Enlarge image

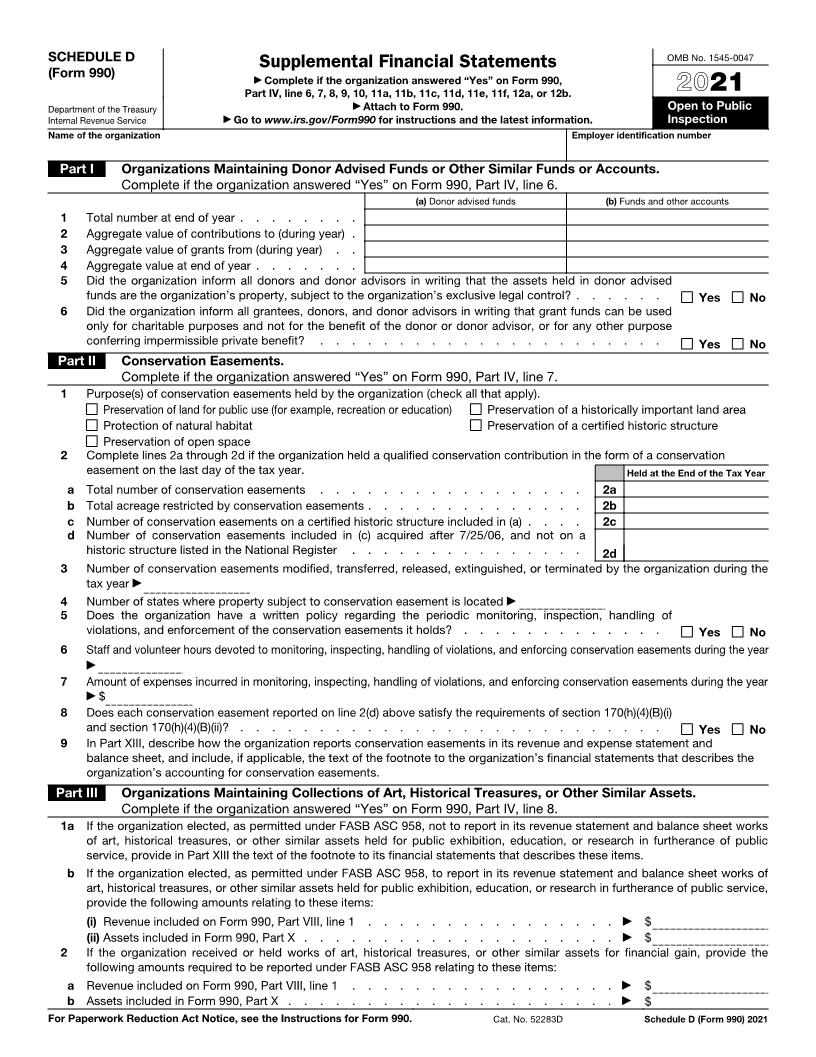

SCHEDULE D OMB No. 1545-0047

Supplemental Financial Statements

(Form 990) ▶ Complete if the organization answered “Yes” on Form 990,

Part IV, line 6, 7, 8, 9, 10, 11a, 11b, 11c, 11d, 11e, 11f, 12a, or 12b. 2021

Department of the Treasury ▶ Attach to Form 990. Open to Public

Internal Revenue Service ▶ Go to www.irs.gov/Form990 for instructions and the latest information. Inspection

Name of the organization Employer identification number

Part I Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts.

Complete if the organization answered “Yes” on Form 990, Part IV, line 6.

(a) Donor advised funds (b) Funds and other accounts

1 Total number at end of year . . . . . . . .

2 Aggregate value of contributions to (during year) .

3 Aggregate value of grants from (during year) . .

4 Aggregate value at end of year . . . . . . .

5 Did the organization inform all donors and donor advisors in writing that the assets held in donor advised

funds are the organization’s property, subject to the organization’s exclusive legal control? . . . . . . Yes No

6 Did the organization inform all grantees, donors, and donor advisors in writing that grant funds can be used

only for charitable purposes and not for the benefit of the donor or donor advisor, or for any other purpose

conferring impermissible private benefit? . . . . . . . . . . . . . . . . . . . . . . Yes No

Part II Conservation Easements.

Complete if the organization answered “Yes” on Form 990, Part IV, line 7.

1 Purpose(s) of conservation easements held by the organization (check all that apply).

Preservation of land for public use (for example, recreation or education) Preservation of a historically important land area

Protection of natural habitat Preservation of a certified historic structure

Preservation of open space

2 Complete lines 2a through 2d if the organization held a qualified conservation contribution in the form of a conservation

easement on the last day of the tax year. Held at the End of the Tax Year

a Total number of conservation easements . . . . . . . . . . . . . . . . . 2a

b Total acreage restricted by conservation easements . . . . . . . . . . . . . . 2b

c Number of conservation easements on a certified historic structure included in (a) . . . . 2c

d Number of conservation easements included in (c) acquired after 7/25/06, and not on a

historic structure listed in the National Register . . . . . . . . . . . . . . . 2d

3 Number of conservation easements modified, transferred, released, extinguished, or terminated by the organization during the

tax year ▶

4 Number of states where property subject to conservation easement is located ▶

5 Does the organization have a written policy regarding the periodic monitoring, inspection, handling of

violations, and enforcement of the conservation easements it holds? . . . . . . . . . . . . . Yes No

6 Staff and volunteer hours devoted to monitoring, inspecting, handling of violations, and enforcing conservation easements during the year

▶

7 Amount of expenses incurred in monitoring, inspecting, handling of violations, and enforcing conservation easements during the year

▶ $

8 Does each conservation easement reported on line 2(d) above satisfy the requirements of section 170(h)(4)(B)(i)

and section 170(h)(4)(B)(ii)? . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

9 In Part XIII, describe how the organization reports conservation easements in its revenue and expense statement and

balance sheet, and include, if applicable, the text of the footnote to the organization’s financial statements that describes the

organization’s accounting for conservation easements.

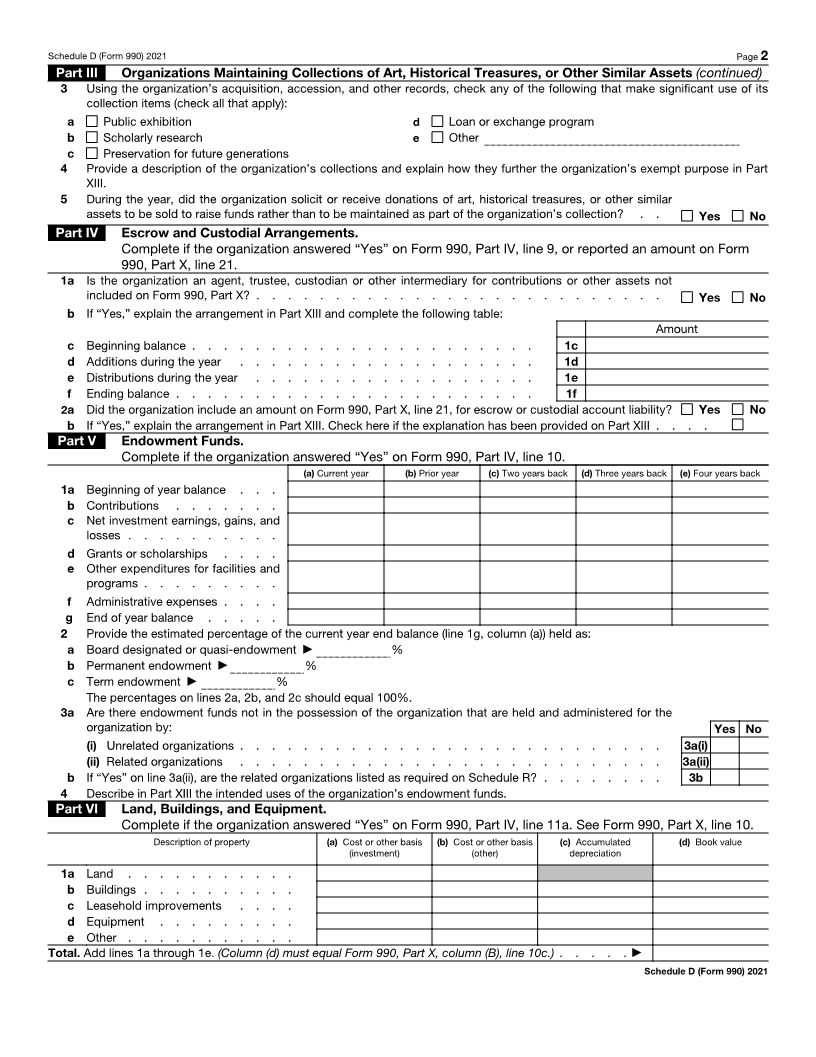

Part III Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets.

Complete if the organization answered “Yes” on Form 990, Part IV, line 8.

1 a If the organization elected, as permitted under FASB ASC 958, not to report in its revenue statement and balance sheet works

of art, historical treasures, or other similar assets held for public exhibition, education, or research in furtherance of public

service, provide in Part XIII the text of the footnote to its financial statements that describes these items.

b If the organization elected, as permitted under FASB ASC 958, to report in its revenue statement and balance sheet works of

art, historical treasures, or other similar assets held for public exhibition, education, or research in furtherance of public service,

provide the following amounts relating to these items:

(i) Revenue included on Form 990, Part VIII, line 1 . . . . . . . . . . . . . . . . ▶ $

(ii) Assets included in Form 990, Part X . . . . . . . . . . . . . . . . . . . . ▶ $

2 If the organization received or held works of art, historical treasures, or other similar assets for financial gain, provide the

following amounts required to be reported under FASB ASC 958 relating to these items:

a Revenue included on Form 990, Part VIII, line 1 . . . . . . . . . . . . . . . . . ▶ $

b Assets included in Form 990, Part X . . . . . . . . . . . . . . . . . . . . . ▶ $

For Paperwork Reduction Act Notice, see the Instructions for Form 990. Cat. No. 52283D Schedule D (Form 990) 2021