Enlarge image

OMB No. 1545-0895

General Business Credit

Form 3800

▶

Department of the Treasury Go to www.irs.gov/Form3800 for instructions and the latest information. 2021

Attachment

Internal Revenue Service (99) ▶ You must attach all pages of Form 3800, pages 1, 2, and 3, to your tax return. Sequence No. 22

Name(s) shown on return Identifying number

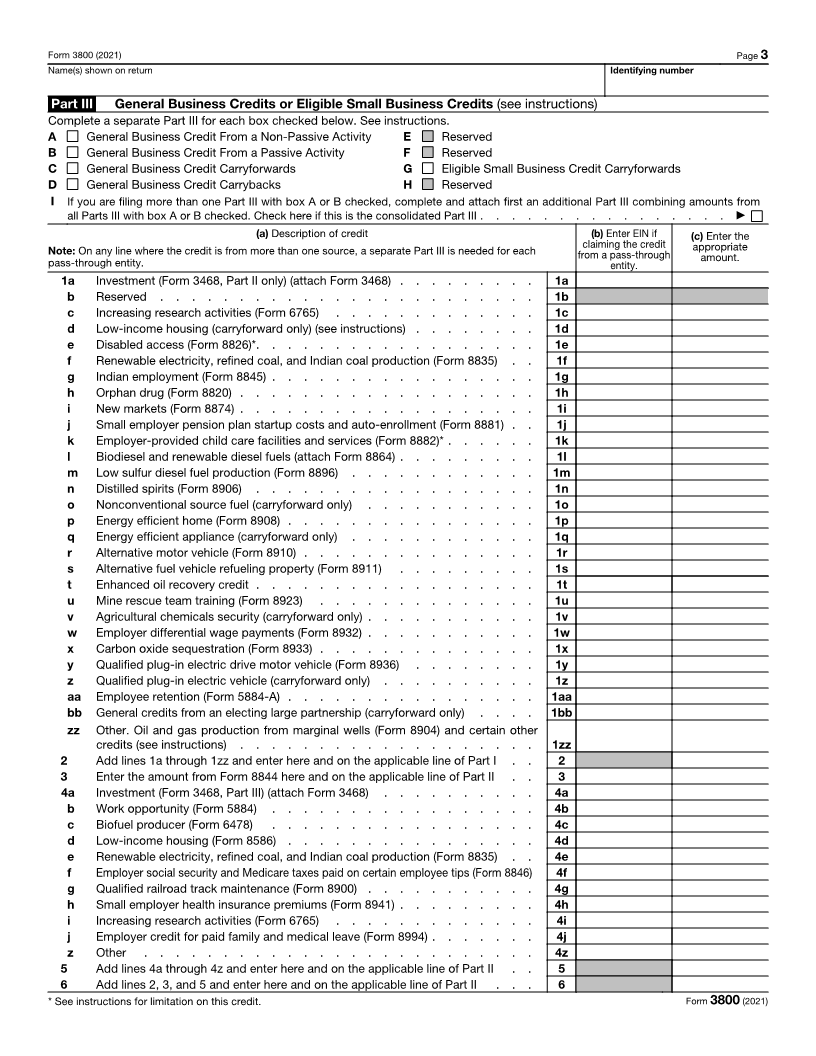

Part I Current Year Credit for Credits Not Allowed Against Tentative Minimum Tax (TMT)

(See instructions and complete Part(s) III before Parts I and II.)

1 General business credit from line 2 of all Parts III with box A checked . . . . . . . . . . . 1

2 Passive activity credits from line 2 of all Parts III with box B checked . . . 2

3 Enter the applicable passive activity credits allowed for 2021. See instructions . . . . . . . . 3

4 Carryforward of general business credit to 2021. Enter the amount from line 2 of Part III with box C

checked. See instructions for statement to attach . . . . . . . . . . . . . . . . . 4

Check this box if the carryforward was changed or revised from the original reported amount . . . . . . . . ▶

5 Carryback of general business credit from 2022. Enter the amount from line 2 of Part III with box D

checked. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Add lines 1, 3, 4, and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . 6

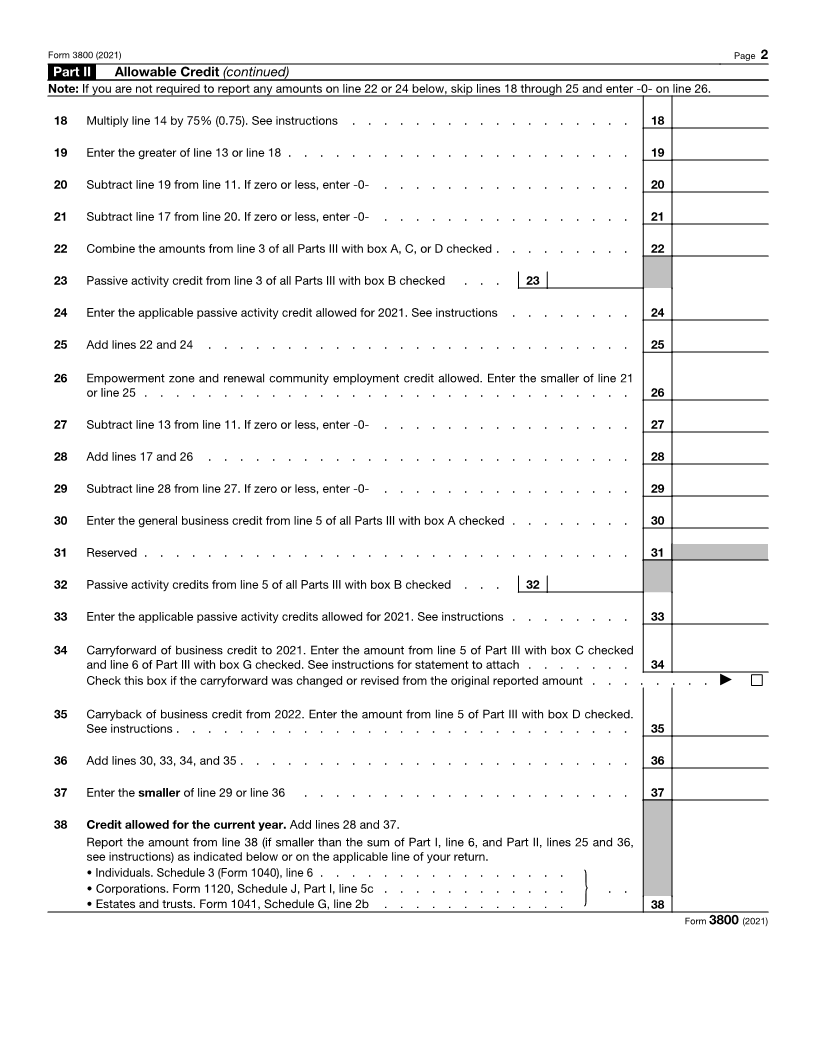

Part II Allowable Credit

7 Regular tax before credits:

• Individuals. Enter the sum of the amounts from Form 1040, 1040-SR, or 1040-NR, line

16, and Schedule 2 (Form 1040), line 2 . . . . . . . . . . . . . . .

• Corporations. Enter the amount from Form 1120, Schedule J, Part I, line 2; or the

applicable line of your return . . . . . . . . . . . . . . . . . . . . . 7

• Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G,

lines 1a and 1b, plus any Form 8978 amount included on line 1d; or the amount from

the applicable line of your return . . . . . . . . . . . . . . . . . }

8 Alternative minimum tax:

• Individuals. Enter the amount from Form 6251, line 11 . . . . . . . . . .

• Corporations. Enter -0- . . . . . . . . . . . . . . . . . . . . . . . 8

• Estates and trusts. Enter the amount from Schedule I (Form 1041), line 54 . . . . }

9 Add lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10a Foreign tax credit . . . . . . . . . . . . . . . . . . . . 10a

b Certain allowable credits (see instructions) . . . . . . . . . . . . 10b

c Add lines 10a and 10b . . . . . . . . . . . . . . . . . . . . . . . . . . 10c

11 Net income tax. Subtract line 10c from line 9. If zero, skip lines 12 through 15 and enter -0- on line 16 11

12 Net regular tax. Subtract line 10c from line 7. If zero or less, enter -0- . . . 12

13 Enter 25% (0.25) of the excess, if any, of line 12 over $25,000. See

instructions . . . . . . . . . . . . . . . . . . . . . . 13

14 Tentative minimum tax:

• Individuals. Enter the amount from Form 6251, line 9 . . . . . .

• Corporations. Enter -0- . . . . . . . . . . . . . . . . 14

• Estates and trusts. Enter the amount from Schedule I (Form 1041),

line 52 . . . . . . . . . . . . . . . . . . . . . }

15 Enter the greater of line 13 or line 14 . . . . . . . . . . . . . . . . . . . . . . 15

16 Subtract line 15 from line 11. If zero or less, enter -0- . . . . . . . . . . . . . . . . 16

17 Enter the smaller of line 6 or line 16 . . . . . . . . . . . . . . . . . . . . . . 17

C corporations: See the line 17 instructions if there has been an ownership change, acquisition, or

reorganization.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12392F Form 3800 (2021)