Enlarge image

OMB No. 1545-0074

Qualified Adoption Expenses

Form 8839

Attach to Form 1040, 1040-SR, or 1040-NR.

Department of the Treasury Go to www.irs.gov/Form8839 for instructions and the latest information. Attachment 2022

Internal Revenue Service Sequence No. 38

Name(s) shown on return Your social security number

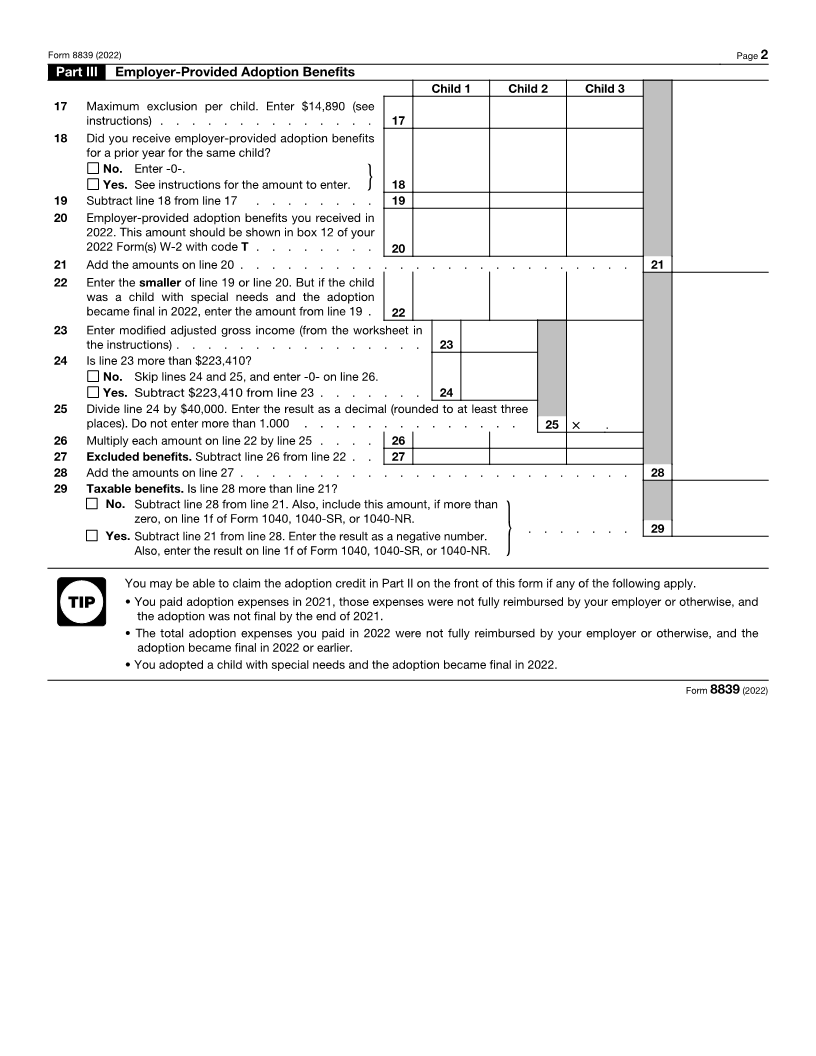

Part I Information About Your Eligible Child or Children—You must complete this part.

See instructions for details, including what to do if you need more space.

Check if child was— (g)

1 (a) (b) (c) (d) (e) (f) Check if

Child’s name Child’s year born before a child a foreign Child’s adoption

of birth 2005 and with special child identifying number became final in

First Last disabled needs 2022 or earlier

Child

1

Child

2

Child

3

Caution: If the child was a foreign child, seeSpecial rules in the instructions for line 1, column (e), before you complete Part II or

Part III. If you received employer-provided adoption benefits, complete Part III on the back next.

Part II Adoption Credit

Child 1 Child 2 Child 3

2 Maximum adoption credit per child. Enter $14,890

(see instructions) . . . . . . . . . . . . 2

3 Did you file Form 8839 for a prior year for the same

child? No. Enter -0-.

Yes. See instructions for the amount to

enter. } 3

4 Subtract line 3 from line 2 . . . . . . . . . 4

5 Qualified adoption expenses (see instructions) . . 5

Caution: Your qualified adoption expenses may not

be equal to the adoption expenses you paid in 2022.

6 Enter the smaller of line 4 or line 5 . . . . . . 6

7 Enter modified adjusted gross income (see instructions) . . . . . . . . . 7

8 Is line 7 more than $223,410?

No. Skip lines 8 and 9, and enter -0- on line 10.

Yes. Subtract $223,410 from line 7 . . . . . . . . . . . . . . 8

9 Divide line 8 by $40,000. Enter the result as a decimal (rounded to at least three places). Do not enter

more than 1.000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 × .

10 Multiply each amount on line 6 by line 9 . . . . . 10

11 Subtract line 10 from line 6 . . . . . . . . . 11

12 Add the amounts on line 11 . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Credit carryforward, if any, from prior years. See your Adoption Credit Carryforward Worksheet in the

2021 Form 8839 instructions . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Add lines 12 and 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Enter the amount from line 5 of the Credit Limit Worksheet in the instructions . . . . . . . . 15

16 Adoption Credit. Enter the smaller of line 14 or line 15 here and on Schedule 3 (Form 1040), line 6c. If

line 15 is smaller than line 14, you may have a credit carryforward (see instructions) . . . . . . 16

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 22843L Form 8839 (2022)