Enlarge image

Election by a Small Business Corporation

Form 2553 (Under section 1362 of the Internal Revenue Code)

(Rev. December 2017) (Including a late election filed pursuant to Rev. Proc. 2013-30) OMB No. 1545-0123

Department of the Treasury ▶ You can fax this form to the IRS. See separate instructions.

Internal Revenue Service ▶ Go to www.irs.gov/Form2553 for instructions and the latest information.

Note: This election to be an S corporation can be accepted only if all the tests are met under Who May Elect in the instructions, all

shareholders have signed the consent statement, an officer has signed below, and the exact name and address of the corporation

(entity) and other required form information have been provided.

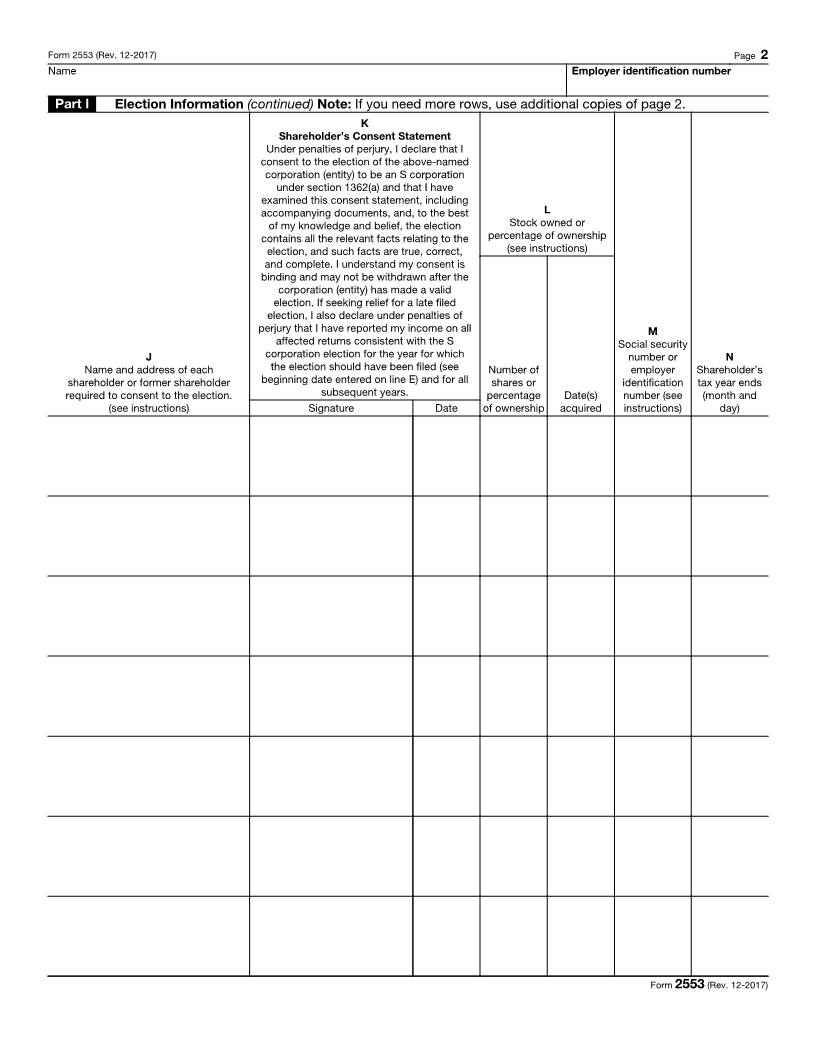

Part I Election Information

Name (see instructions) A Employer identification number

Type

Number, street, and room or suite no. If a P.O. box, see instructions. B Date incorporated

or

Print

City or town, state or province, country, and ZIP or foreign postal code C State of incorporation

D Check the applicable box(es) if the corporation (entity), after applying for the EIN shownA in above, changednameits or address

E Election is to be effective for tax year beginning (month, day, year) (see instructions) . . . . . . ▶

Caution: A corporation (entity) making the election for its first tax year in existence will usually enter the

beginning date of a short tax year that begins on a date other than January 1.

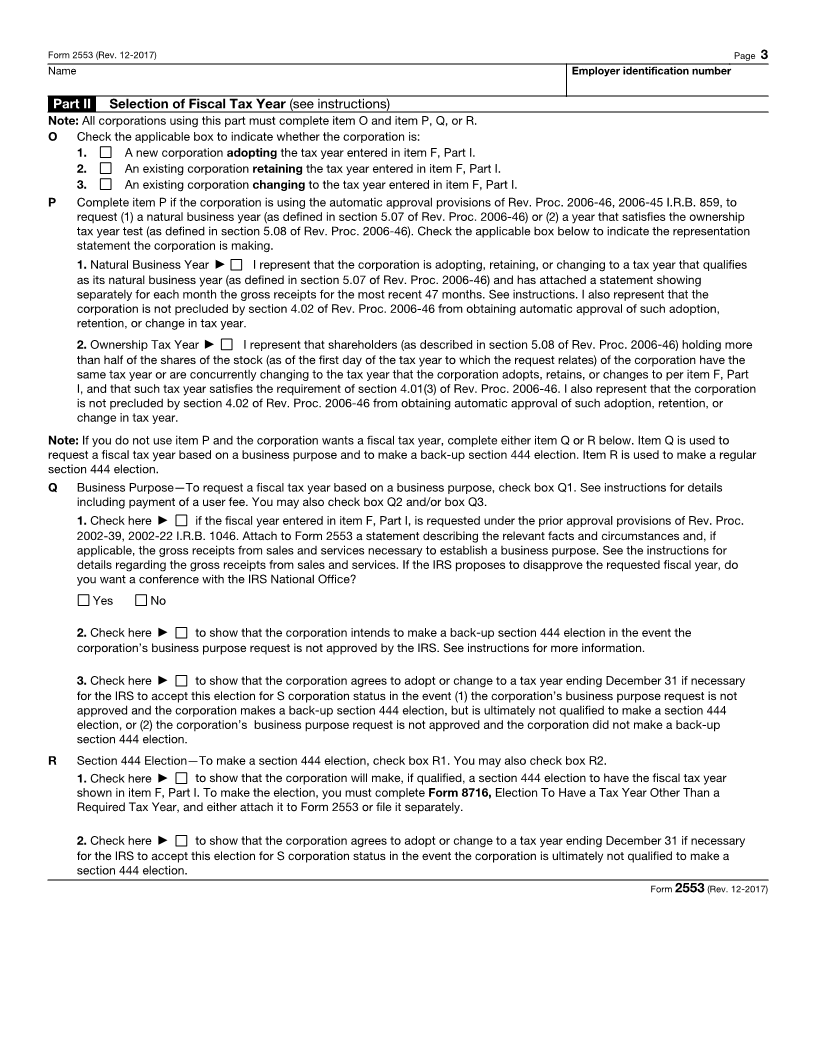

F Selected tax year:

(1) Calendar year

(2) Fiscal year ending (month and day) ▶

(3) 52-53-week year ending with reference to the month of December

(4) 52-53-week year ending with reference to the month of ▶

If box (2) or (4) is checked, complete Part II.

G If more than 100 shareholders are listed for item J (see page 2), check this box if treating members of a family as one

shareholder results in no more than 100 shareholders (see test 2 under Who May Elect in the instructions) ▶

H Name and title of officer or legal representative whom the IRS may call for more information Telephone number of officer or legal

representative

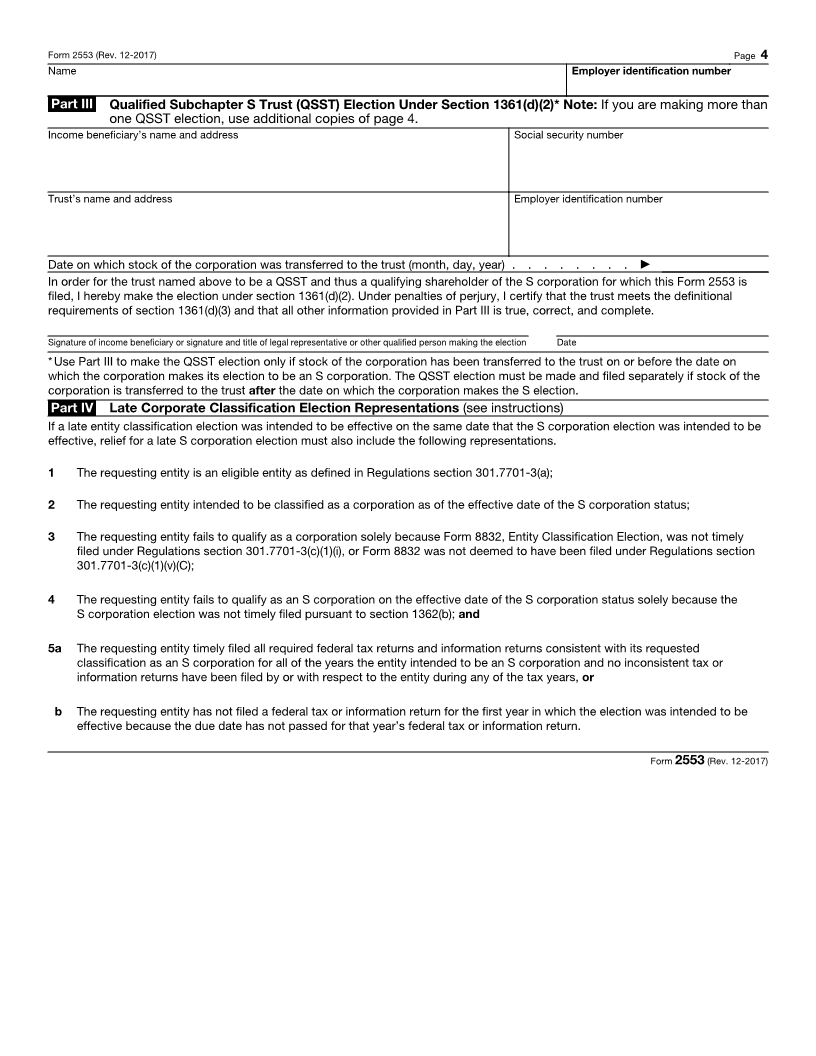

I If this S corporation election is being filed late, I declare I had reasonable cause for not filing Form 2553 timely. If this late

election is being made by an entity eligible to elect to be treated as a corporation, I declare I also had reasonable cause for not

filing an entity classification election timely and the representations listed in Part IV are true. See below for my explanation of the

reasons the election or elections were not made on time and a description of my diligent actions to correct the mistake upon its

discovery. See instructions.

Under penalties of perjury, I declare that I have examined this election, including accompanying documents, and, to the best of my

knowledge and belief, the election contains all the relevant facts relating to the election, and such facts are true, correct, and complete.

Sign

Here ▲

Signature of officer Title Date

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 18629R Form 2553 (Rev. 12-2017)