Enlarge image

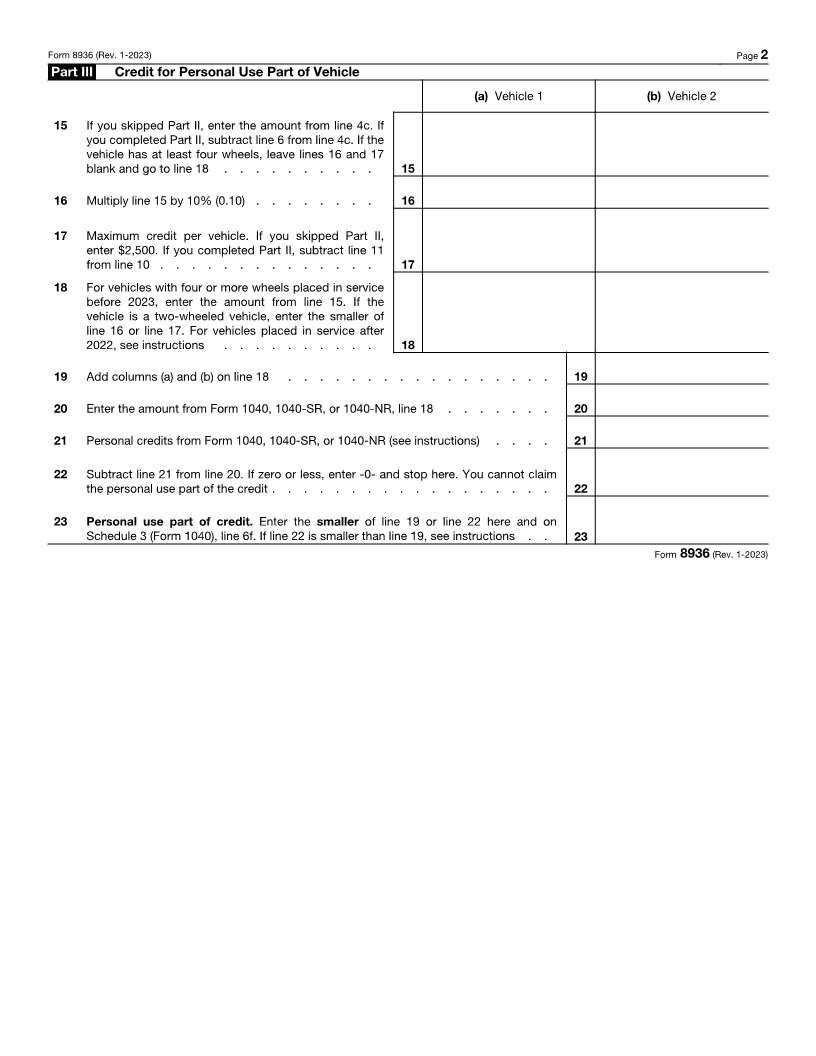

Qualified Plug-in Electric Drive Motor Vehicle Credit OMB No. 1545-2137

Form 8936 (Including Qualified Two-Wheeled Plug-in Electric Vehicles and New Clean Vehicles)

(Rev. January 2023)

Department of the Treasury Attach to your tax return. Attachment

Internal Revenue Service Go to www.irs.gov/Form8936 for instructions and the latest information. Sequence No. 69

Name(s) shown on return Identifying number

Note: This credit is for qualified plug-in electric drive motor vehicles placed in service before 2023, qualified two-wheeled plug-in

electric vehicles acquired before but placed in service in 2022, and new clean vehicles placed in service after 2022. See separate

instructions for vehicle definitions and other requirements.

Part I Tentative Credit

Use a separate column for each vehicle. If you need more columns, (a) Vehicle 1 (b) Vehicle 2

use additional Forms 8936 and include the totals on lines 12 and 19.

1 Year, make, and model of vehicle . . . . . . . 1

2 Vehicle identification number (see instructions) . . 2

3 Enter date vehicle was placed in service (MM/DD/YYYY) 3

4a If the vehicle is a two-wheeled vehicle, enter the cost of

the vehicle. If the vehicle has at least four wheels, see

instructions . . . . . . . . . . . . . . 4a

b Phase-out percentage (see instructions) . . . . . 4b % %

c Tentative credit. Multiply line 4a by line 4b . . . . 4c

Next: If you did NOT use your vehicle for business or investment purposes and did not have a credit from a partnership or S corporation,

skip Part II and go to Part III. All others, go to Part II.

Part II Credit for Business/Investment Use Part of Vehicle

5 Business/investment use percentage (see instructions) 5 % %

6 Multiply line 4c by line 5. If the vehicle has at least four

wheels, leave lines 7 through 10 blank and go to line 11 6

7 Section 179 expense deduction (see instructions) . 7

8 Subtract line 7 from line 6 . . . . . . . . . 8

9 Multiply line 8 by 10% (0.10) . . . . . . . . 9

10 Maximum credit per vehicle . . . . . . . . . 10 2,500 2,500

11 For vehicles with four or more wheels, enter the

amount from line 6. If the vehicle is a two-wheeled

vehicle, enter the smaller of line 9 or line 10 . . . 11

12 Add columns (a) and (b) on line 11 . . . . . . . . . . . . . . . . . 12

13 Qualified plug-in electric drive motor vehicle credit from partnerships and S corporations

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . 13

14 Business/investment use part of credit. Add lines 12 and 13. Partnerships and

S corporations, stop here and report this amount on Schedule K. All others, report this

amount on Form 3800, Part III, line 1y . . . . . . . . . . . . . . . . 14

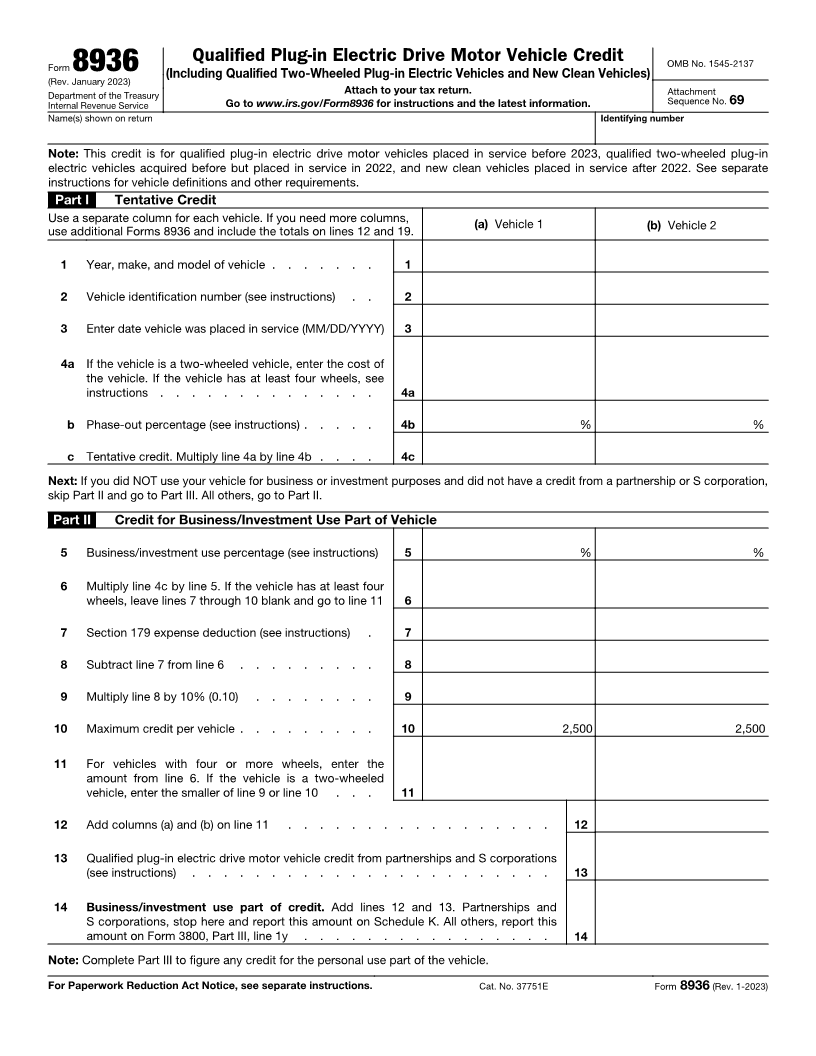

Note: Complete Part III to figure any credit for the personal use part of the vehicle.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 37751E Form 8936 (Rev. 1-2023)