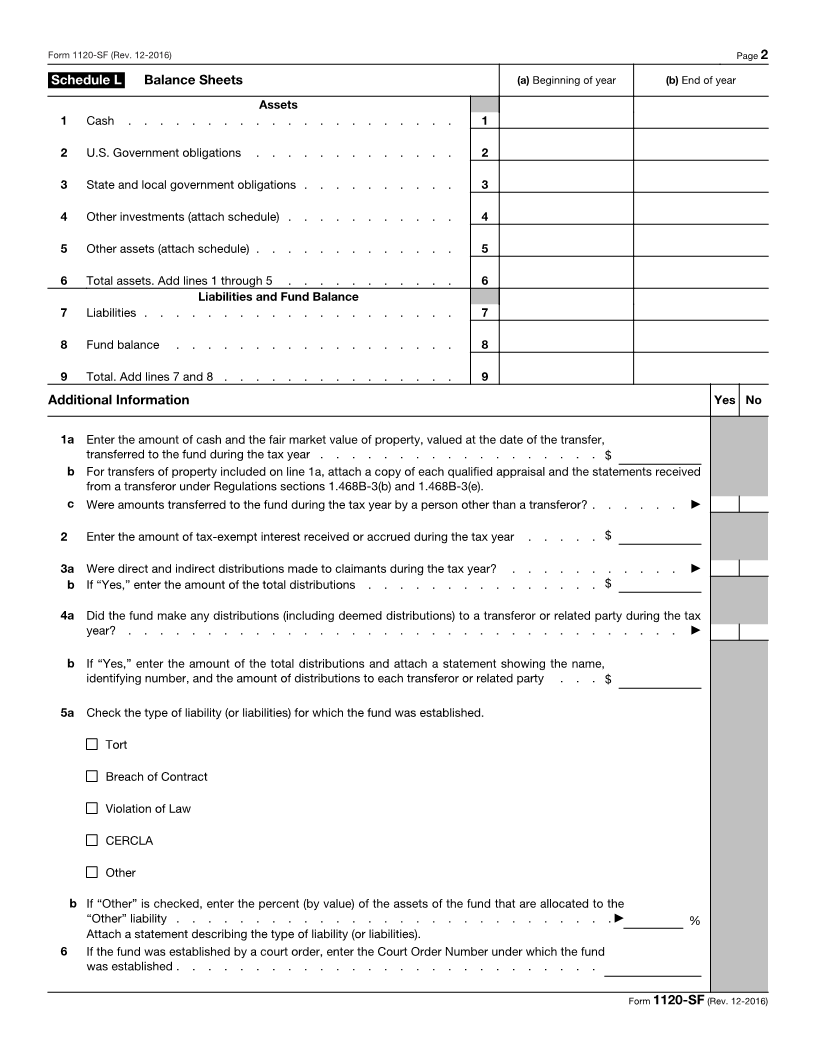

Enlarge image

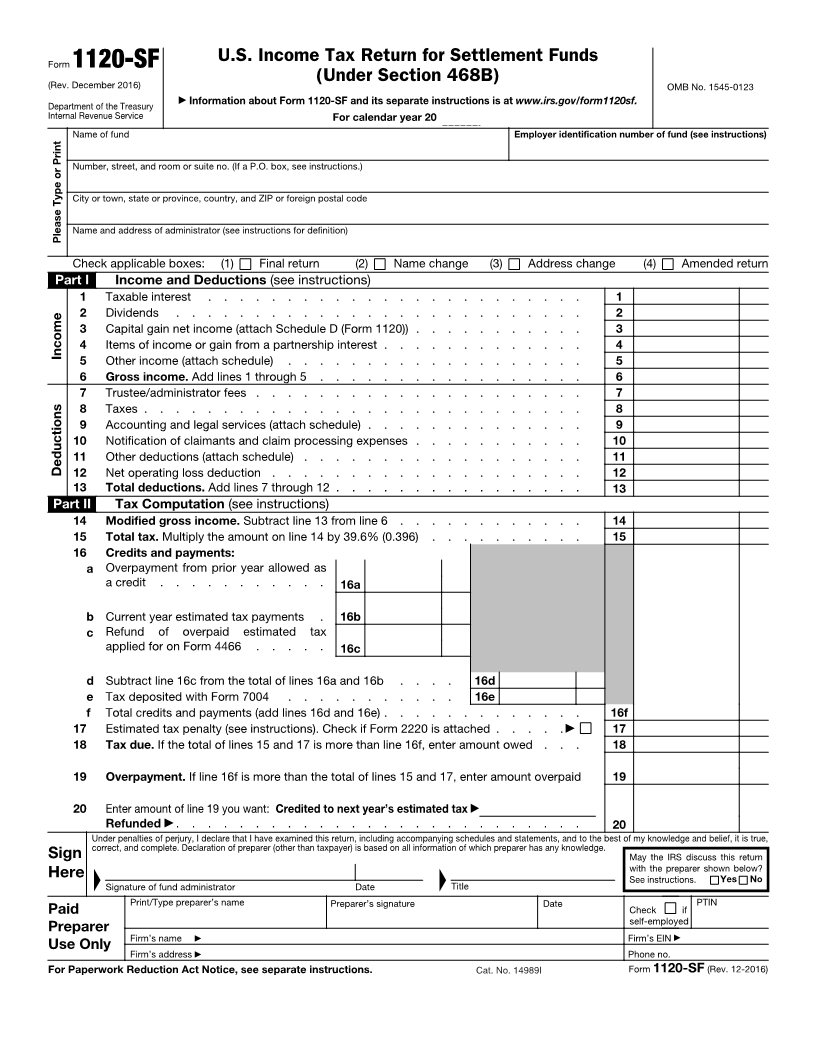

U.S. Income Tax Return for Settlement Funds

Form 1120-SF

(Rev. December 2016) (Under Section 468B) OMB No. 1545-0123

▶

Department of the Treasury Information about Form 1120-SF and its separate instructions is at www.irs.gov/form1120sf.

Internal Revenue Service For calendar year 20

Name of fund Employer identification number of fund (see instructions)

Number, street, and room or suite no. (If a P.O. box, see instructions.)

City or town, state or province, country, and ZIP or foreign postal code

Name and address of administrator (see instructions for definition)

Please Type or Print

Check applicable boxes: (1) Final return (2) Name change (3) Address change (4) Amended return

Part I Income and Deductions (see instructions)

1 Taxable interest . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Capital gain net income (attach Schedule D (Form 1120)) . . . . . . . . . . . 3

4 Items of income or gain from a partnership interest . . . . . . . . . . . . . 4

Income

5 Other income (attach schedule) . . . . . . . . . . . . . . . . . . . 5

6 Gross income. Add lines 1 through 5 . . . . . . . . . . . . . . . . . 6

7 Trustee/administrator fees . . . . . . . . . . . . . . . . . . . . . 7

8 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Accounting and legal services (attach schedule) . . . . . . . . . . . . . . 9

10 Notification of claimants and claim processing expenses . . . . . . . . . . . 10

11 Other deductions (attach schedule) . . . . . . . . . . . . . . . . . . 11

Deductions 12 Net operating loss deduction . . . . . . . . . . . . . . . . . . . . 12

13 Total deductions. Add lines 7 through 12 . . . . . . . . . . . . . . . . 13

Part II Tax Computation (see instructions)

14 Modified gross income. Subtract line 13 from line 6 . . . . . . . . . . . . 14

15 Total tax. Multiply the amount on line 14 by 39.6% (0.396) . . . . . . . . . . 15

16 Credits and payments:

a Overpayment from prior year allowed as

a credit . . . . . . . . . . . 16a

b Current year estimated tax payments . 16b

c Refund of overpaid estimated tax

applied for on Form 4466 . . . . . 16c

d Subtract line 16c from the total of lines 16a and 16b . . . . 16d

e Tax deposited with Form 7004 . . . . . . . . . . . 16e

f Total credits and payments (add lines 16d and 16e) . . . . . . . . . . . . . 16f

17 Estimated tax penalty (see instructions). Check if Form 2220 is attached . . . . . ▶ 17

18 Tax due. If the total of lines 15 and 17 is more than line 16f, enter amount owed . . . 18

19 Overpayment. If line 16f is more than the total of lines 15 and 17, enter amount overpaid 19

20 Enter amount of line 19 you want: Credited to next year’s estimated tax ▶

Refunded ▶ . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign ▲ ▲ May the IRS discuss this return

with the preparer shown below?

Here See instructions. Yes No

Signature of fund administrator Date Title

Print/Type preparer’s name Preparer’s signature Date PTIN

Paid Check if

self-employed

Preparer ▶

Firm’s name ▶ Firm’s EIN

Firm’s address

Use Only ▶ Phone no.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 14989I Form 1120-SF (Rev. 12-2016)