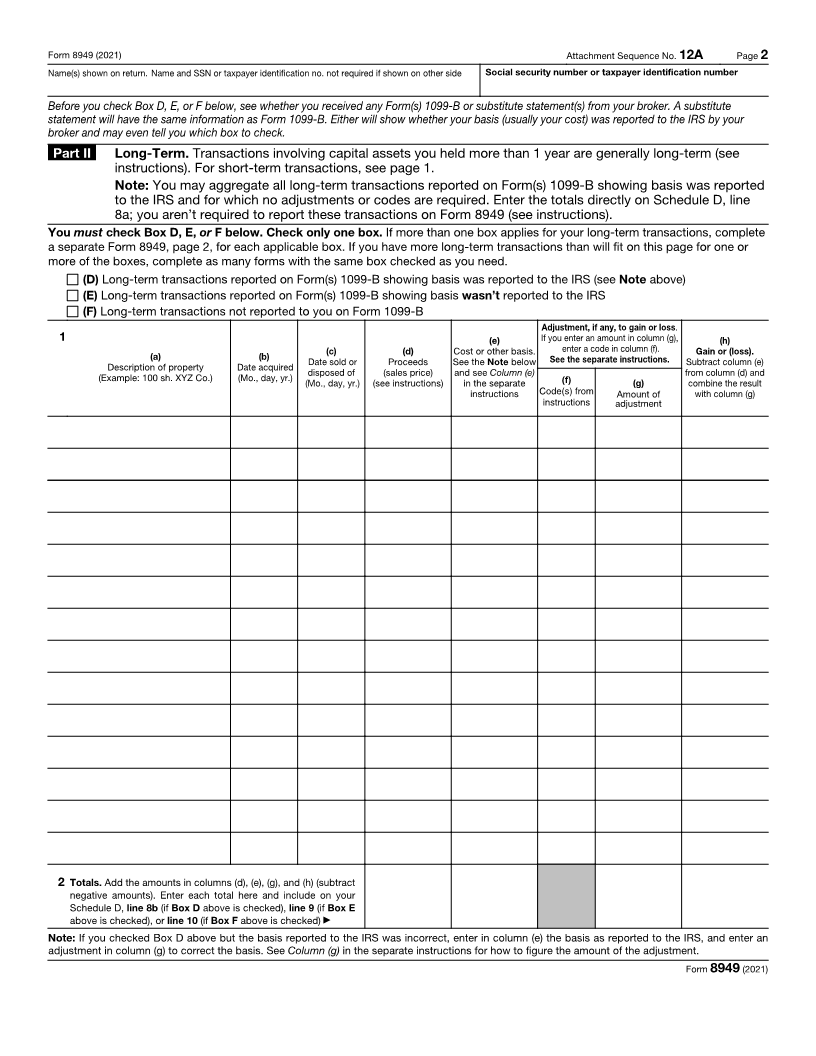

Enlarge image

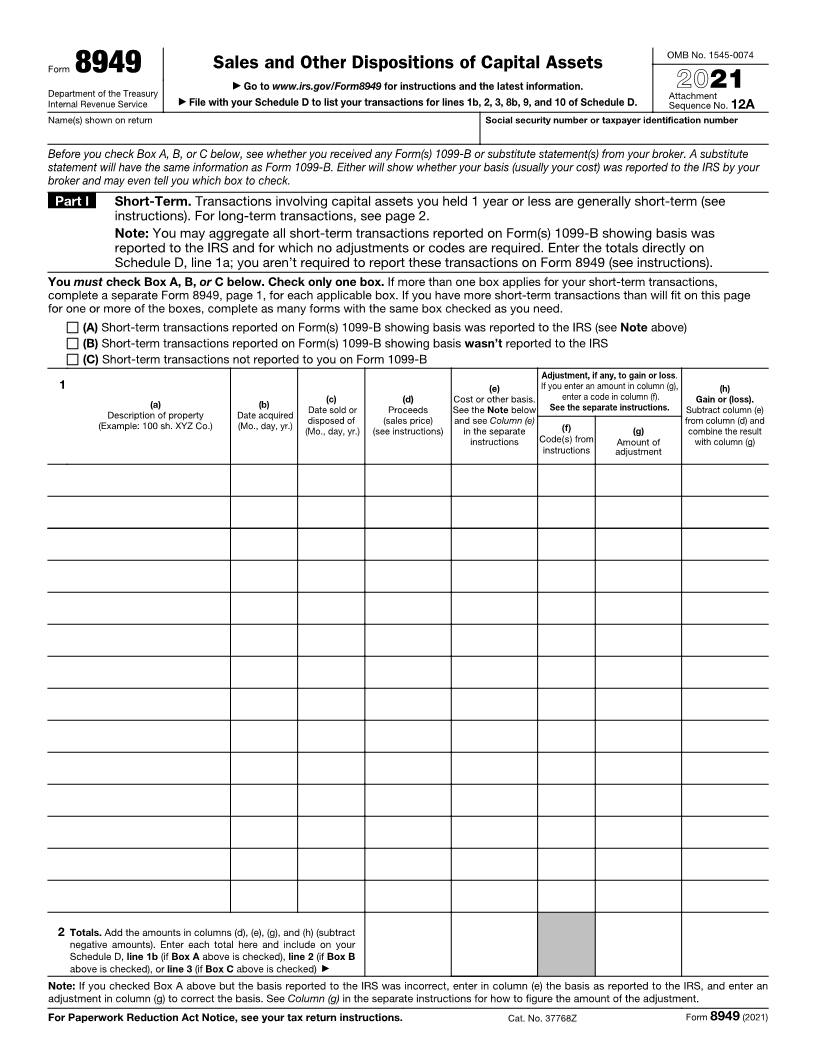

OMB No. 1545-0074

Sales and Other Dispositions of Capital Assets

Form 8949

▶

Department of the Treasury Go to www.irs.gov/Form8949 for instructions and the latest information. 2021

Attachment

Internal Revenue Service ▶ File with your Schedule D to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of Schedule D. Sequence No. 12A

Name(s) shown on return Social security number or taxpayer identification number

Before you check Box A, B, or C below, see whether you received any Form(s) 1099-B or substitute statement(s) from your broker. A substitute

statement will have the same information as Form 1099-B. Either will show whether your basis (usually your cost) was reported to the IRS by your

broker and may even tell you which box to check.

Part I Short-Term. Transactions involving capital assets you held 1 year or less are generally short-term (see

instructions). For long-term transactions, see page 2.

Note: You may aggregate all short-term transactions reported on Form(s) 1099-B showing basis was

reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on

Schedule D, line 1a; you aren’t required to report these transactions on Form 8949 (see instructions).

You must check Box A, B, or C below. Check only one box. If more than one box applies for your short-term transactions,

complete a separate Form 8949, page 1, for each applicable box. If you have more short-term transactions than will fit on this page

for one or more of the boxes, complete as many forms with the same box checked as you need.

(A) Short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above)

(B) Short-term transactions reported on Form(s) 1099-B showing basis wasn’t reported to the IRS

(C) Short-term transactions not reported to you on Form 1099-B

Adjustment, if any, to gain or loss .

1 (e) If you enter an amount in column (g), (h)

(a) (b) (c) (d) Cost or other basis. enter a code in column (f). Gain or (loss).

Description of property Date acquired Date sold or Proceeds See the Note below See the separate instructions. Subtract column (e)

(Example: 100 sh. XYZ Co.) (Mo., day, yr.) disposed of (sales price) and see Column (e) from column (d) and

(Mo., day, yr.) (see instructions) in the separate (f) (g) combine the result

instructions Code(s) from Amount of with column (g)

instructions adjustment

2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract

negative amounts). Enter each total here and include on your

Schedule D, line 1b (if Box A above is checked), line 2 (if Box B

above is checked), or line 3 (if Box C above is checked) ▶

Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an

adjustment in column (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment.

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 37768Z Form 8949 (2021)