- 5 -

Enlarge image

|

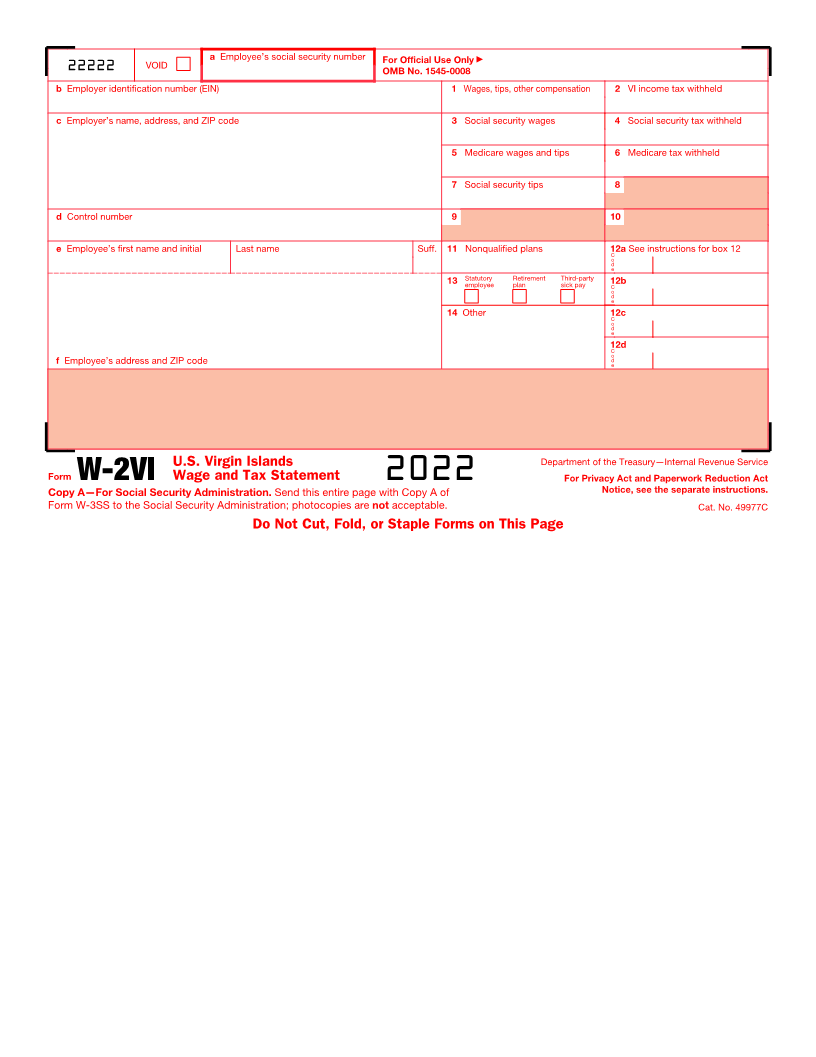

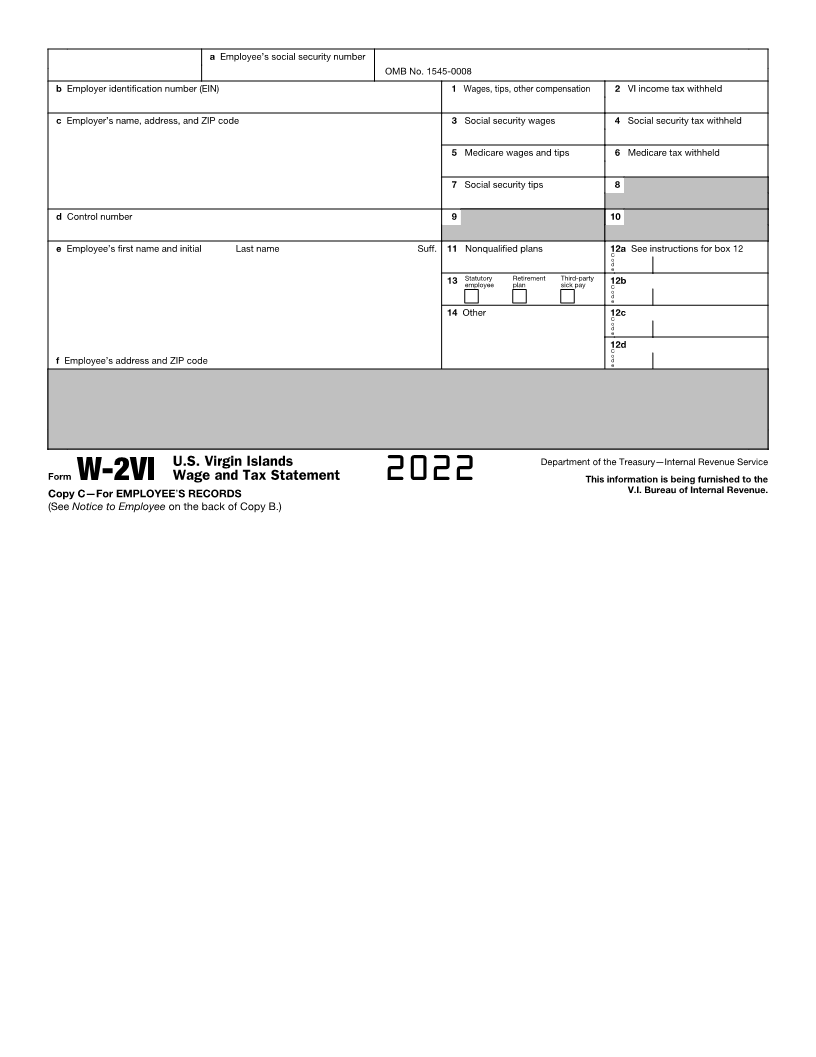

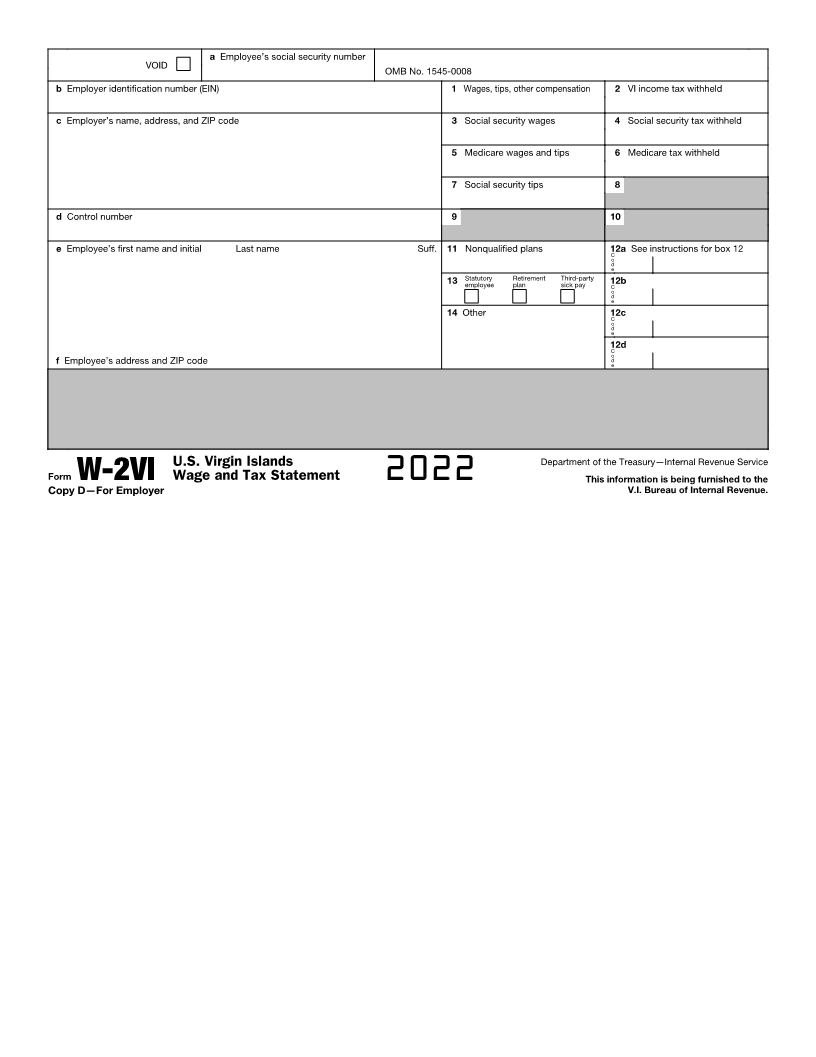

Notice to Employee Unreported tip income. You must file Form 4137, Social Security and Medicare

Tax on Unreported Tip Income, with your income tax return to figure the social

Do you have to file? Refer to the Form 1040 instructions to determine if you are security and Medicare tax owed on tips you didn’t report to your employer. Enter

required to file a tax return. Even if you don’t have to file a tax return, you may be this amount on the wages line of your tax return. (Form 1040-SS filers, see the

eligible for a refund if box 2 shows an amount or if you are eligible for any credit. instructions for Form 1040-SS, Part I, line 6.) By filing this form, your social

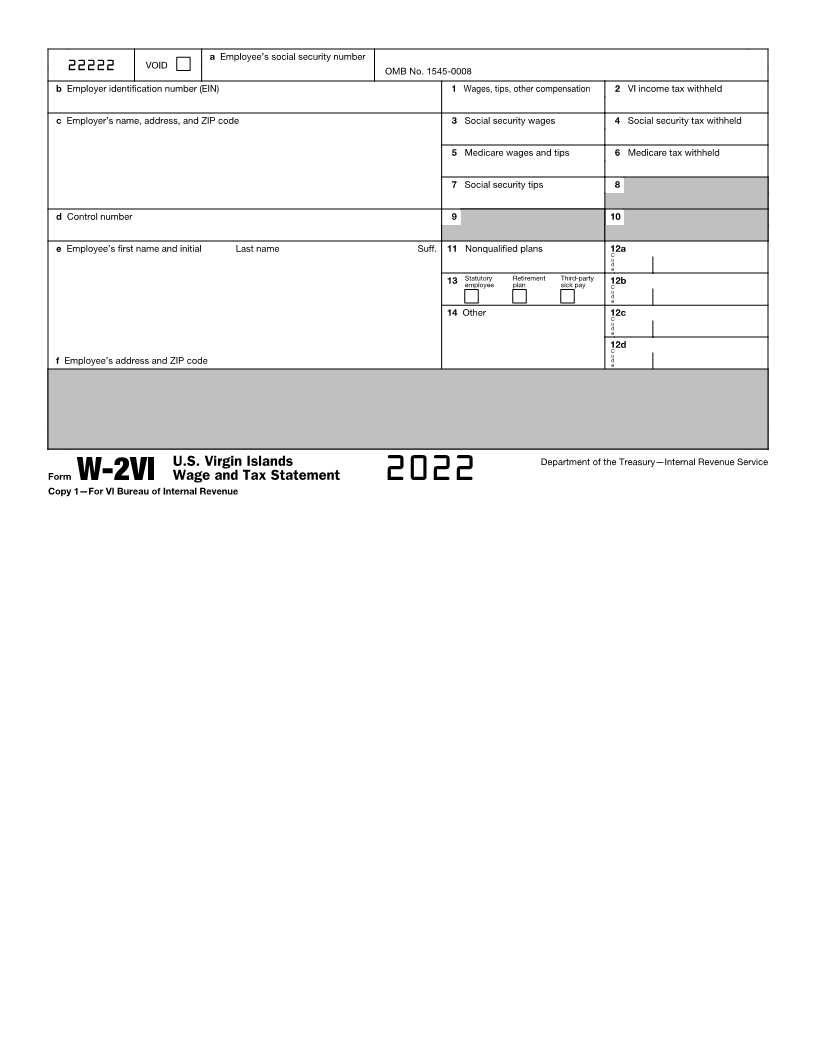

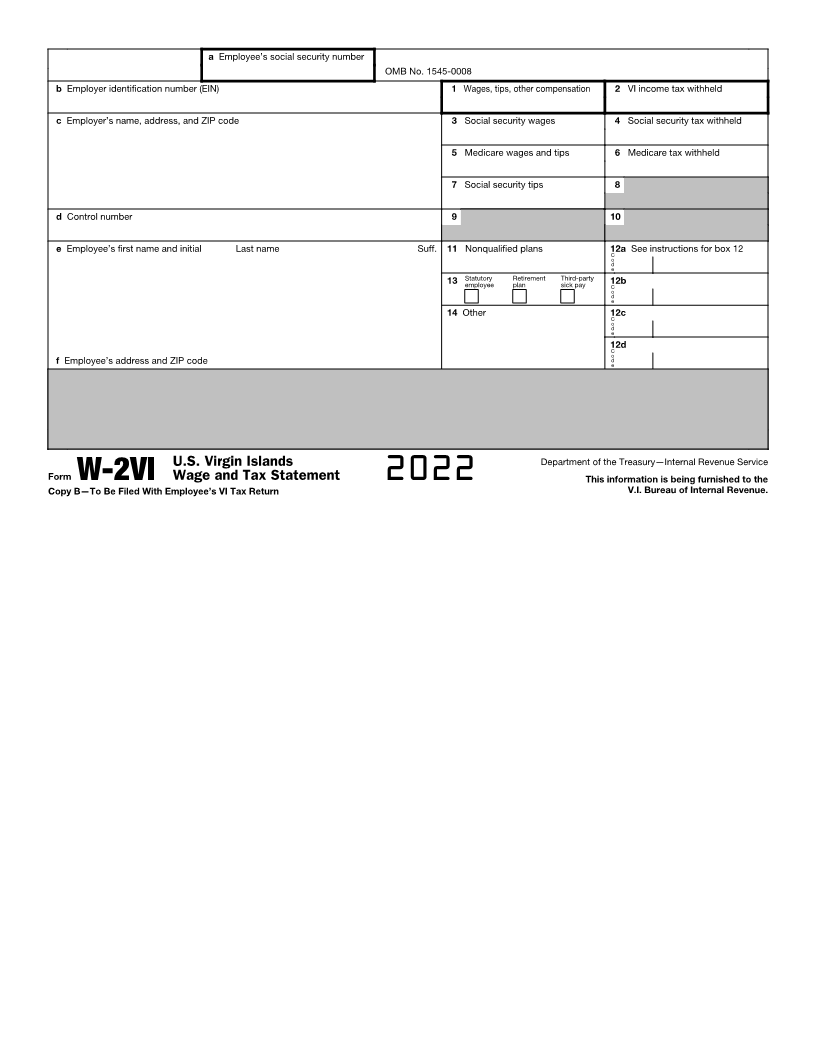

Copies B and C; corrections. File Copy B of this form with your 2022 U.S. Virgin security tips will be credited to your social security record (used to figure your

Islands income tax return. Keep Copy C for your records. If your name, social benefits).

security number (SSN), or address is incorrect, correct Copies B and C and ask (See also the Instructions for Employee on this page and the back of Copy C.)

your employer to correct your employment record. Be sure to ask your employer

to file Form W-2c, Corrected Wage and Tax Statement, with the Social Security

Administration (SSA) to correct any name, amount, or SSN error reported to the Instructions for Employee

SSA. Be sure to get your copies of Form W-2c from your employer for all

corrections made so you may file them with your tax return. (See also Notice to Employee on this page.)

Estimated tax. If you expect to owe $1,000 or more in tax for 2023, you may have Box 5. You may be required to report this amount on Form 8959, Additional

to make estimated tax payments to your local territory tax department. You may Medicare Tax. See the Form 1040 instructions to determine if you are required to

also have to make estimated tax payments to the U.S. Internal Revenue Service if complete Form 8959.

you are subject to self-employment taxes. See Pub. 570, Tax Guide for Individuals Box 6. This amount includes the 1.45% Medicare Tax withheld on all Medicare

With Income From U.S. Possessions, for additional information. wages and tips shown in box 5, as well as the 0.9% Additional Medicare Tax on

Employee’s social security number (SSN). For your protection, this form may any of those Medicare wages and tips above $200,000.

show only the last four digits of your SSN. However, your employer has reported Box 11. This amount is (a) reported in box 1 if it is a distribution made to you from

your complete SSN to the V.I. Bureau of Internal Revenue and the SSA. a nonqualified deferred compensation or nongovernmental section 457(b) plan, or

Clergy and religious workers. If you aren’t subject to social security and (b) included in box 3 and/or box 5 if it is a prior year deferral under a nonqualified

Medicare taxes, see Pub. 517, Social Security and Other Information for Members or section 457(b) plan that became taxable for social security and Medicare taxes

of the Clergy and Religious Workers. this year because there is no longer a substantial risk of forfeiture of your right to

the deferred amount. This box shouldn’t be used if you had a deferral and a

Cost of employer-sponsored health coverage (if such cost is provided by the distribution in the same calendar year. If you made a deferral and received a

employer). The reporting in box 12, using code DD, of the cost of employer- distribution in the same calendar year, and you are or will be age 62 by the end of

sponsored health coverage is for your information only. The amount reported the calendar year, your employer should file Form SSA-131, Employer Report of

with code DD is not taxable. Special Wage Payments, with the Social Security Administration and give you a

Credit for excess social security tax. If one employer paid you wages during copy.

2022 and more than $9,114 in social security tax was withheld, you can claim a Box 12. The following list explains the codes shown in box 12. You may need this

refund of the excess by filing Form 1040 or 1040-SR with the V.I. Bureau of information to complete your tax return. Elective deferrals (codes D, E, F, and S)

Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802. and designated Roth contributions (codes AA, BB, and EE) under all plans are

If you had more than one employer in 2022 and more than $9,114 in social generally limited to a total of $20,500 ($14,000 if you have only SIMPLE plans;

security tax was withheld, you can have the excess refunded by filing Form 843, $23,500 for section 403(b) plans if you qualify for the 15-year rule explained in

Claim for Refund and Request for Abatement, with the Department of the Pub. 571). Deferrals under code G are limited to $20,500. Deferrals under code H

Treasury, Internal Revenue Service Center, Austin, TX 73301-0215, USA. However, are limited to $7,000.

if you are required to file Form 1040 or 1040-SR with the United States, you must (continued on back of Copy C)

claim the excess tax as a credit on Form 1040 or 1040-SR.

|