Enlarge image

Note: Form 2553 begins on the next page.

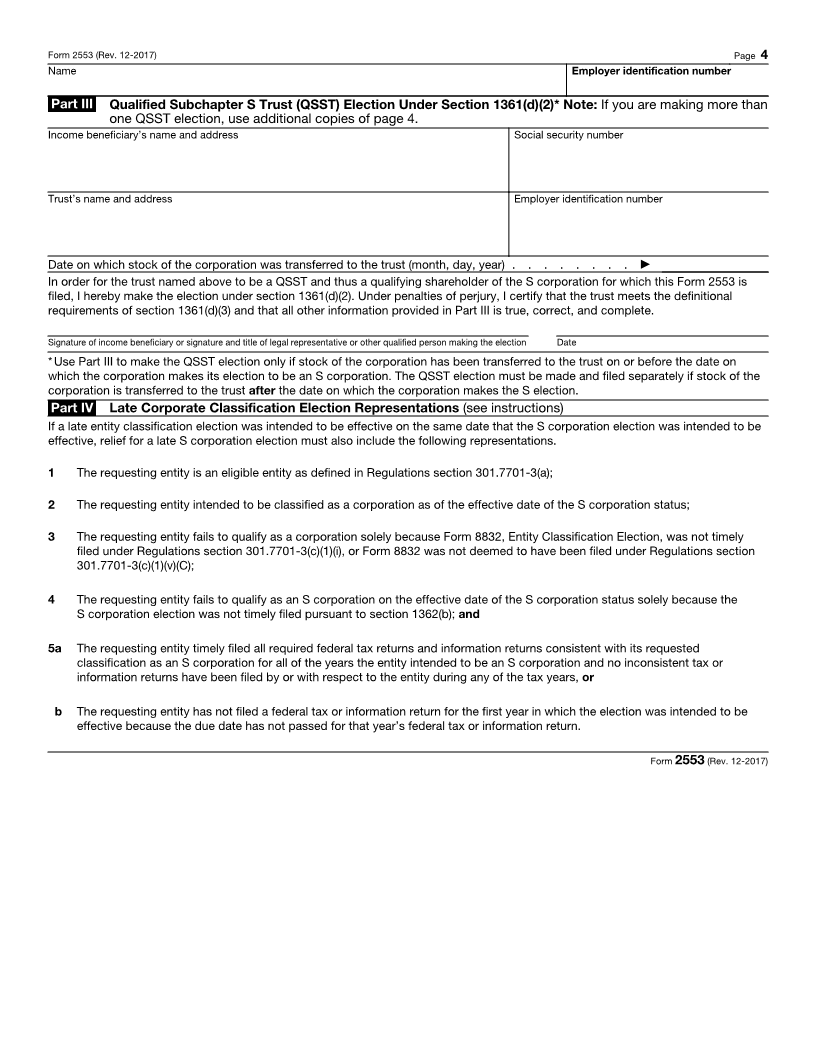

Where To File Form 2553 after 6/17/19

If the corporation’s principal business, office, Use the following address

or agency is located in or fax number

Connecticut, Delaware, District of Columbia, Department of the Treasury

Georgia, Illinois, Indiana, Kentucky, Maine, Internal Revenue Service

Maryland, Massachusetts, Michigan, New Kansas City, MO 64999

Hampshire, New Jersey, New York, North Carolina,

Ohio, Pennsylvania, Rhode Island, South Carolina,

Tennessee, Vermont, Virginia, West Virginia, Fax # 855-887-7734

Wisconsin

Alabama, Alaska, Arizona, Arkansas, California, Department of the Treasury

Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Internal Revenue Service

Louisiana, Minnesota, Mississippi, Missouri, Ogden, UT 84201

Montana, Nebraska, Nevada, New Mexico, North

Dakota, Oklahoma, Oregon, South Dakota, Texas,

Utah, Washington, Wyoming Fax # 855-214-7520