Enlarge image

New Markets Credit OMB No. 1545-1804

Form 8874

(Rev. October 2020) ▶ Attach to your tax return. Attachment

Department of the Treasury ▶ Go to www.irs.gov/Form8874 for the latest information. Sequence No. 127

Internal Revenue Service

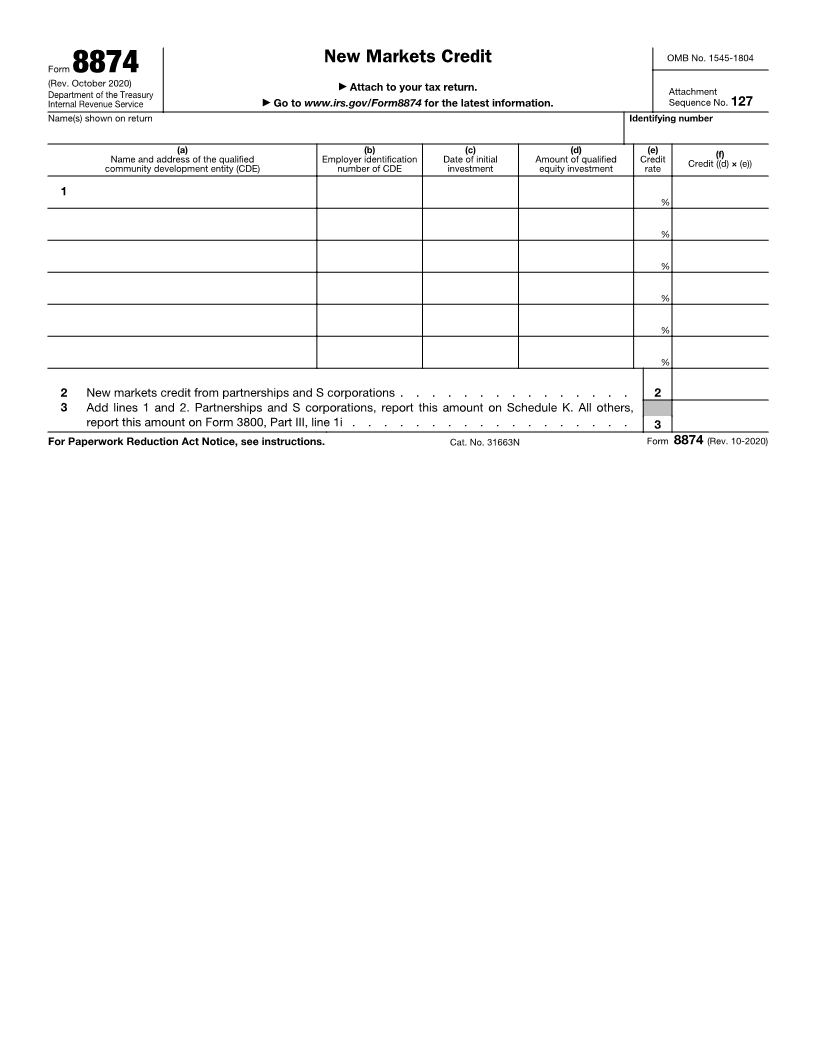

Name(s) shown on return Identifying number

(a) (b) (c) (d) (e) (f)

Name and address of the qualified Employer identification Date of initial Amount of qualified Credit Credit ((d) × (e))

community development entity (CDE) number of CDE investment equity investment rate

1

%

%

%

%

%

%

2 New markets credit from partnerships and S corporations . . . . . . . . . . . . . . . 2

3 Add lines 1 and 2. Partnerships and S corporations, report this amount on Schedule K. All others,

report this amount on Form 3800, Part III, line 1i . . . . . . . . . . . . . . . . . . 3

For Paperwork Reduction Act Notice, see instructions. Cat. No. 31663N Form 8874 (Rev. 10-2020)