Enlarge image

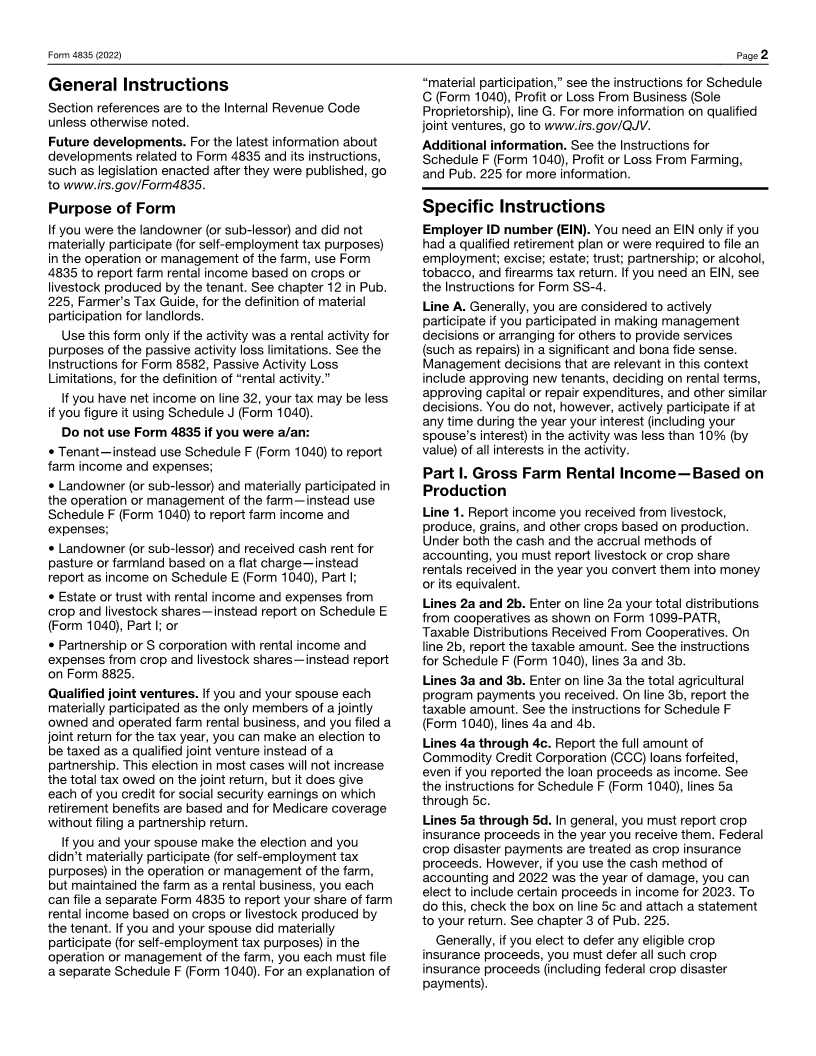

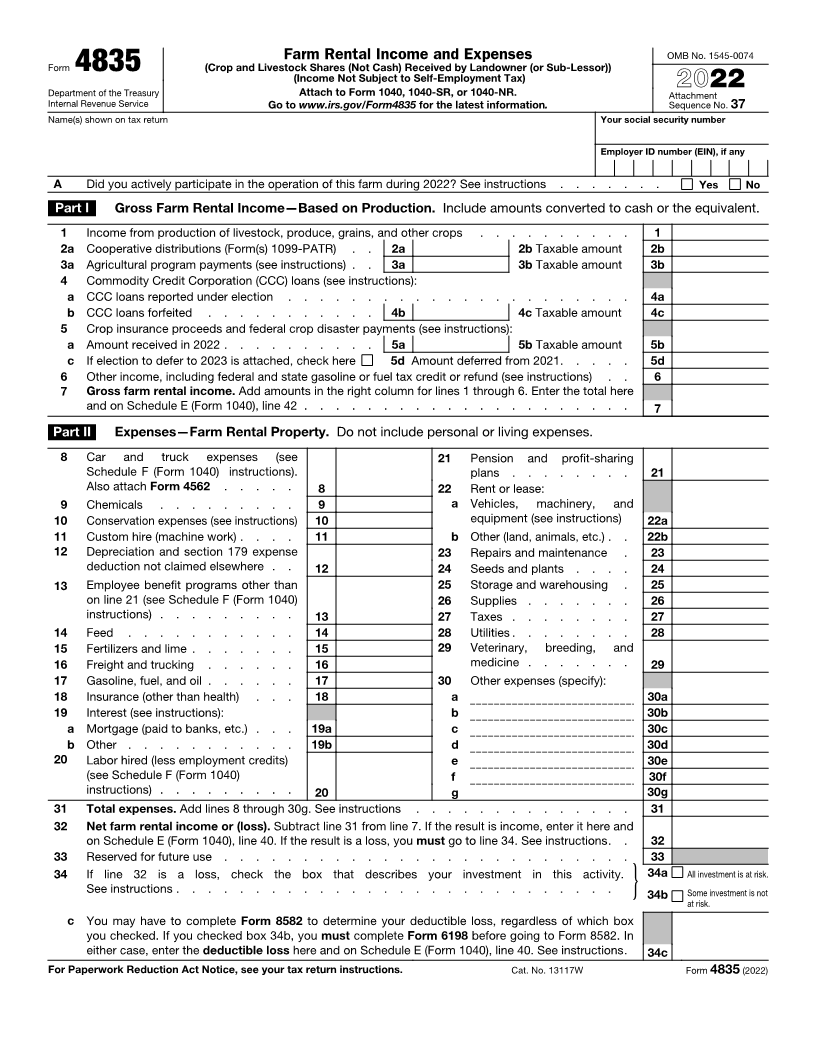

Farm Rental Income and Expenses OMB No. 1545-0074

Form 4835 (Crop and Livestock Shares (Not Cash) Received by Landowner (or Sub-Lessor))

(Income Not Subject to Self-Employment Tax)

Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. 2022

Attachment

Internal Revenue Service Go to www.irs.gov/Form4835 for the latest information. Sequence No. 37

Name(s) shown on tax return Your social security number

Employer ID number (EIN), if any

A Did you actively participate in the operation of this farm during 2022? See instructions . . . . . . . Yes No

Part I Gross Farm Rental Income—Based on Production. Include amounts converted to cash or the equivalent.

1 Income from production of livestock, produce, grains, and other crops . . . . . . . . . . 1

2 a Cooperative distributions (Form(s) 1099-PATR) . . 2a 2b Taxable amount 2b

3 a Agricultural program payments (see instructions) . . 3a 3b Taxable amount 3b

4 Commodity Credit Corporation (CCC) loans (see instructions):

a CCC loans reported under election . . . . . . . . . . . . . . . . . . . . . . 4a

b CCC loans forfeited . . . . . . . . . . . 4b 4c Taxable amount 4c

5 Crop insurance proceeds and federal crop disaster payments (see instructions):

a Amount received in 2022 . . . . . . . . . . 5a 5b Taxable amount 5b

c If election to defer to 2023 is attached, check here 5d Amount deferred from 2021. . . . . 5d

6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . 6

7 Gross farm rental income. Add amounts in the right column for lines 1 through 6. Enter the total here

and on Schedule E (Form 1040), line 42 . . . . . . . . . . . . . . . . . . . . . 7

Part II Expenses—Farm Rental Property. Do not include personal or living expenses.

8 Car and truck expenses (see 21 Pension and profit-sharing

Schedule F (Form 1040) instructions). plans . . . . . . . . 21

Also attach Form 4562 . . . . . 8 22 Rent or lease:

9 Chemicals . . . . . . . . . 9 a Vehicles, machinery, and

10 Conservation expenses (see instructions) 10 equipment (see instructions) 22a

11 Custom hire (machine work) . . . . 11 b Other (land, animals, etc.) . . 22b

12 Depreciation and section 179 expense 23 Repairs and maintenance . 23

deduction not claimed elsewhere . . 12 24 Seeds and plants . . . . 24

13 Employee benefit programs other than 25 Storage and warehousing . 25

on line 21 (see Schedule F (Form 1040) 26 Supplies . . . . . . . 26

instructions) . . . . . . . . . 13 27 Taxes . . . . . . . . 27

14 Feed . . . . . . . . . . . 14 28 Utilities . . . . . . . . 28

15 Fertilizers and lime . . . . . . . 15 29 Veterinary, breeding, and

16 Freight and trucking . . . . . . 16 medicine . . . . . . . 29

17 Gasoline, fuel, and oil . . . . . . 17 30 Other expenses (specify):

18 Insurance (other than health) . . . 18 a 30a

19 Interest (see instructions): b 30b

a Mortgage (paid to banks, etc.) . . . 19a c 30c

b Other . . . . . . . . . . . 19b d 30d

20 Labor hired (less employment credits) e 30e

(see Schedule F (Form 1040) f 30f

instructions) . . . . . . . . . 20 g 30g

31 Total expenses. Add lines 8 through 30g. See instructions . . . . . . . . . . . . . . 31

32 Net farm rental income or (loss). Subtract line 31 from line 7. If the result is income, enter it here and

on Schedule E (Form 1040), line 40. If the result is a loss, you must go to line 34. See instructions. . 32

33 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . 33

34 If line 32 is a loss, check the box that describes your investment in this activity. 34a All investment is at risk.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . } 34b Some investment is not

at risk.

c You may have to complete Form 8582 to determine your deductible loss, regardless of which box

you checked. If you checked box 34b, you must complete Form 6198 before going to Form 8582. In

either case, enter the deductible loss here and on Schedule E (Form 1040), line 40. See instructions. 34c

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13117W Form 4835 (2022)