded to the nearest dollar. If rounding is used, it using the Wage Bracket Method Tables for Income Tax

must be used consistently. Withheld tax amounts should Withholding included in Pub. 15 (For use in 2019).

be rounded to the nearest whole dollar by dropping

amounts under 50 cents and increasing amounts from

50 to 99 cents to the next dollar. For example, $2.30 Social Security and Medicare Tax for

becomes $2 and $2.50 becomes $3. 2019

For social security, the tax rate is 6.2% each for the

Withholding Adjustment for employee and employer, unchanged from 2018. The

Nonresident Aliens social security wage base limit is $132,900. The

Medicare tax rate is 1.45% each for the employee and

For 2019, apply the procedure discussed next to figure employer, unchanged from 2018. There is no wage base

the amount of income tax to withhold from the wages of limit for Medicare tax.

nonresident alien employees performing services within

the United States.

IRS.gov Catalog No. 21974B