Enlarge image

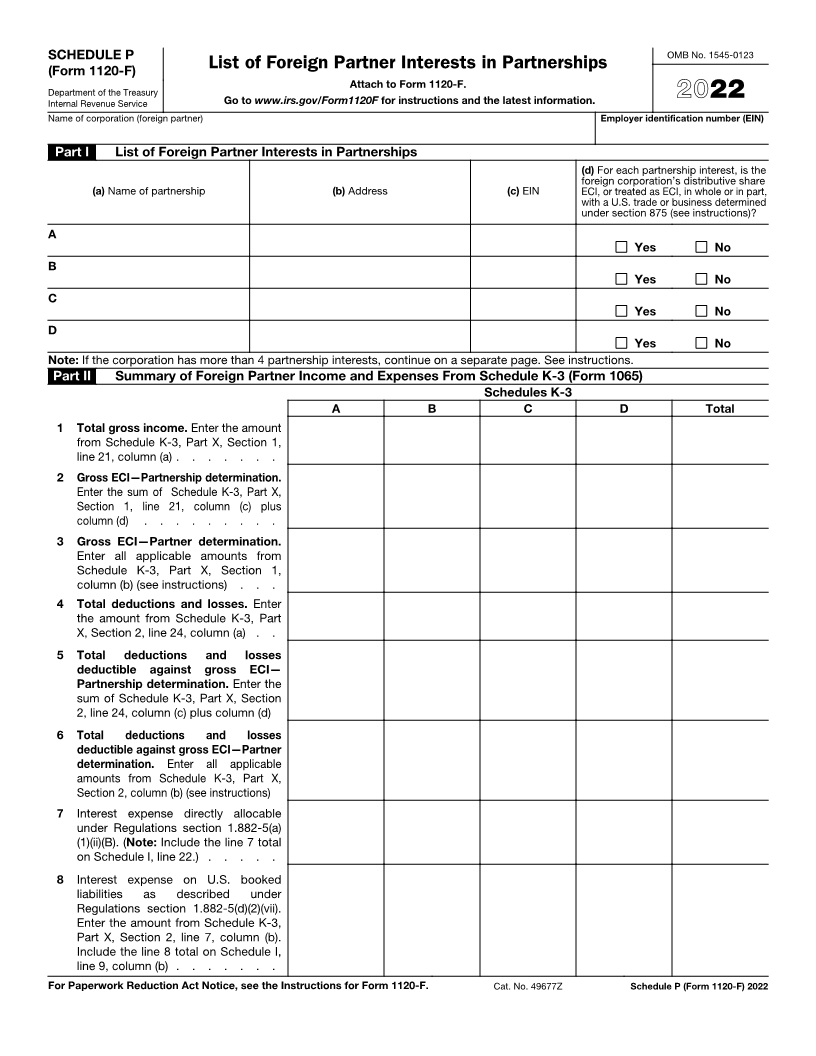

SCHEDULE P OMB No. 1545-0123

(Form 1120-F) List of Foreign Partner Interests in Partnerships

Attach to Form 1120-F.

Department of the Treasury 2022

Internal Revenue Service Go to www.irs.gov/Form1120F for instructions and the latest information.

Name of corporation (foreign partner) Employer identification number (EIN)

Part I List of Foreign Partner Interests in Partnerships

(d) For each partnership interest, is the

foreign corporation’s distributive share

(a) Name of partnership (b) Address (c) EIN ECI, or treated as ECI, in whole or in part,

with a U.S. trade or business determined

under section 875 (see instructions)?

A

Yes No

B

Yes No

C

Yes No

D

Yes No

Note: If the corporation has more than 4 partnership interests, continue on a separate page. See instructions.

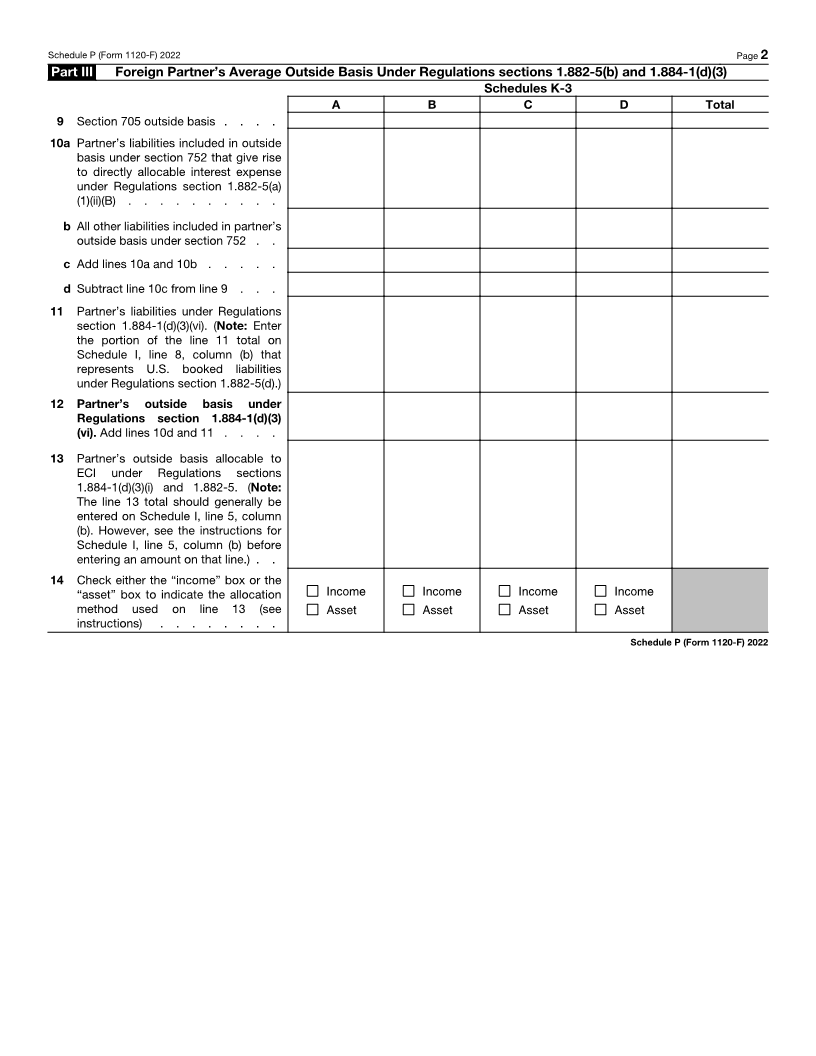

Part II Summary of Foreign Partner Income and Expenses From Schedule K-3 (Form 1065)

Schedules K-3

A B C D Total

1 Total gross income. Enter the amount

from Schedule K-3, Part X, Section 1,

line 21, column (a) . . . . . . .

2 Gross ECI—Partnership determination.

Enter the sum of Schedule K-3, Part X,

Section 1, line 21, column (c) plus

column (d) . . . . . . . . .

3 Gross ECI—Partner determination.

Enter all applicable amounts from

Schedule K-3, Part X, Section 1,

column (b) (see instructions) . . .

4 Total deductions and losses. Enter

the amount from Schedule K-3, Part

X, Section 2, line 24, column (a) . .

5 Total deductions and losses

deductible against gross ECI—

Partnership determination. Enter the

sum of Schedule K-3, Part X, Section

2, line 24, column (c) plus column (d)

6 Total deductions and losses

deductible against gross ECI—Partner

determination. Enter all applicable

amounts from Schedule K-3, Part X,

Section 2, column (b) (see instructions)

7 Interest expense directly allocable

under Regulations section 1.882-5(a)

(1)(ii)(B). (Note: Include the line 7 total

on Schedule I, line 22.) . . . . .

8 Interest expense on U.S. booked

liabilities as described under

Regulations section 1.882-5(d)(2)(vii).

Enter the amount from Schedule K-3,

Part X, Section 2, line 7, column (b).

Include the line 8 total on Schedule I,

line 9, column (b) . . . . . . .

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-F. Cat. No. 49677Z Schedule P (Form 1120-F) 2022