Enlarge image

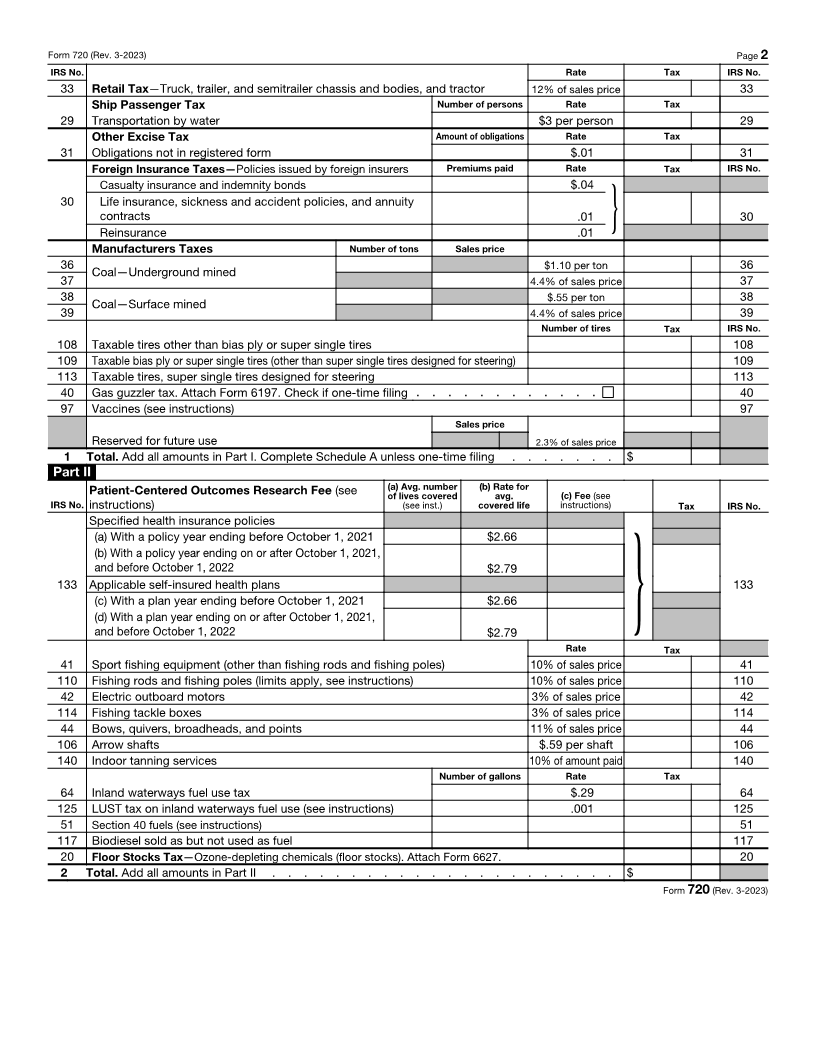

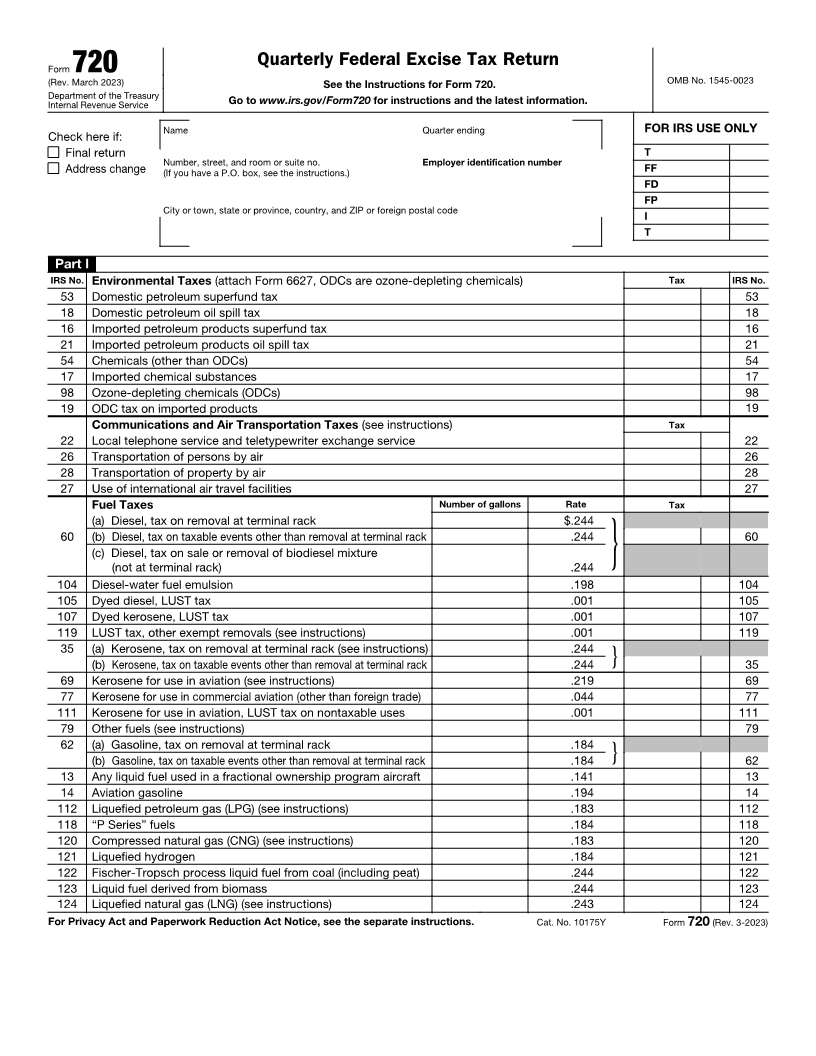

Quarterly Federal Excise Tax Return

Form 720 OMB No. 1545-0023

(Rev. March 2023) See the Instructions for Form 720.

Department of the Treasury Go to www.irs.gov/Form720 for instructions and the latest information.

Internal Revenue Service

Name Quarter ending FOR IRS USE ONLY

Check here if:

Final return T

Number, street, and room or suite no. Employer identification number

Address change (If you have a P.O. box, see the instructions.) FF

FD

FP

City or town, state or province, country, and ZIP or foreign postal code I

T

Part I

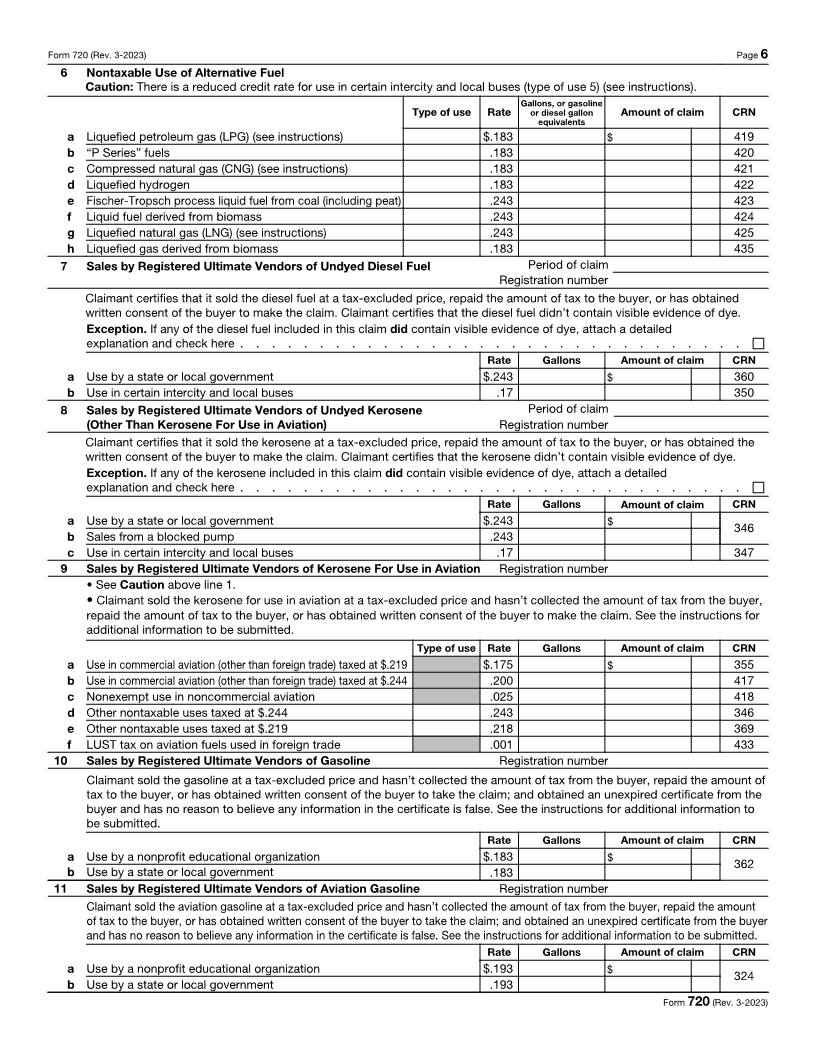

IRS No. Environmental Taxes (attach Form 6627, ODCs are ozone-depleting chemicals) Tax IRS No.

53 Domestic petroleum superfund tax 53

18 Domestic petroleum oil spill tax 18

16 Imported petroleum products superfund tax 16

21 Imported petroleum products oil spill tax 21

54 Chemicals (other than ODCs) 54

17 Imported chemical substances 17

98 Ozone-depleting chemicals (ODCs) 98

19 ODC tax on imported products 19

Communications and Air Transportation Taxes (see instructions) Tax

22 Local telephone service and teletypewriter exchange service 22

26 Transportation of persons by air 26

28 Transportation of property by air 28

27 Use of international air travel facilities 27

Fuel Taxes Number of gallons Rate Tax

(a) Diesel, tax on removal at terminal rack $.244

60 (b) Diesel, tax on taxable events other than removal at terminal rack .244 60

(c) Diesel, tax on sale or removal of biodiesel mixture

(not at terminal rack) .244 }

104 Diesel-water fuel emulsion .198 104

105 Dyed diesel, LUST tax .001 105

107 Dyed kerosene, LUST tax .001 107

119 LUST tax, other exempt removals (see instructions) .001 119

35 (a) Kerosene, tax on removal at terminal rack (see instructions) .244

(b) Kerosene, tax on taxable events other than removal at terminal rack .244 } 35

69 Kerosene for use in aviation (see instructions) .219 69

77 Kerosene for use in commercial aviation (other than foreign trade) .044 77

111 Kerosene for use in aviation, LUST tax on nontaxable uses .001 111

79 Other fuels (see instructions) 79

62 (a) Gasoline, tax on removal at terminal rack .184

(b) Gasoline, tax on taxable events other than removal at terminal rack .184 } 62

13 Any liquid fuel used in a fractional ownership program aircraft .141 13

14 Aviation gasoline .194 14

112 Liquefied petroleum gas (LPG) (see instructions) .183 112

118 “P Series” fuels .184 118

120 Compressed natural gas (CNG) (see instructions) .183 120

121 Liquefied hydrogen .184 121

122 Fischer-Tropsch process liquid fuel from coal (including peat) .244 122

123 Liquid fuel derived from biomass .244 123

124 Liquefied natural gas (LNG) (see instructions) .243 124

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 10175Y Form 720 (Rev. 3-2023)