- 4 -

Enlarge image

|

Form 8855 (1-2009) Page 3

General Instructions 1040-NR, if applicable) due for the When To File

combined electing trust(s) for each tax

Section references are to the Internal year during the election period and has File the election by the due date

Revenue Code unless otherwise noted. agreed to accept that responsibility. If (including extensions, if any) of the Form

there is no executor and there is only 1041 (or Form 1040-NR, if applicable)

Purpose one QRT making the section 645 for the first tax year of the related estate

The trustees of each qualified revocable election, the trustee of that electing trust (or the filing trust). This applies even if

trust (QRT) and the executor of the is the filing trustee. the combined related estate and electing

trust(s) do not have sufficient income to

related estate, if any, use Form 8855 to A filing trust is an electing trust whose be required to file Form 1041.

make a section 645 election. This trustee was appointed as the filing

election allows a QRT to be treated and trustee by all electing trust(s) if there is In general, the due date for the first

taxed (for income tax purposes) as part no executor. If there is no executor and income tax return is the 15th day of the

of its related estate during the election only one QRT is making the election, 4th month after the close of the first tax

period. Once the election is made, it that QRT is the filing trust. year of the related estate. For

cannot be revoked. exceptions, see Regulations section

Election Period 1.6072-1(c). For the purpose of

Definitions determining the tax year if there is no

The election period is the period of time executor, treat the filing trust as an

A QRT is any trust (or part of a trust) during which an electing trust is treated estate. If the estate is granted an

that, on the day the decedent died, was and taxed as part of its related estate. extension of time to file its income tax

treated as owned by the decedent under

section 676 by reason of a power to The election period begins on the date return for its first tax year, the due date

revoke that was exercisable by the of the decedent’s death and terminates of the Form 8855 is the extended due

decedent (determined without regard to on the earlier of: date.

section 672(e)). • The day on which each electing trust For instructions on when to file an

For this purpose, a QRT includes a and the related estate, if any, have amended election, see Amended

trust that was treated as owned by the distributed all of their assets or Election Needed When an Executor Is

decedent under section 676 by reason • The day before the applicable date. Appointed After a Valid Election Is Made

on page 4.

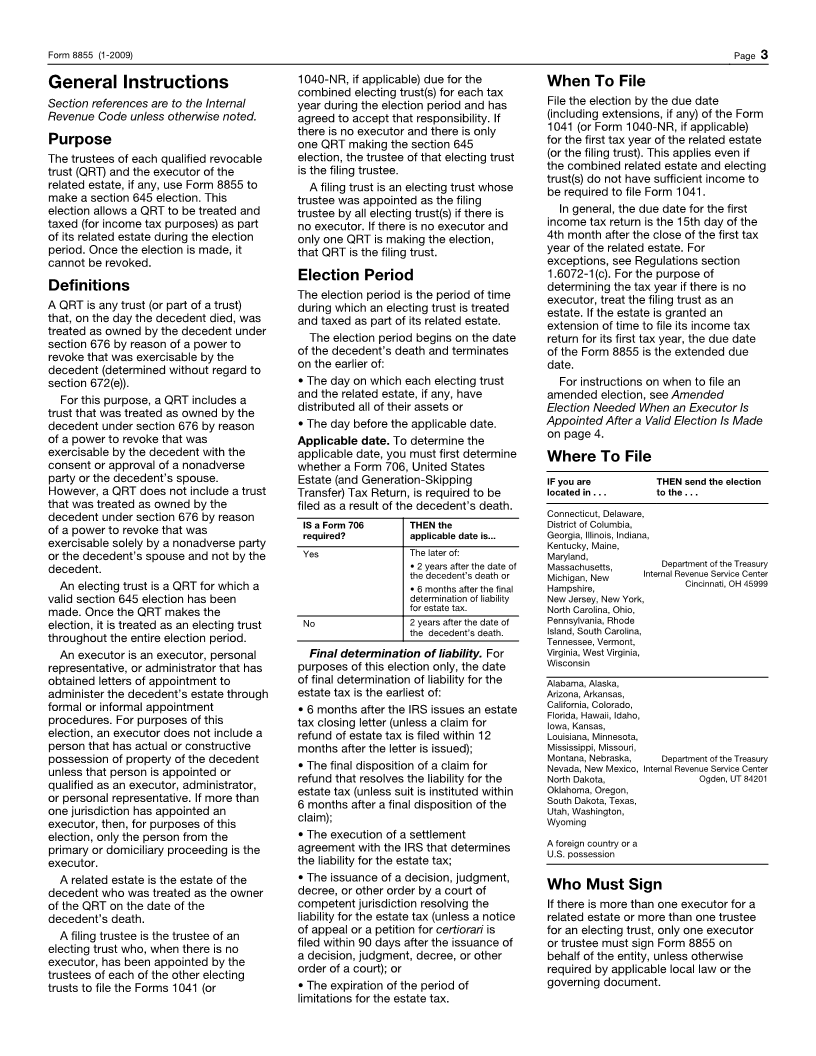

of a power to revoke that was Applicable date. To determine the

exercisable by the decedent with the applicable date, you must first determine Where To File

consent or approval of a nonadverse whether a Form 706, United States

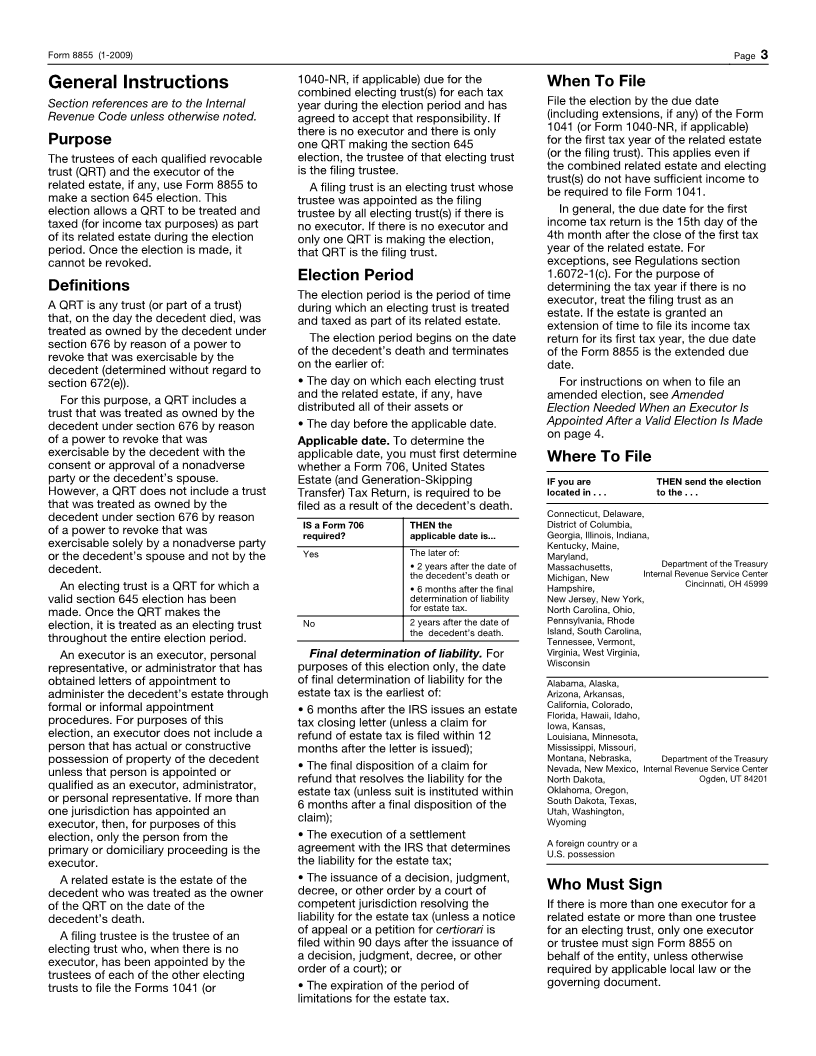

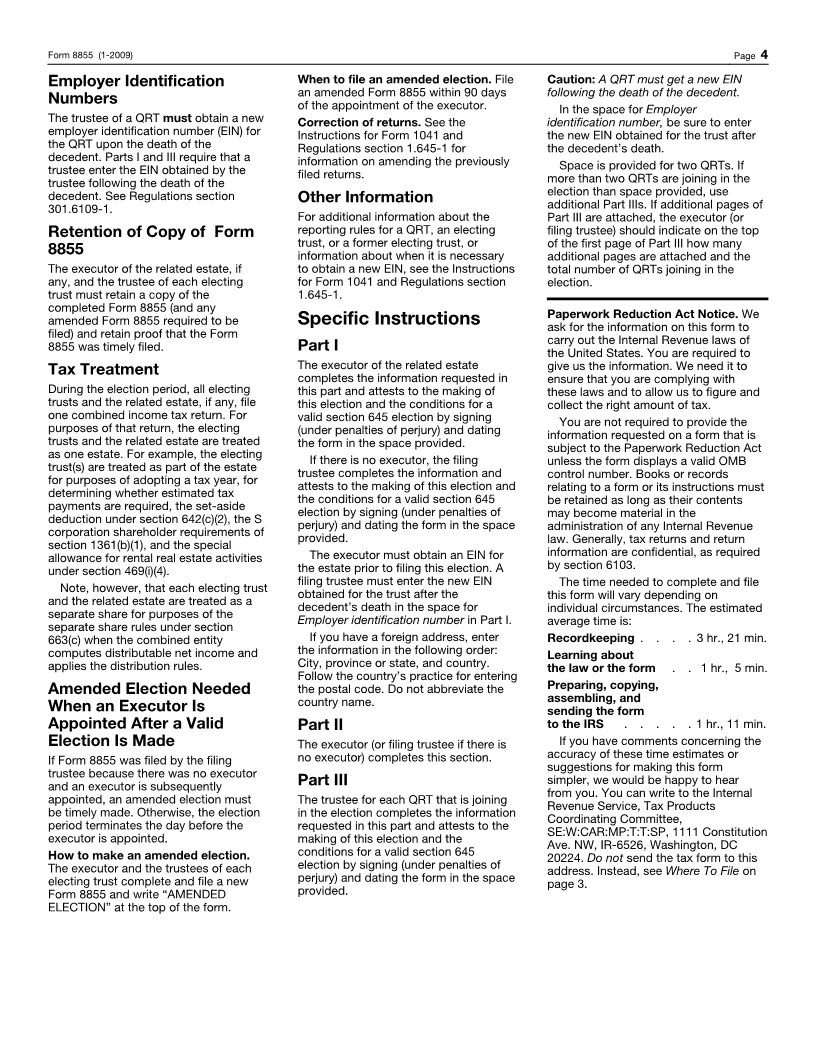

party or the decedent’s spouse. Estate (and Generation-Skipping IF you are THEN send the election

However, a QRT does not include a trust Transfer) Tax Return, is required to be located in . . . to the . . .

that was treated as owned by the filed as a result of the decedent’s death.

decedent under section 676 by reason Connecticut, Delaware,

of a power to revoke that was IS a Form 706 THEN the District of Columbia,

required? applicable date is... Georgia, Illinois, Indiana,

exercisable solely by a nonadverse party Kentucky, Maine,

or the decedent’s spouse and not by the Yes The later of: Maryland,

decedent. • 2 years after the date of Massachusetts, Department of the Treasury

the decedent’s death or Michigan, New Internal Revenue Service Center

An electing trust is a QRT for which a • 6 months after the final Hampshire, Cincinnati, OH 45999

valid section 645 election has been determination of liability New Jersey, New York,

made. Once the QRT makes the for estate tax. North Carolina, Ohio,

election, it is treated as an electing trust No 2 years after the date of Pennsylvania, Rhode

throughout the entire election period. the decedent’s death. Island, South Carolina,

Tennessee, Vermont,

An executor is an executor, personal Final determination of liability. For Virginia, West Virginia,

representative, or administrator that has purposes of this election only, the date Wisconsin

obtained letters of appointment to of final determination of liability for the Alabama, Alaska,

administer the decedent’s estate through estate tax is the earliest of: Arizona, Arkansas,

formal or informal appointment • 6 months after the IRS issues an estate California, Colorado,

Florida, Hawaii, Idaho,

procedures. For purposes of this tax closing letter (unless a claim for Iowa, Kansas,

election, an executor does not include a refund of estate tax is filed within 12 Louisiana, Minnesota,

person that has actual or constructive months after the letter is issued); Mississippi, Missouri,

Montana, Nebraska, Department of the Treasury

possession of property of the decedent • The final disposition of a claim for Nevada, New Mexico, Internal Revenue Service Center

unless that person is appointed or refund that resolves the liability for the North Dakota, Ogden, UT 84201

qualified as an executor, administrator, estate tax (unless suit is instituted within Oklahoma, Oregon,

or personal representative. If more than 6 months after a final disposition of the South Dakota, Texas,

Utah, Washington,

one jurisdiction has appointed an claim); Wyoming

executor, then, for purposes of this

election, only the person from the • The execution of a settlement

primary or domiciliary proceeding is the agreement with the IRS that determines A foreign country or a

U.S. possession

executor. the liability for the estate tax;

A related estate is the estate of the • The issuance of a decision, judgment,

decedent who was treated as the owner decree, or other order by a court of Who Must Sign

of the QRT on the date of the competent jurisdiction resolving the If there is more than one executor for a

decedent’s death. liability for the estate tax (unless a notice related estate or more than one trustee

A filing trustee is the trustee of an of appeal or a petition for certiorari is for an electing trust, only one executor

electing trust who, when there is no filed within 90 days after the issuance of or trustee must sign Form 8855 on

executor, has been appointed by the a decision, judgment, decree, or other behalf of the entity, unless otherwise

trustees of each of the other electing order of a court); or required by applicable local law or the

trusts to file the Forms 1041 (or • The expiration of the period of governing document.

limitations for the estate tax.

|