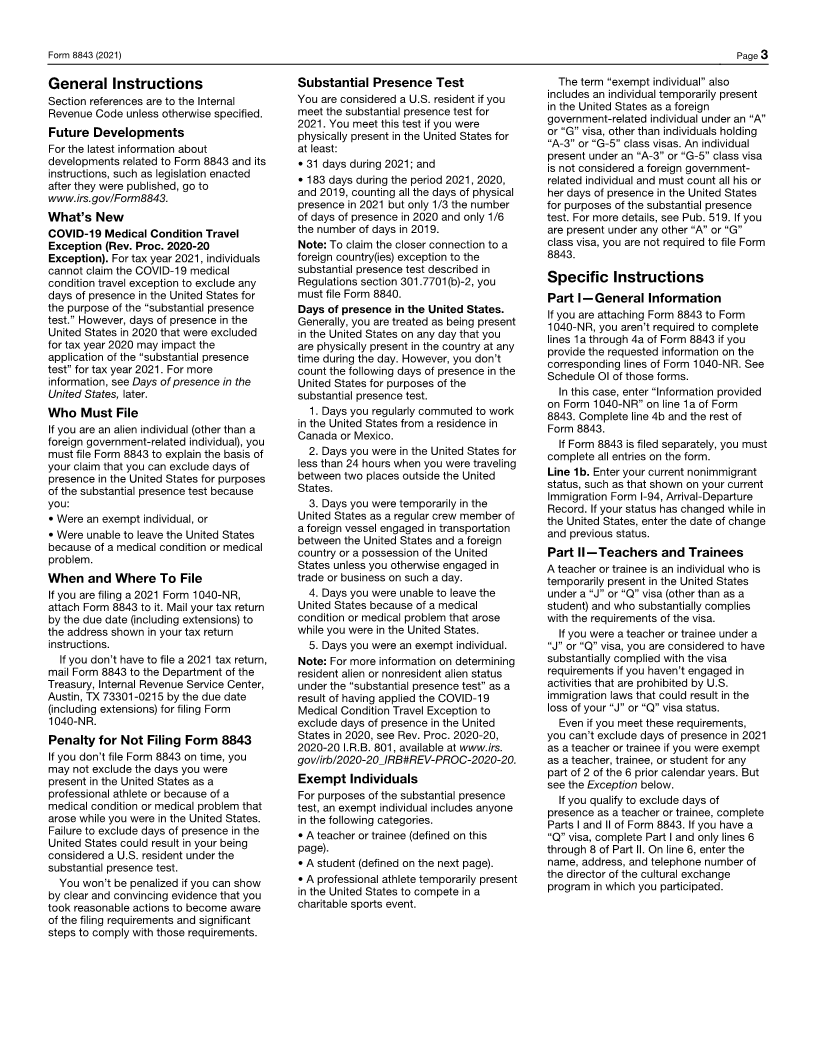

Enlarge image

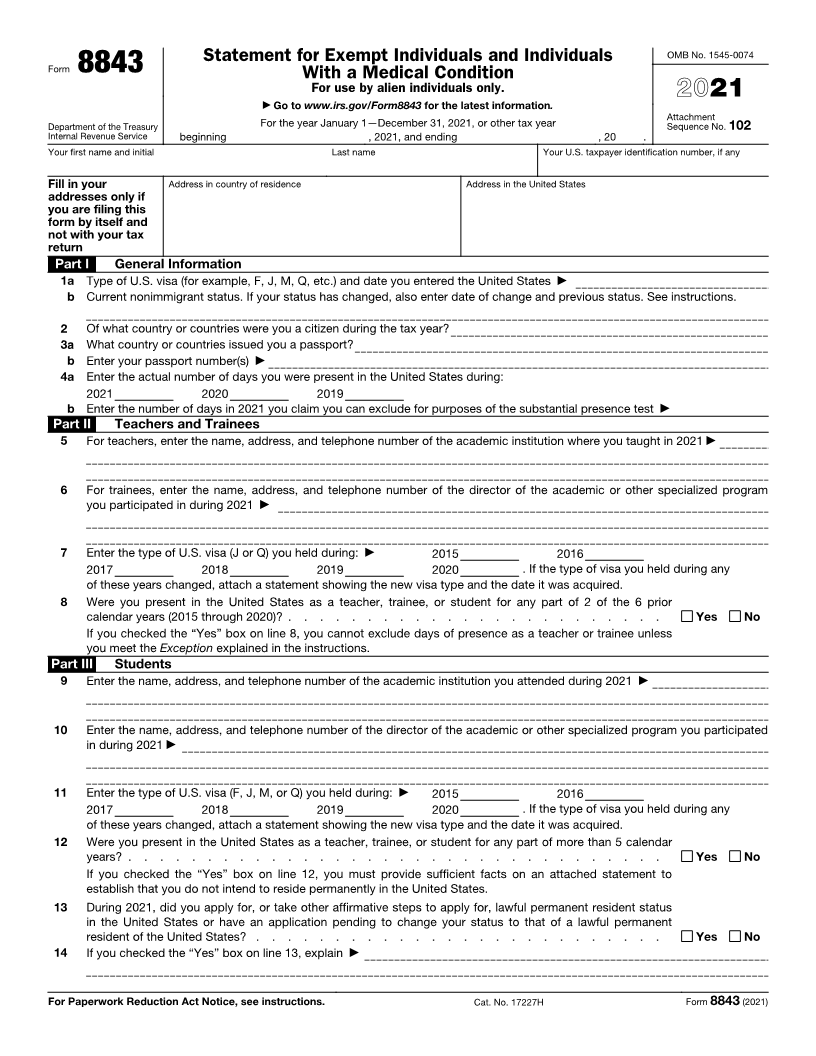

Statement for Exempt Individuals and Individuals OMB No. 1545-0074

Form 8843 With a Medical Condition

For use by alien individuals only.

2021

▶ Go to www.irs.gov/Form8843 for the latest information.

Attachment

Department of the Treasury For the year January 1—December 31, 2021, or other tax year Sequence No. 102

Internal Revenue Service beginning , 2021, and ending , 20 .

Your first name and initial Last name Your U.S. taxpayer identification number, if any

Fill in your Address in country of residence Address in the United States

addresses only if

you are filing this

form by itself and

not with your tax

return

Part I General Information

1a Type of U.S. visa (for example, F, J, M, Q, etc.) and date you entered the United States ▶

b Current nonimmigrant status. If your status has changed, also enter date of change and previous status. See instructions.

2 Of what country or countries were you a citizen during the tax year?

3a What country or countries issued you a passport?

b Enter your passport number(s) ▶

4a Enter the actual number of days you were present in the United States during:

2021 2020 2019

b Enter the number of days in 2021 you claim you can exclude for purposes of the substantial presence test ▶

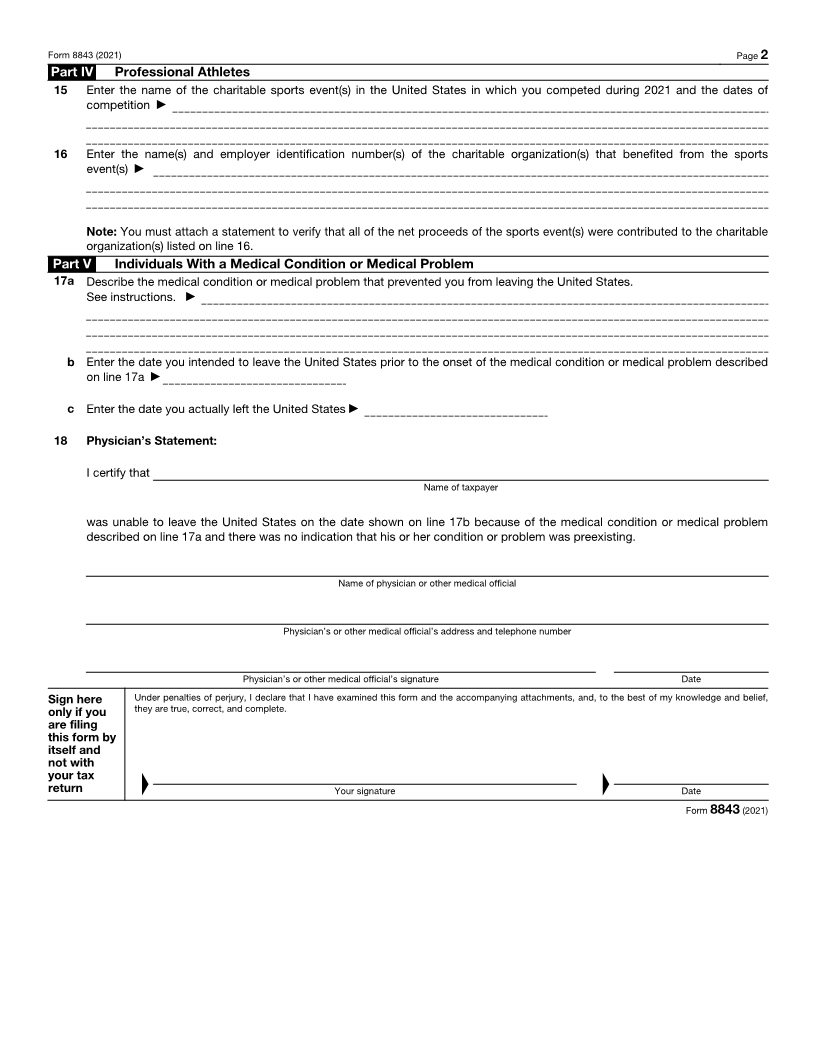

Part II Teachers and Trainees

5 For teachers, enter the name, address, and telephone number of the academic institution where you taught in 2021 ▶

6 For trainees, enter the name, address, and telephone number of the director of the academic or other specialized program

you participated in during 2021 ▶

7 Enter the type of U.S. visa (J or Q) you held during: ▶ 2015 2016

2017 2018 2019 2020 . If the type of visa you held during any

of these years changed, attach a statement showing the new visa type and the date it was acquired.

8 Were you present in the United States as a teacher, trainee, or student for any part of 2 of the 6 prior

calendar years (2015 through 2020)? . . . . . . . . . . . . . . . . . . . . . . . . Yes No

If you checked the “Yes” box on line 8, you cannot exclude days of presence as a teacher or trainee unless

you meet the Exception explained in the instructions.

Part III Students

9 Enter the name, address, and telephone number of the academic institution you attended during 2021 ▶

10 Enter the name, address, and telephone number of the director of the academic or other specialized program you participated

in during 2021 ▶

11 Enter the type of U.S. visa (F, J, M, or Q) you held during: ▶ 2015 2016

2017 2018 2019 2020 . If the type of visa you held during any

of these years changed, attach a statement showing the new visa type and the date it was acquired.

12 Were you present in the United States as a teacher, trainee, or student for any part of more than 5 calendar

years? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

If you checked the “Yes” box on line 12, you must provide sufficient facts on an attached statement to

establish that you do not intend to reside permanently in the United States.

13 During 2021, did you apply for, or take other affirmative steps to apply for, lawful permanent resident status

in the United States or have an application pending to change your status to that of a lawful permanent

resident of the United States? . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

14 If you checked the “Yes” box on line 13, explain ▶

For Paperwork Reduction Act Notice, see instructions. Cat. No. 17227H Form 8843 (2021)