Enlarge image

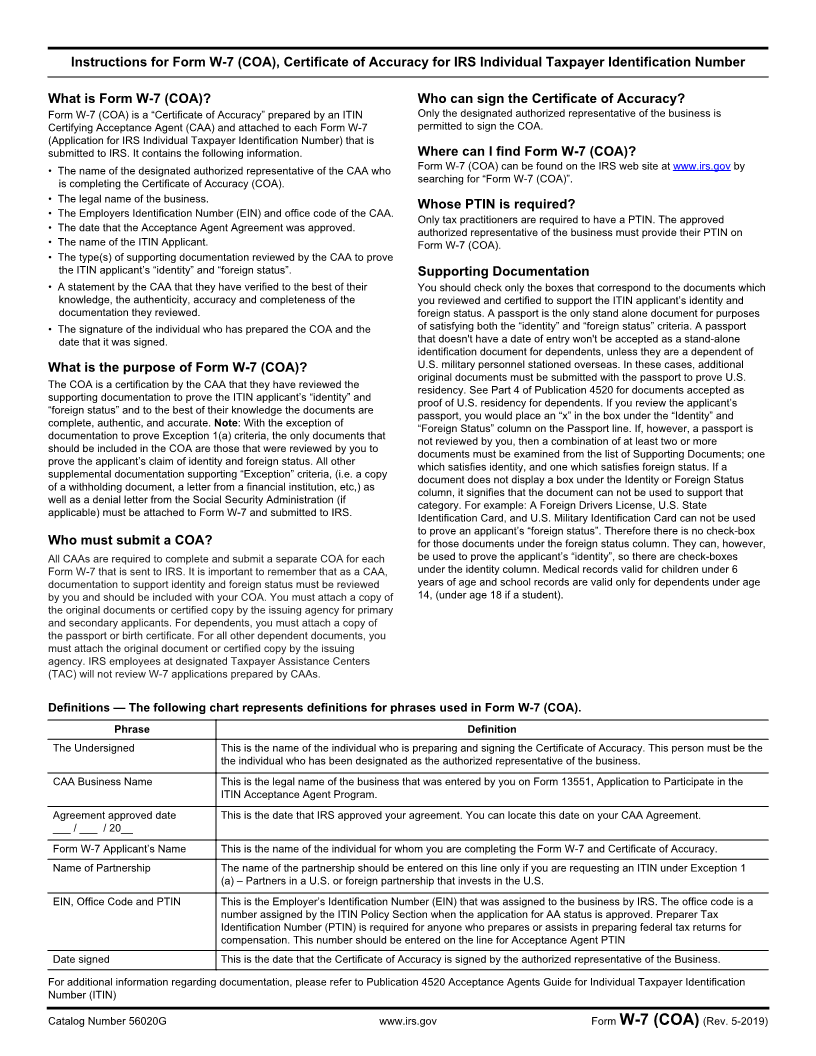

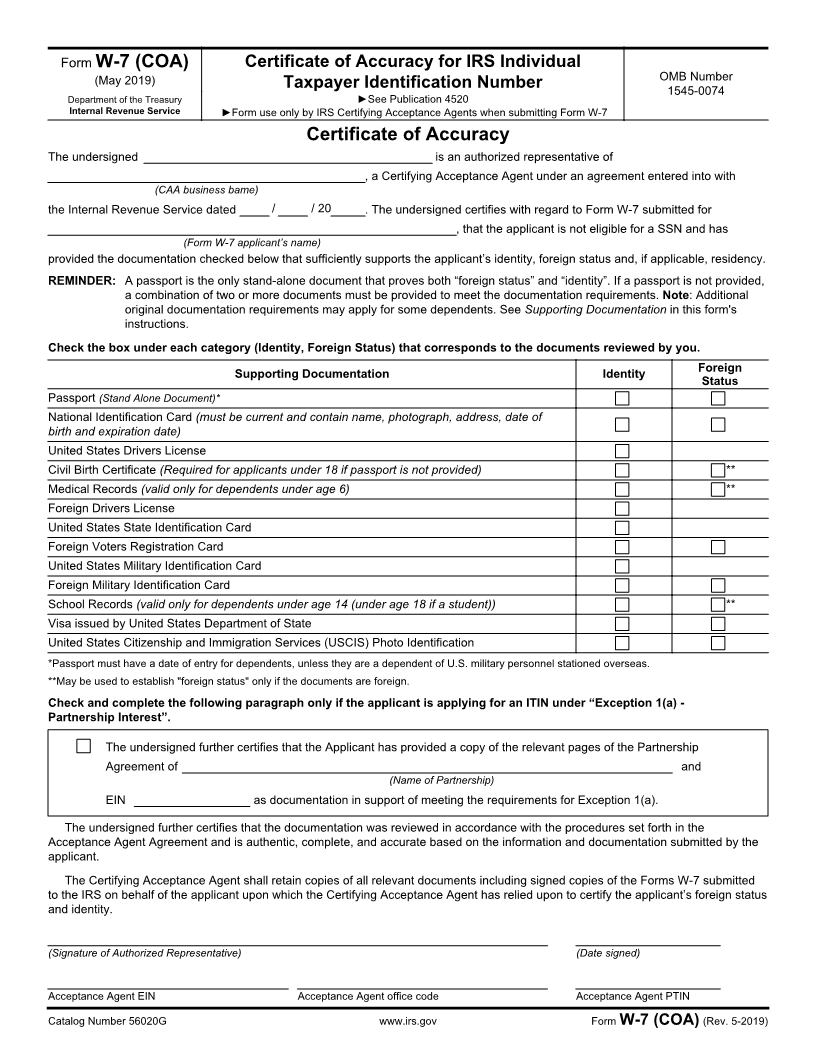

Form W-7 (COA) Certificate of Accuracy for IRS Individual

OMB Number

(May 2019) Taxpayer Identification Number 1545-0074

Department of the Treasury ►See Publication 4520

Internal Revenue Service ►Form use only by IRS Certifying Acceptance Agents when submitting Form W-7

Certificate of Accuracy

The undersigned is an authorized representative of

, a Certifying Acceptance Agent under an agreement entered into with

(CAA business bame)

the Internal Revenue Service dated / / 20 . The undersigned certifies with regard to Form W-7 submitted for

, that the applicant is not eligible for a SSN and has

(Form W-7 applicant’s name)

provided the documentation checked below that sufficiently supports the applicant’s identity, foreign status and, if applicable, residency.

REMINDER: A passport is the only stand-alone document that proves both “foreign status” and “identity”. If a passport is not provided,

a combination of two or more documents must be provided to meet the documentation requirements. Note: Additional

original documentation requirements may apply for some dependents. See Supporting Documentation in this form's

instructions.

Check the box under each category (Identity, Foreign Status) that corresponds to the documents reviewed by you.

Supporting Documentation Identity Foreign

Status

Passport (Stand Alone Document)*

National Identification Card (must be current and contain name, photograph, address, date of

birth and expiration date)

United States Drivers License

Civil Birth Certificate (Required for applicants under 18 if passport is not provided) **

Medical Records (valid only for dependents under age 6) **

Foreign Drivers License

United States State Identification Card

Foreign Voters Registration Card

United States Military Identification Card

Foreign Military Identification Card

School Records (valid only for dependents under age 14 (under age 18 if a student)) **

Visa issued by United States Department of State

United States Citizenship and Immigration Services (USCIS) Photo Identification

*Passport must have a date of entry for dependents, unless they are a dependent of U.S. military personnel stationed overseas.

**May be used to establish "foreign status" only if the documents are foreign.

Check and complete the following paragraph only if the applicant is applying for an ITIN under “Exception 1(a) -

Partnership Interest”.

The undersigned further certifies that the Applicant has provided a copy of the relevant pages of the Partnership

Agreement of and

(Name of Partnership)

EIN as documentation in support of meeting the requirements for Exception 1(a).

The undersigned further certifies that the documentation was reviewed in accordance with the procedures set forth in the

Acceptance Agent Agreement and is authentic, complete, and accurate based on the information and documentation submitted by the

applicant.

The Certifying Acceptance Agent shall retain copies of all relevant documents including signed copies of the Forms W-7 submitted

to the IRS on behalf of the applicant upon which the Certifying Acceptance Agent has relied upon to certify the applicant’s foreign status

and identity.

(Signature of Authorized Representative) (Date signed)

Acceptance Agent EIN Acceptance Agent office code Acceptance Agent PTIN

Catalog Number 56020G www.irs.gov Form W-7 (COA) (Rev. 5-2019)