Enlarge image

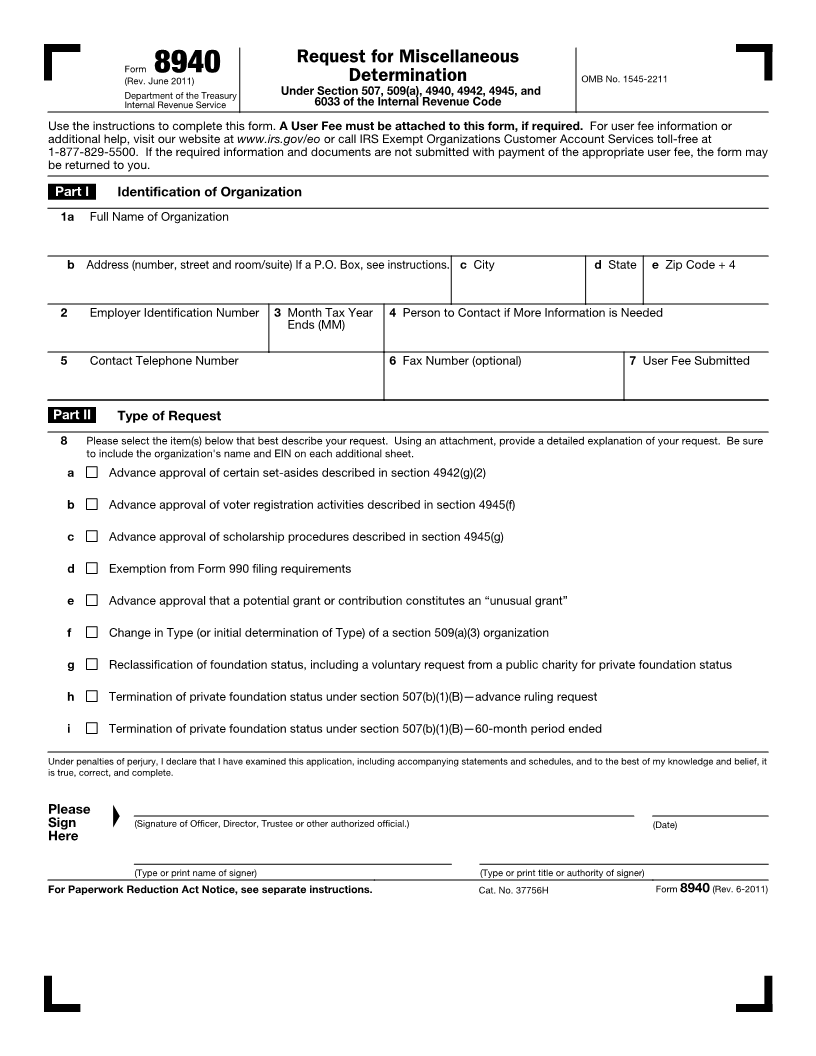

The form you are looking for begins on the next page of this file. Before viewing it, please see

the important update information below.

New Mailing Address

The mailing address for certain forms have changed since the forms were last published. The new mailing

address are shown below.

Mailing Address for Forms 1023, 1024, 1024-A, 1028, 5300, 5307, 5310, 5310-A, 5316, 8717, 8718, 8940:

Internal Revenue Service Center

TE/GE Stop 31A Team 105

P.O. Box 12192

Covington, KY 41042-0192

Deliveries by private delivery service (PDS) should be made to:

Internal Revenue Service Center

7940 Kentucky Drive

TE/GE Stop 31A Team 105

Florence, KY 41042

This update supplements the forms’ instructions. Filers should rely on this update for the change described,

which will be incorporated into the next revision of the form’s instructions.