Enlarge image

860312

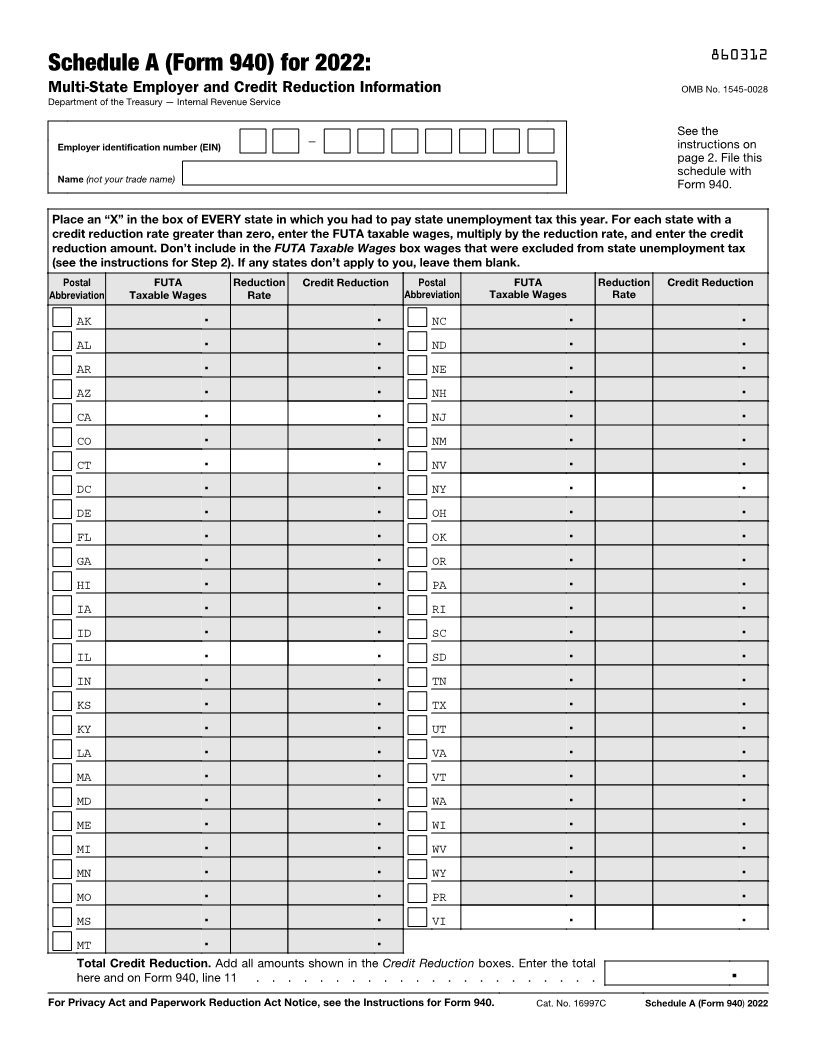

Schedule A (Form 940) for 2022:

Multi-State Employer and Credit Reduction Information OMB No. 1545-0028

Department of the Treasury — Internal Revenue Service

See the

Employer identification number (EIN) — instructions on

page 2. File this

schedule with

Name (not your trade name) Form 940.

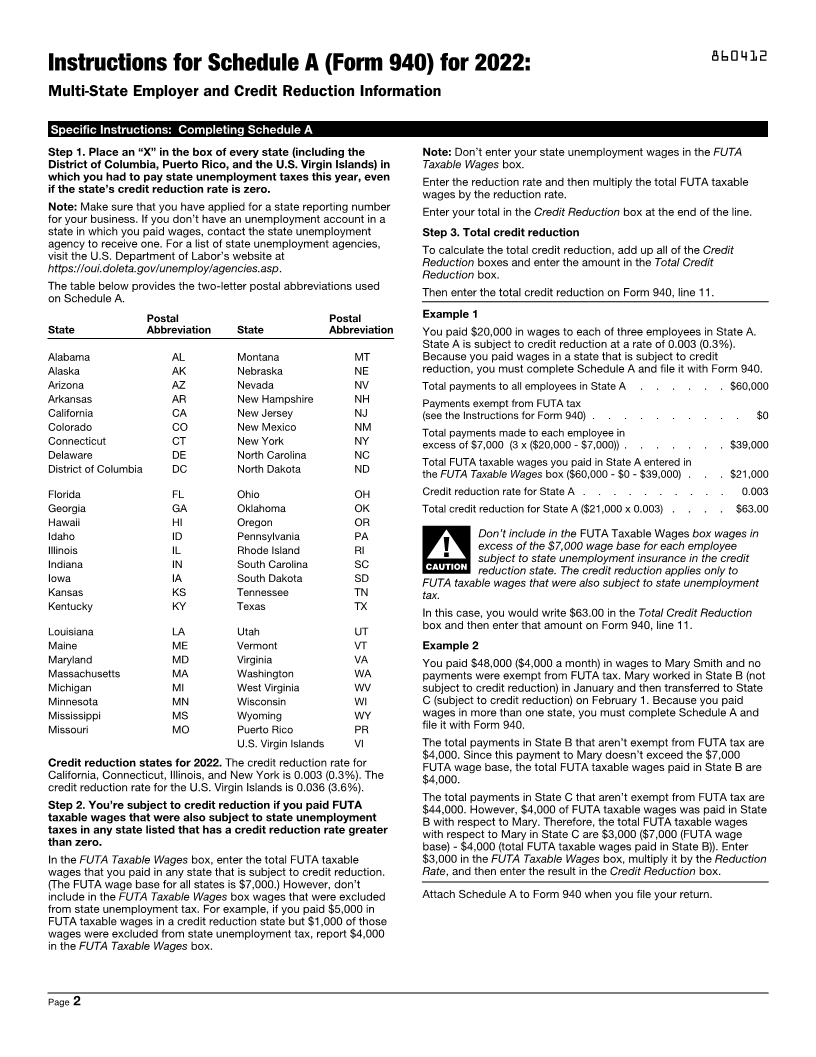

Place an “X” in the box of EVERY state in which you had to pay state unemployment tax this year. For each state with a

credit reduction rate greater than zero, enter the FUTA taxable wages, multiply by the reduction rate, and enter the credit

reduction amount. Don’t include in the FUTA Taxable Wages box wages that were excluded from state unemployment tax

(see the instructions for Step 2). If any states don’t apply to you, leave them blank.

Postal FUTA Reduction Credit Reduction Postal FUTA Reduction Credit Reduction

Abbreviation Taxable Wages Rate Abbreviation Taxable Wages Rate

AK . . NC . .

AL . . ND . .

AR . . NE . .

AZ . . NH . .

CA . . NJ . .

CO . . NM . .

CT . . NV . .

DC . . NY . .

DE . . OH . .

FL . . OK . .

GA . . OR . .

HI . . PA . .

IA . . RI . .

ID . . SC . .

IL . . SD . .

IN . . TN . .

KS . . TX . .

KY . . UT . .

LA . . VA . .

MA . . VT . .

MD . . WA . .

ME . . WI . .

MI . . WV . .

MN . . WY . .

MO . . PR . .

MS . . VI . .

MT . .

Total Credit Reduction. Add all amounts shown in the Credit Reduction boxes. Enter the total

here and on Form 940, line 11 . . . . . . . . . . . . . . . . . . . . . . .

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 940. Cat. No. 16997C Schedule A (Form 940)2022