Enlarge image

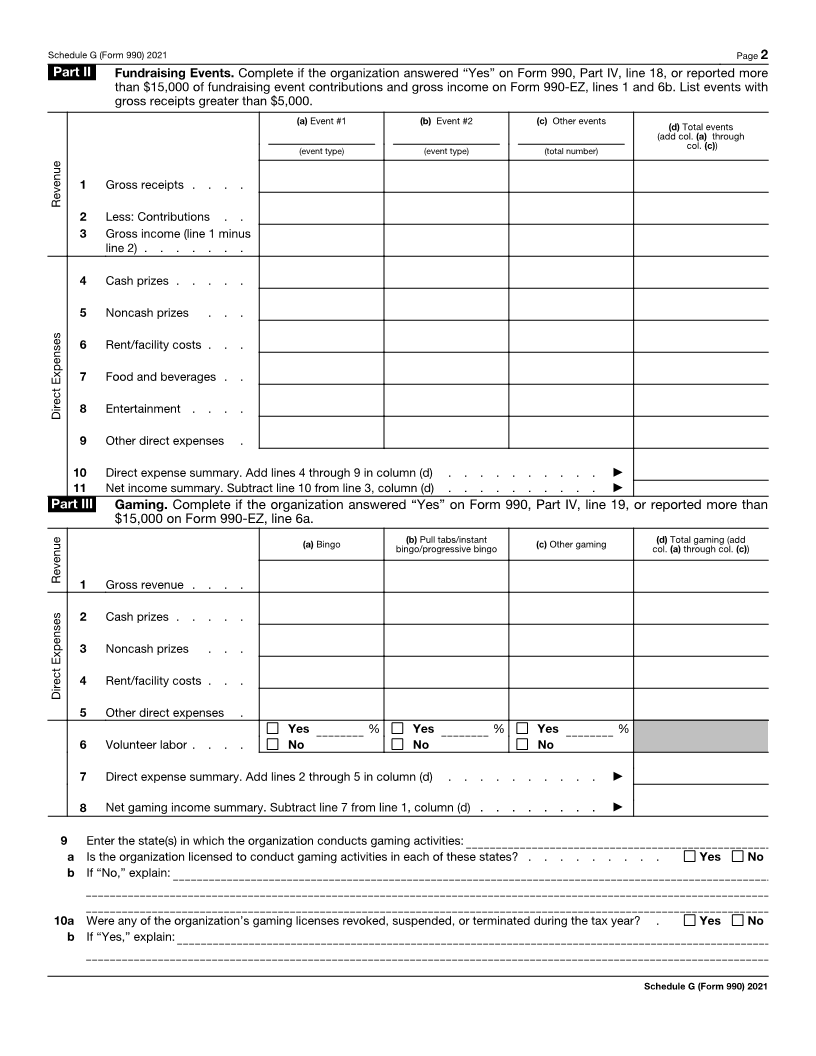

SCHEDULE G Supplemental Information Regarding Fundraising or Gaming Activities OMB No. 1545-0047

(Form 990) Complete if the organization answered “Yes ”on Form 990, Part IV, line 17, 18, or 19, or if the

organization entered more than $15,000 on Form 990-EZ, line 6a.

Department of the Treasury ▶ Attach to Form 990 or Form 990-EZ. 2021

Internal Revenue Service ▶ Go to www.irs.gov/Form990 for instructions and the latest information. Open to Public

Inspection

Name of the organization Employer identification number

Part I Fundraising Activities. Complete if the organization answered “Yes” on Form 990, Part IV, line 17.

Form 990-EZ filers are not required to complete this part.

1 Indicate whether the organization raised funds through any of the following activities. Check all that apply.

a Mail solicitations e Solicitation of non-government grants

b Internet and email solicitations f Solicitation of government grants

c Phone solicitations g Special fundraising events

d In-person solicitations

2 a Did the organization have a written or oral agreement with any individual (including officers, directors, trustees,

or key employees listed in Form 990, Part VII) or entity in connection with professional fundraising services? Yes No

b If “Yes,” list the 10 highest paid individuals or entities (fundraisers) pursuant to agreements under which the fundraiser is to be

compensated at least $5,000 by the organization.

(iii) Did fundraiser have (v) Amount paid to

(i) Name and address of individual (ii) Activity custody or control of (iv) Gross receipts (or retained by) (vi) Amount paid to

or entity (fundraiser) contributions? from activity fundraiser listed in (or retained by)

col. (i) organization

Yes No

1

2

3

4

5

6

7

8

9

10

Total . . . . . . . . . . . . . . . . . . . . . . ▶

3 List all states in which the organization is registered or licensed to solicit contributions or has been notified it is exempt from

registration or licensing.

For Paperwork Reduction Act Notice, see the Instructions for Form 990 or 990-EZ. Cat. No. 50083H Schedule G (Form 990) 2021