Enlarge image

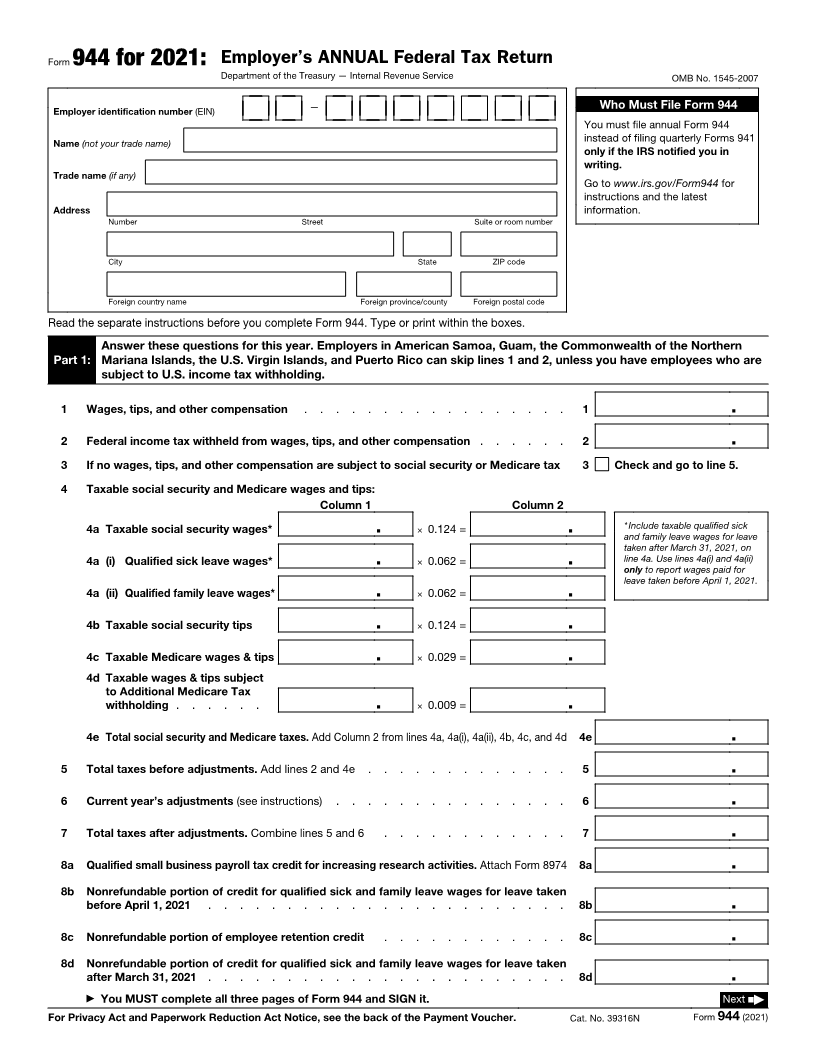

Form 944 for 2021: Employer’s ANNUAL Federal Tax Return

Department of the Treasury — Internal Revenue Service OMB No. 1545-2007

Employer identification number (EIN) — Who Must File Form 944

You must file annual Form 944

Name (not your trade name) instead of filing quarterly Forms 941

only if the IRS notified you in

writing.

Trade name (if any)

Go to www.irs.gov/Form944 for

instructions and the latest

Address information.

Number Street Suite or room number

City State ZIP code

Foreign country name Foreign province/county Foreign postal code

Read the separate instructions before you complete Form 944. Type or print within the boxes.

Answer these questions for this year. Employers in American Samoa, Guam, the Commonwealth of the Northern

Part 1: Mariana Islands, the U.S. Virgin Islands, and Puerto Rico can skip lines 1 and 2, unless you have employees who are

subject to U.S. income tax withholding.

1 Wages, tips, and other compensation . . . . . . . . . . . . . . . . . 1 .

2 Federal income tax withheld from wages, tips, and other compensation . . . . . . 2 .

3 If no wages, tips, and other compensation are subject to social security or Medicare tax 3 Check and go to line 5.

4 Taxable social security and Medicare wages and tips:

Column 1 Column 2

4a Taxable social security wages* . × 0.124 = . *Include taxable qualified sick

and family leave wages for leave

taken after March 31, 2021, on

4a (i) Qualified sick leave wages* . × 0.062 = . line 4a. Use lines 4a(i) and 4a(ii)

only to report wages paid for

leave taken before April 1, 2021.

4a (ii) Qualified family leave wages* . × 0.062 = .

4b Taxable social security tips . × 0.124 = .

4c Taxable Medicare wages & tips . × 0.029 = .

4d Taxable wages & tips subject

to Additional Medicare Tax

withholding . . . . . . . × 0.009 = .

4e Total social security and Medicare taxes. Add Column 2 from lines 4a, 4a(i), 4a(ii), 4b, 4c, and 4d 4e .

5 Total taxes before adjustments. Add lines 2 and 4e . . . . . . . . . . . . . 5 .

6 Current year’s adjustments (see instructions) . . . . . . . . . . . . . . . 6 .

7 Total taxes after adjustments. Combine lines 5 and 6 . . . . . . . . . . . . 7 .

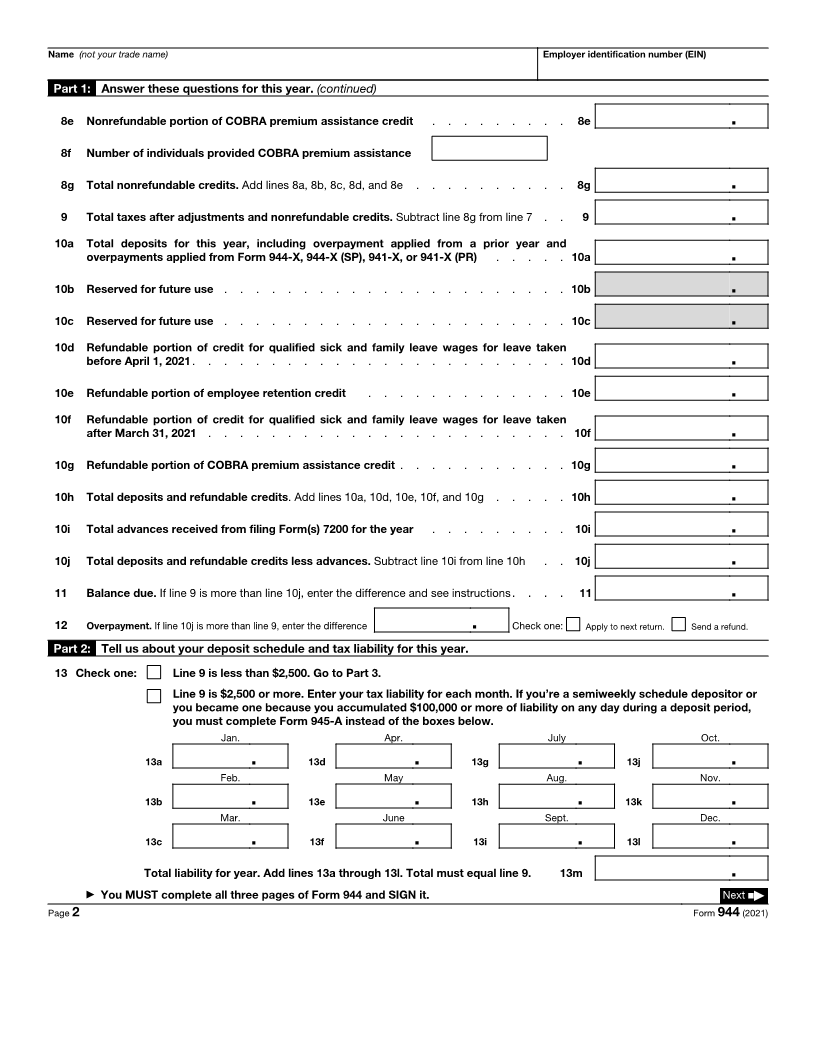

8a Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 8a .

8 b Nonrefundable portion of credit for qualified sick and family leave wages for leave taken

before April 1, 2021 . . . . . . . . . . . . . . . . . . . . . . . 8b .

8c Nonrefundable portion of employee retention credit . . . . . . . . . . . . 8c .

8 d Nonrefundable portion of credit for qualified sick and family leave wages for leave taken

after March 31, 2021 . . . . . . . . . . . . . . . . . . . . . . . 8d .

▶ You MUST complete all three pages of Form 944 and SIGN it. Next ■▶

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Cat. No. 39316N Form 944 (2021)