Enlarge image

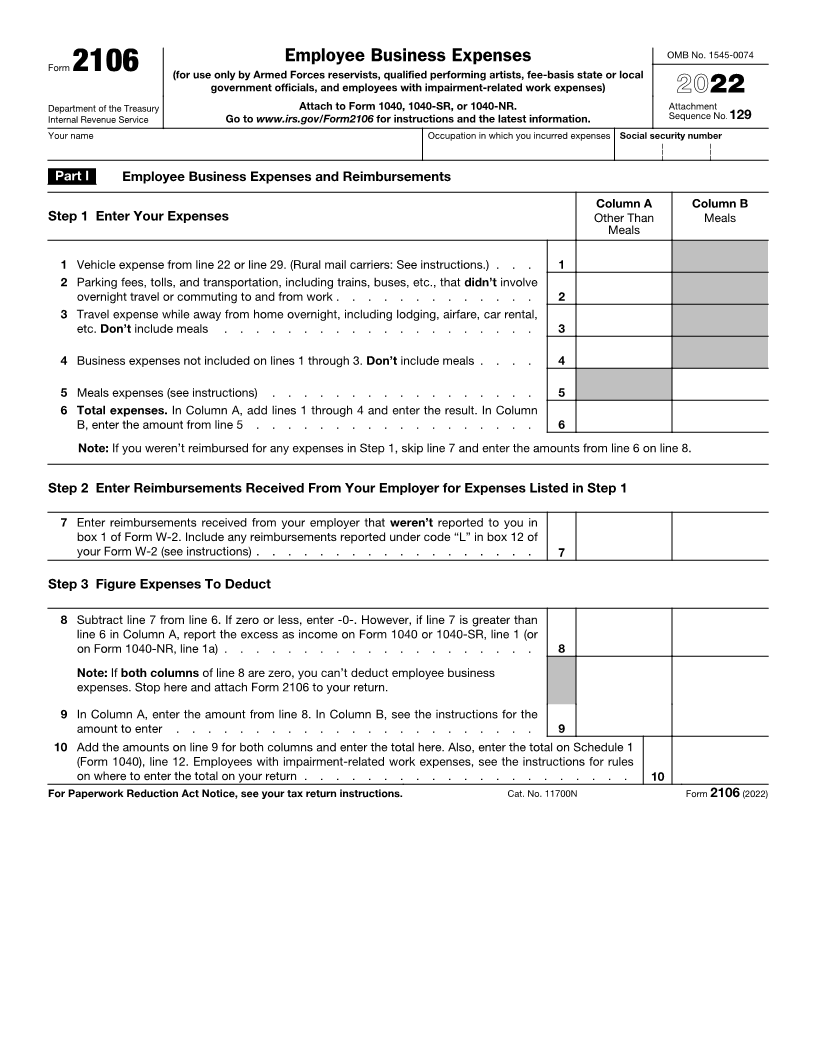

Employee Business Expenses OMB No. 1545-0074

Form 2106 (for use only by Armed Forces reservists, qualified performing artists, fee-basis state or local

government officials, and employees with impairment-related work expenses) 2022

Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Attachment

Internal Revenue Service Go to www.irs.gov/Form2106 for instructions and the latest information. Sequence No. 129

Your name Occupation in which you incurred expenses Social security number

Part I Employee Business Expenses and Reimbursements

Column A Column B

Step 1 Enter Your Expenses Other Than Meals

Meals

1 Vehicle expense from line 22 or line 29. (Rural mail carriers: See instructions.) . . . 1

2 Parking fees, tolls, and transportation, including trains, buses, etc., that didn’t involve

overnight travel or commuting to and from work . . . . . . . . . . . . . 2

3 Travel expense while away from home overnight, including lodging, airfare, car rental,

etc. Don’t include meals . . . . . . . . . . . . . . . . . . . . 3

4 Business expenses not included on lines 1 through 3. Don’t include meals . . . . 4

5 Meals expenses (see instructions) . . . . . . . . . . . . . . . . . 5

6 Total expenses. In Column A, add lines 1 through 4 and enter the result. In Column

B, enter the amount from line 5 . . . . . . . . . . . . . . . . . . 6

Note: If you weren’t reimbursed for any expenses in Step 1, skip line 7 and enter the amounts from line 6 on line 8.

Step 2 Enter Reimbursements Received From Your Employer for Expenses Listed in Step 1

7 Enter reimbursements received from your employer that weren’t reported to you in

box 1 of Form W-2. Include any reimbursements reported under code “L” in box 12 of

your Form W-2 (see instructions) . . . . . . . . . . . . . . . . . . 7

Step 3 Figure Expenses To Deduct

8 Subtract line 7 from line 6. If zero or less, enter -0-. However, if line 7 is greater than

line 6 in Column A, report the excess as income on Form 1040 or 1040-SR, line 1 (or

on Form 1040-NR, line 1a) . . . . . . . . . . . . . . . . . . . . 8

Note: Ifboth columns of line 8 are zero, you can’t deduct employee business

expenses. Stop here and attach Form 2106 to your return.

9 In Column A, enter the amount from line 8. In Column B, see the instructions for the

amount to enter . . . . . . . . . . . . . . . . . . . . . . . 9

10 Add the amounts on line 9 for both columns and enter the total here. Also, enter the total on Schedule 1

(Form 1040), line 12. Employees with impairment-related work expenses, see the instructions for rules

on where to enter the total on your return . . . . . . . . . . . . . . . . . . . . . 10

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11700N Form 2106 (2022)